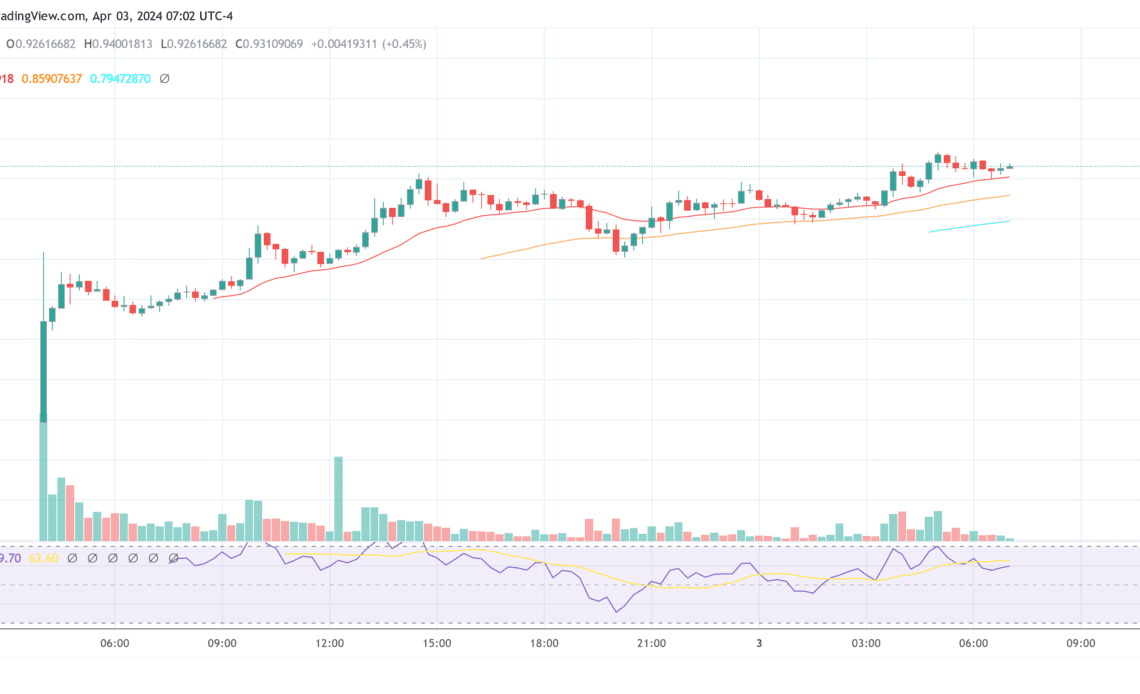

Ethena Labs’ new governance token, ENA, is witnessing a staggering 60% increase in its value, shortly after its introduction to the market. The spike in ENA’s price to approximately $0.96 has catapulted its market capitalization to nearly $1.34 billion, ranking ENA as the 80th largest cryptocurrency by market cap.

This ascent followed Ethena’s strategic distribution of 750 million ENA tokens, representing 5% of its total supply, through an airdrop to holders of its USDe token. The USDe, a synthetic dollar, is central to Ethena’s offering, leveraging a blend of ether liquid staking tokens and short Ether (ETH) perpetual futures positions to maintain a target value near $1.

The Ethena Labs airdrop went live 2 hours ago, with $450M of ENA to distribute.

The largest $ENA recipient so far has been 0xb56, who received 3.30M ENA worth $1.96M.

Track ENA on Arkham:https://t.co/coFsTcBUCa https://t.co/RSZwXLhCB6 pic.twitter.com/l6c7bqKghG

— Arkham (@ArkhamIntel) April 2, 2024

At the heart of Ethena’s value proposition is the ENA token, engineered to facilitate a digital dollar platform on the Ethereum blockchain. This platform seeks to provide a viable alternative to conventional banking mechanisms through its innovative ‘Internet Bond’. By harnessing the potential of derivative markets and staked Ethereum, the Internet Bond offers a dollar-denominated savings instrument accessible globally, independent of traditional banking infrastructure.

The total supply of ENA tokens is capped at 15 billion, with an initial issuance of 1.425 billion tokens. The distribution plan prioritizes ecosystem development (30%), core contributor rewards (30%), investor engagement (25%), and foundation support (15%), embodying a holistic approach to tokenomics. Notably, Binance’s endorsement of ENA as the 50th project on its Binance Launchpool, enabling users to farm ENA tokens by staking BNB and FDUSD, underscores the token’s appeal.

At press time, ENA traded at $0.93, up 60% in the past 24 hours.

Fantom Co-Founder Warns Of Luna-Like Collapse

Andre Cronje, co-founder of the Fantom Foundation, issued a warning on X, recalling the concerns that preceded the collapse of Terra Luna. Cronje dissected the structure of perpetual contracts (perps), a derivative product that enables traders to speculate on the price movement of an asset without holding the actual asset.

This…

Click Here to Read the Full Original Article at NewsBTC…