The price of Ethereum (ETH) exhibited superior performance compared to Bitcoin (BTC) in the previous week, mostly because of the registration of Blackrock’s Spot ETF, which instilled optimism that ETH will surpass its previous peak in 2023 and exceed $2,500.

In a groundbreaking twist since the Ethereum (ETH) Shanghai upgrade earlier this year, the value of Ether has triumphantly surpassed the $2,000 milestone, propelled by the recent surge in Bitcoin (BTC) towards the $38,000 mark.

Ethereum Breaks Past $2K

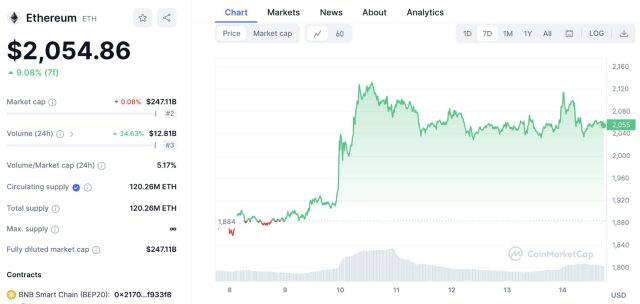

At the time of writing, ETH was trading at $2,054, up 7% in the last seven days, data from CoinMarketCap shows.

Source: CoinMarketCap

Despite the lingering uncertainty, cryptocurrency aficionados exude optimism, envisioning forthcoming profits as certain investors, driven by impatience, eagerly await the unfolding market dynamics.

Cryptocurrency on-chain data analysis firm Lookonchain unveils a spectacle of whale activity amidst the surge in Ethereum prices. The report highlights notable transactions, with one whale raking in a staggering $154 million profit, while another faces a substantial loss of $183 million.

Bullish or Bearish on $ETH?

Did SmartMoneys and Whales buy or sell $ETH over the past week?

1/🧵

Here is a thread. pic.twitter.com/8yvCO0UI9H

— Lookonchain (@lookonchain) November 14, 2023

Within the thread, Lookonchain zoomed its lens on the whale using the “0xee47” address, showcasing a remarkable uptick in their Ethereum holdings by 3,200 ETH, equivalent to an impressive $6.7 million. The buildup signifies a significant advancement subsequent to the whale’s debut venture into ETH buys on July 5, 2022.

Currently, their portfolio consists of a significant amount of 183,740 ETH, which is estimated to be worth nearly $388 million. This indicates an unrealized profit of approximately $155 million.

ETHUSD trading at $2,010 today. Chart: TradingView.com

ETH Price Gets Boost From Spot ETF Filing

Last week, the price of Ethereum experienced a significant increase, surpassing the $2,000 mark. This spike was attributed to the confirmation by BlackRock, a prominent investment management company, regarding their intentions to introduce an Ethereum Spot Exchange-Traded Fund (ETF).

This confirmation was made through a filing with the NASDAQ. According to on-chain data, a group of financially astute institutional investors engaged in significant purchases of Ether over the weekend, amounting to millions of…

Click Here to Read the Full Original Article at NewsBTC…