Ethereum (ETH) just delivered one of its strongest moves in years, breaking its all-time high of around $4,860 after a bullish surge on Friday. The cryptocurrency soared by more than 13% in a single day, marking a pivotal moment for the market and confirming the strength of Ethereum’s ongoing rally.

Related Reading

Momentum is firmly on the side of the bulls, as Ethereum continues to outperform Bitcoin. While BTC consolidates around the same price range it held a month ago, ETH has taken the lead, strengthening the case for an extended altcoin rally. The market is entering a phase where altcoins are beginning to show strength across the board, with Ethereum spearheading this trend.

Adding to the optimism, top analyst Ted Pillows shared fresh insights pointing to Ethereum’s continued dominance in decentralized finance (DeFi). He emphasized that Ethereum remains the number 1 chain in DeFi, reinforcing its position as the backbone of the sector. With institutional adoption rising, exchange supply shrinking, and derivatives activity heating up, many see Ethereum as primed for a sustained rally.

Ethereum Netflows Surge Amid Fed Speculation

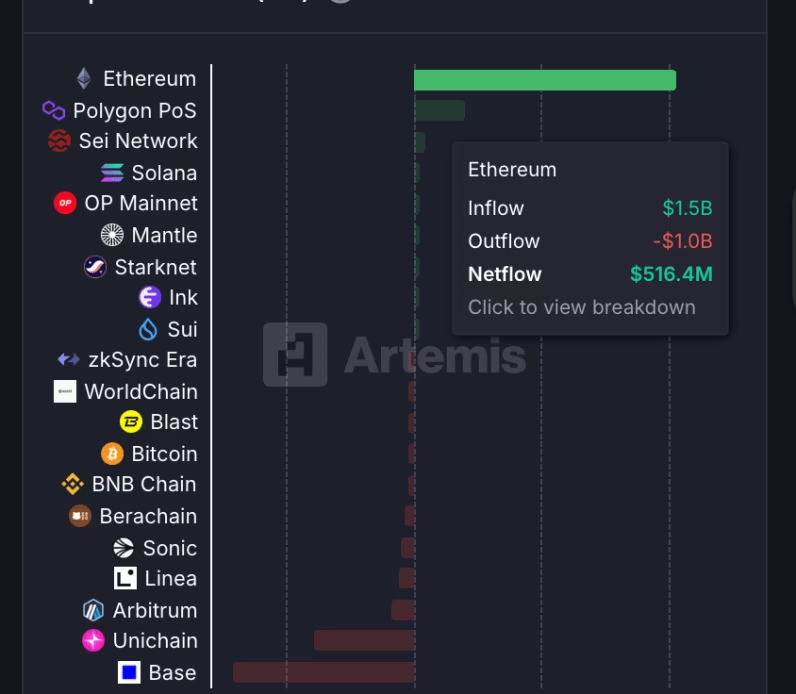

Ethereum’s dominance in the crypto market has once again been reinforced by its recent on-chain activity. Over the last seven days, Ethereum recorded a netflow of +$516.4 million, significantly outpacing all other networks. To put this into perspective, the second-largest, Polygon, registered just $102.9 million over the same period. This vast difference highlights Ethereum’s position as the clear leader in attracting and holding liquidity.

The timing of this surge is tied closely to macroeconomic developments. Markets began to heat up after Federal Reserve Chairman Jerome Powell’s remarks at Jackson Hole, where he noted that “with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.” This statement has fueled widespread speculation that the Fed could cut interest rates in September, sparking renewed optimism across both traditional and crypto markets.

Ethereum’s strong netflows reflect both institutional and retail conviction. Investors are positioning for further upside in anticipation of improved liquidity conditions. The inflow surge signals not only buying pressure but also a growing shift toward Ethereum as the primary vehicle for DeFi, staking, and treasury strategies.

Related…

Click Here to Read the Full Original Article at NewsBTC…