Key takeaways:

-

Ether closed above $2,700 for the first time in a month.

-

Declining BTC dominance and a pivotal 72-hour window for ETH could confirm the start of an altcoin season.

Ether (ETH) closed above $2,700 on Wednesday for the first time in four weeks, signaling continued bullish momentum. The upward move continued into Thursday, with ETH maintaining a strong higher time frame structure, setting the stage for a rally toward the $3,000 psychological level.

Data analytics platform Swissblock noted that the current scenario for Ether against Bitcoin is much more bullish than Q2, potentially signaling the start of an altseason. The analysis points to ETH inflows gaining momentum and its ecosystem narratives strengthening, contrasting with Bitcoin (BTC) fading strength and consolidation. The chart illustrates ETH’s relative outperformance, echoing an early May flip that sparked the first altcoin recovery since its price bottom on April 7.

Swissblock emphasized a critical 72-hour window, suggesting that if ETH holds strong, it could mark the true onset of altseason. This shift aligns with BTC’s declining dominance, a historical sign of altcoin surges.

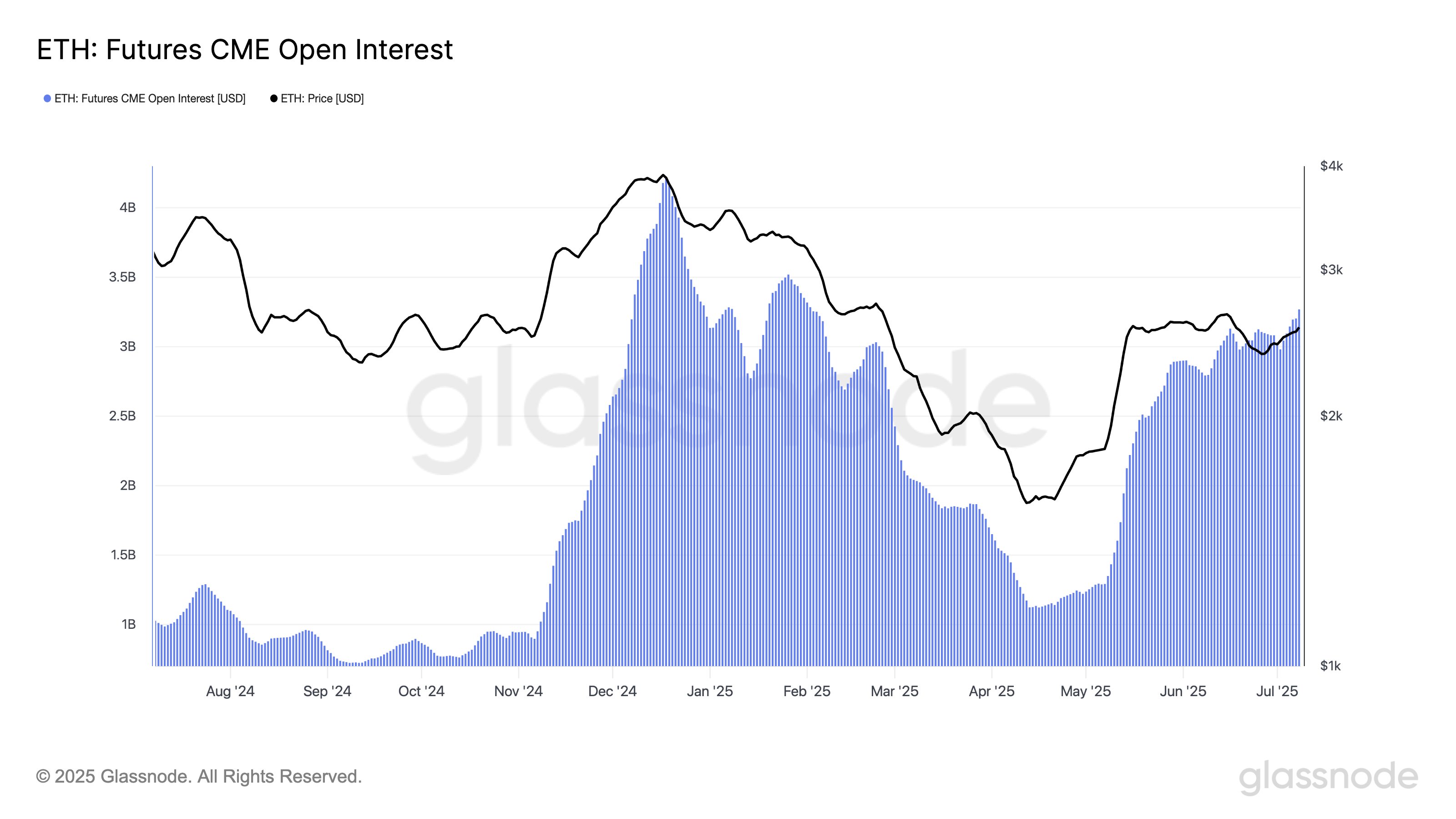

Adding weight to Ether’s recent strength is a clear uptick in institutional demand. Chicago Mercantile Exchange (CME) Ether futures open interest has climbed to $3.27 billion, its highest level since Feb. 2. This surge suggests increased institutional positioning, reflecting a growing appetite among professional investors to gain exposure to ETH as price momentum builds.

Further strengthening this trend is the consistent capital flow into spot ETH exchange-traded funds (ETFs). Net inflows have remained positive for eight consecutive weeks, with over 61,000 ETH accumulated during this period. The alignment of rising futures interest and ETF inflows with ETH’s price breakout adds credibility to the current…

Click Here to Read the Full Original Article at Cointelegraph.com News…