Closely followed analyst Benjamin Cowen says Ethereum may be in the midst of repeating a historical pattern that could bring ETH down to much lower levels.

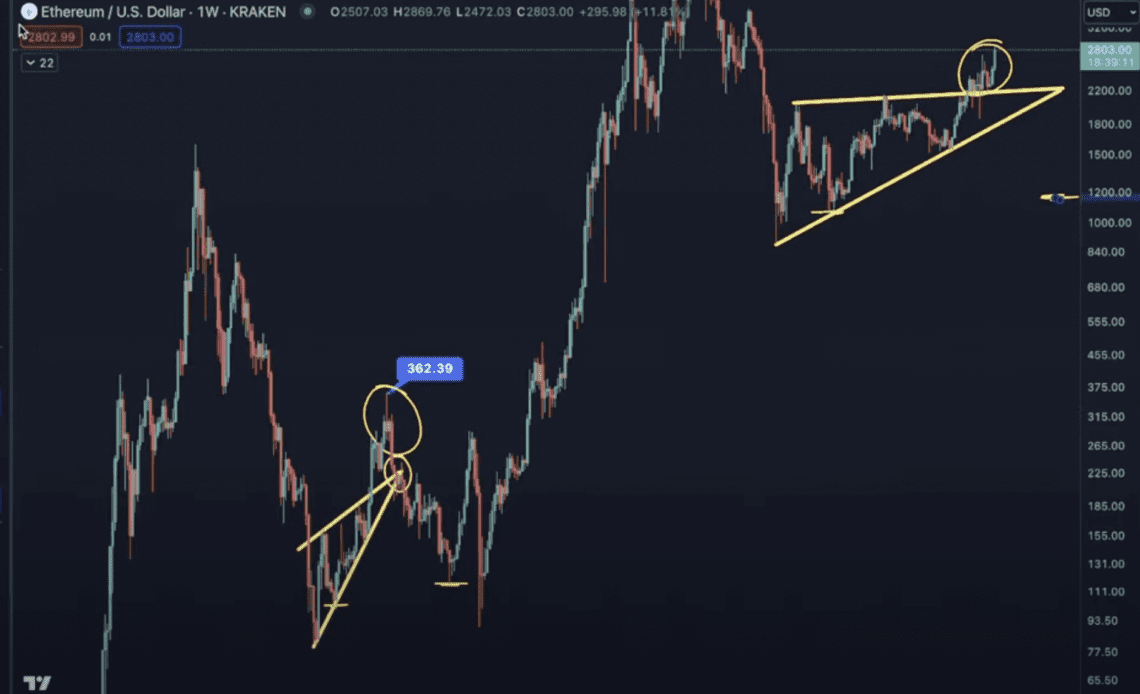

In a new strategy session, Cowen tells his 790,000 YouTube subscribers that in the last crypto bear market, Ethereum didn’t bottom out until canceling out a previous breakout from a rising wedge and then retesting a macro low.

He also notes that ETH crashed immediately after the Ethereum/Bitcoin (ETH/BTC) pair broke down.

With ETH/BTC teetering on support, Cowen says that the next breakdown could be what leads to a leg down for ETH/USD, which he says may see Ethereum trading at the $1,200 level.

“It was not only the process of the unvinversion of the yield curve, but it was also the breakdown of the ETH/BTC valuation.

If you look at the ETH/BTC valuation, you will notice it was precisely here in July of 2019 when ETH/BTC broke down. And in July of 2019, that is where ETH/USD started to go down [from $362.39], and that is where ETH/USD went back through this wedge and came all the way back down here ($118).

You will notice in fact, that this low that ETH put in in December 2019, was actually slightly above this higher low [at $95]. This higher low here [November 2022] happened to be around $1,000, so if it’s going to play out in a similar fashion – which it very well might not – it would imply going back and testing that low.

But again, you will notice that this drop did not occur until after the ETH/BTC valuation broke down. It was after ETH/BTC broke down that ETH/USD finally got this drop. And where are we today? We are close to seeing a very similar process play out.”

At time of writing, ETH/BTC is trading at 0.05581 BTC ($2,927), still above Cowen’s support at 0.049 BTC ($2,570).

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price…

Click Here to Read the Full Original Article at Ethereum News – The Daily Hodl…