Ethereum’s Ether (ETH) token dropped by over 7.5% in its Bitcoin (BTC) pair in 2023. But ETH/BTC may wipe its year-to-date (YTD) losses entirely in April as Ethereum’s long-awaited Shanghai hard fork is just days away.

The upgrade is set for April 12, enabling Ethereum stakers to withdraw around 1.1 billion ETH in rewards — worth over $2 billion as of April 8.

ETH price undergoes key technical bounce

Many experts see the hard fork as bullish for Ether in the long term. For instance, the Shanghai buzz has helped Ether outperform Bitcoin in April so far.

As a result, the ETH/BTC pair has risen by about 4.75% month-to-date to reach 0.066 BTC as of April 8, a nearly 8% rebound since March 20.

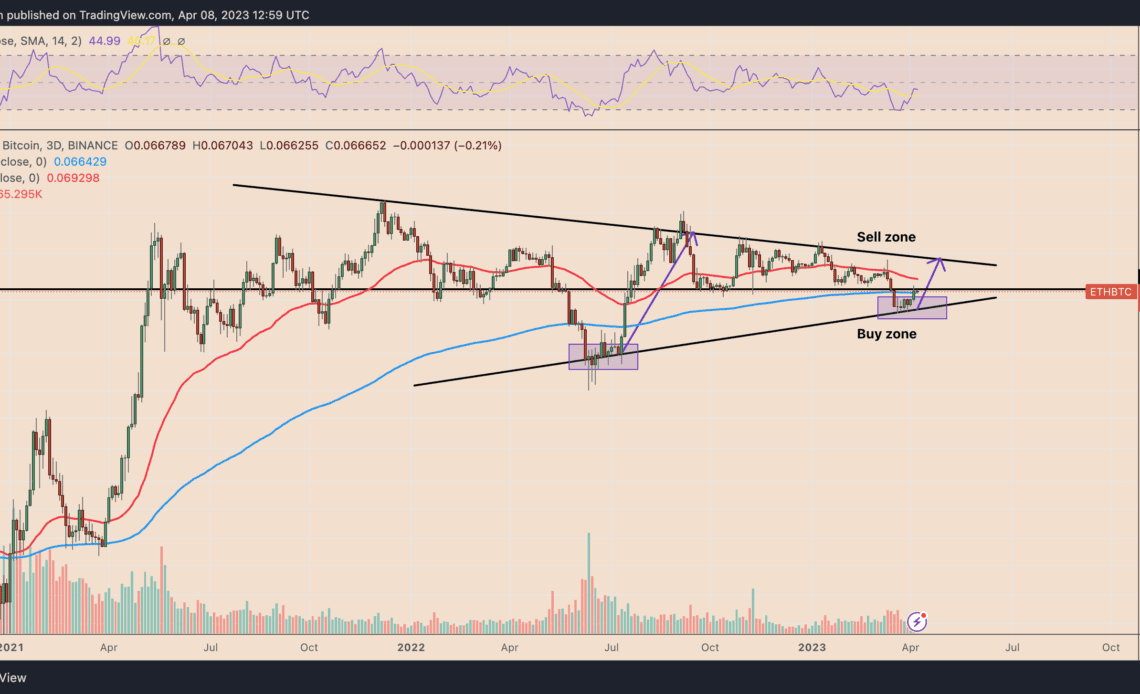

The bounce was largely expected, particularly as ETH/BTC dropped to its historical ascending trendline support. Now, the upside move raises the prospects of an extended bullish retracement toward its descending trendline resistance, marked as a “sell zone” in the chart below.

The fractal-based outlook puts Ether on target for 0.075 BTC by June, up 10% versus current price levels. Meanwhile, the pair’s upside target for April appears to be its 50-3D exponential moving average (50-3D EMA; the red wave) near 0.069 BTC.

Conversely, a decisive close below the 200-3D EMA (the blue wave) near 0.066 BTC, coinciding support/resistance level near 0.067 BTC, risks delaying or — in the worst case scenario — invalidating the bullish retracement setup.

This bearish argument echoes independent market analyst CrediBULL Crypto who expects strong selling pressure near the 0.067 BTC resistance level that would lead to a 50% drop in 2023.

Ethereum vs. dollar outlook

The ETH/USD pair has rallied by more than 50% in 2023, primarily due to similar uptrends elsewhere in the crypto market.

A weakening dollar, lower U.S. Treasury yields, and expectations of a Federal Reserve pivot on…

Click Here to Read the Full Original Article at Cointelegraph.com News…