Ethereum, the second-largest digital asset by market capitalization, is trading near the pivotal $4000 milestone for the first time since December 2021, up 15% during the past week.

Amid this price rally, leading restaking protocol EigenLayer is now the second-largest DeFi protocol in terms of total value locked, according to DeFillama data.

ETH’s price

Ethereum is currently priced at $3954 following a 4% gain during the past day, according to CryptoSlate’s data.

This upward movement in Ethereum’s value can be linked to the excitement surrounding the upcoming Dencun upgrade scheduled to go live on the mainnet by Mar. 13. Dencun brings proto-danksharding to Ethereum, a strategic move aimed at lowering transaction expenses for layer-2 blockchains, thus tackling scalability concerns head-on.

Moreover, the market is anticipating the potential approval of a spot ETH ETF by the US SEC. Should this approval materialize, it could serve as a significant catalyst propelling the ongoing price surge even further.

EigenLayer’s soaring TVL

EigenLayer’s TVL soared to an all-time peak of $11.7 billion during the week, surpassing Aave’s TVL of $11.4 billion.

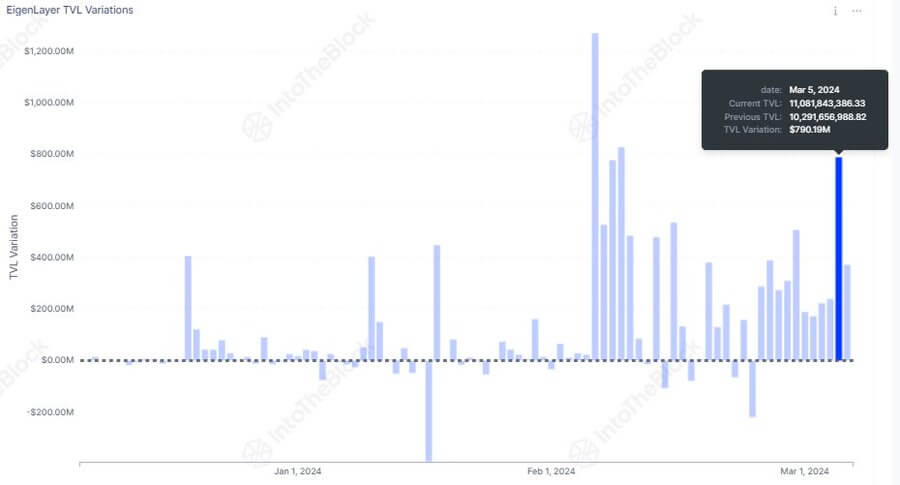

Notably, on Mar. 5, the protocol witnessed a staggering $790 million positive change in TVL, marking its highest daily surge since Feb. 9, according to blockchain analytical firm IntoTheBlock.

The growth trajectory of EigenLayer’s TVL has been remarkable, especially in the past 30 days, witnessing a five-fold surge from approximately $2 billion at the start of the previous month to its current figure. Impressively, the total assets locked on the protocol have skyrocketed to more than 3 million ETH, up from under 1 million in early February.

This surge in TVL closely follows EigenLayer’s decision to lift token restaking restrictions and eliminate TVL caps for individual tokens last month. Community members expect these…

Click Here to Read the Full Original Article at Ethereum (ETH) News | CryptoSlate…