Crypto price action has been rough over the past few months, but a few green shoots are finally beginning to emerge.

While Bitcoin (BTC) remains in a downtrend, its price has recently found support at the $17,000 level, and ping-pong price action in the $16,700–$17,300 range appears to be allowing traders to pursue some interesting setups in a few altcoins.

Let’s take a quick peek at some enticing patterns showing up on the weekly time frame.

Time for Litecoin’s halving hopium?

As a fork of Bitcoin, Litecoin (LTC) tends to turn bullish several months before its reward halving takes place, as was the case in 2015 and 2019.

Litecoin’s next reward halving is 237 days away, and it appears that the altcoin is undergoing a little pre-halving hype. Since Nov. 6, LTC has gained 58.6%, and it is starting to mirror the triple price action that occurred in previous halvings.

The Guppy Multiple Moving Averages (GMMA) indicator on the daily time frame has also turned green — something that rarely happens.

From a technical analysis point of view, LTC maintains a trend of higher lows, consolidation and bull flag breakouts, which are then followed by further consolidation.

If LTC maintains its current market structure and continues to ride along the 20-day moving average, its price could see a pre-halving run up to the $100–$125 area.

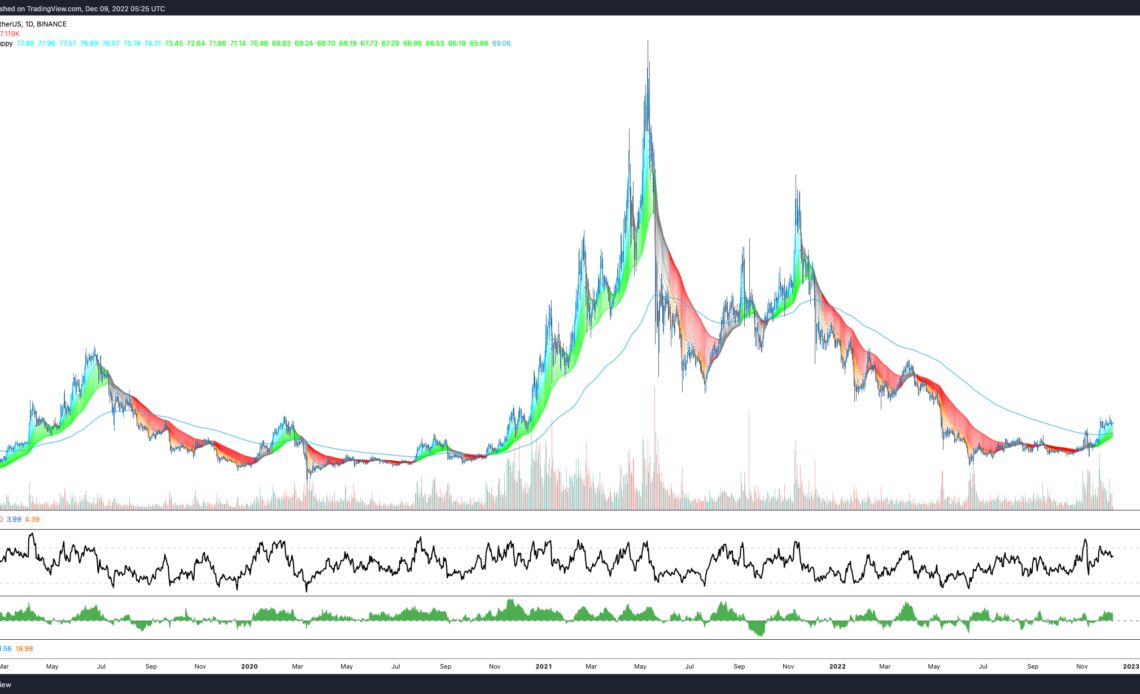

Ether plots its own course

The ETH/BTC weekly timeframe shows some notable developments. Depending on how one sees it, there could be a nice inverse head and shoulders forming.

One could also argue that the ETH/BTC weekly is flashing a massive cup-and-handle pattern.

Like Litecoin, the GMMA indicator in the ETH/BTC weekly pair has been bright green since Aug. 8, which is nearly four months.

Ether’s price action in its U.S. dollar and BTC pair raise eyebrows, especially given the state of the broader market.

Despite this short-term bullish outlook, ETH’s price could be affected by red flags such as Ethereum blockchain censorship, U.S. Office of Foreign Assets Control compliance, ETH’s performance in its supposedly deflationary post-Merge environment, and concerns over the possibility of the U.S. Securities and Exchange Commission and Commodity Futures Trading Commission changing their perspective on Ether being a commodity.

On-chain data tells an interesting…

Click Here to Read the Full Original Article at Cointelegraph.com News…