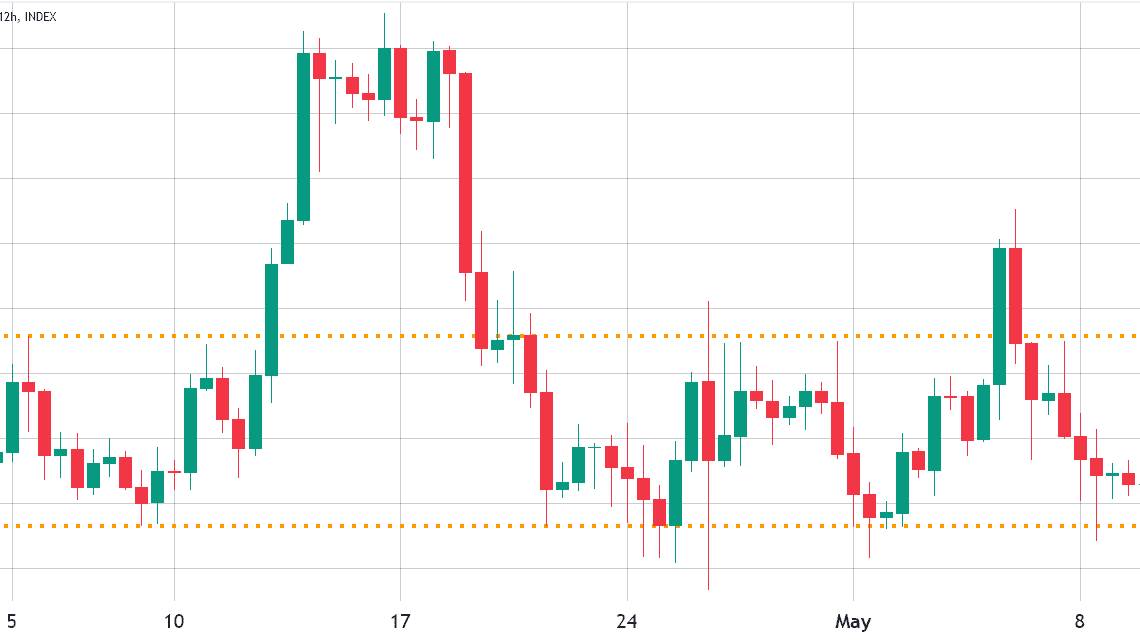

After a brief overshoot above $2,000 on May 6, the Ether (ETH) price has returned to the tight range between $1,820 and $1,950, which has been the norm for the past three weeks.

According to the latest Ether futures and options data, odds favor the Ether price breaking below the $1,820 support as professional traders have been unwilling to add neutral-to-bullish positions using derivatives contracts.

Not even the memecoin frenzy that has boosted Ethereum network demand was able to instill confidence in investors. The average Ethereum transaction fee skyrocketed to $27.70 on May 6, the highest in 12 months, according to BitInfoCharts data. As reported by Cointelegraph, one of the main drivers behind the increase was the insatiable demand for Pepe (PEPE), among other memecoins.

Moreover, the increased gas fees have driven users to layer-2 solutions, which could be interpreted as a weakness. For instance, it causes a decline in the total value locked (TVL) by removing deposits from the Ethereum chain, especially in decentralized finance (DeFi) applications.

Some analysts believe the $30 million Ether sale by the Ethereum Foundation contributed to ETH being unable to break above $2,000, as nearly 20,000 ETH were sent to the Kraken cryptocurrency exchange. The foundation’s last relevant transfer occurred in November 2021, when the price topped around $4,850 and subsequently declined by 80%.

On the macroeconomic side, the 4.9% U.S. April Consumer Price Index (CPI) data announced on May 10, slightly below consensus, further increased investors’ expectations of stable interest rates at the next Federal Reserve (Fed) meeting in June. CME Group’s FedWatch tool showed 94% odds of stability at the current 5% to 5.25% range.

Therefore, with no signs of a Fed pivot on the horizon, the demand for risk-on assets such as cryptocurrencies should remain under pressure. But, if investors fear that Ether has higher odds of…

Click Here to Read the Full Original Article at Cointelegraph.com News…