On Saturday, January 20, the Dogecoin price rose by more than 23% within 5 hours. As NewsBTC reported, the creation of the X Payments account was the cause of the sudden price increase, which reignited hopes within the community about the integration of DOGE. However, the speculative surge was short-lived, with only around 4% of the gains remaining at time of publication.

When Will Dogecoin Price ‘Moon’?

In a new analysis, Skew, a well-known figure in the crypto analysis sphere, has presented a nuanced perspective on the potential drivers for an lasting upswing of the Dogecoin (DOGE) price. Skew’s findings are grounded in both technical and speculative market dynamics.

Skew’s examination of the DOGE 4-hour (4H) chart revealed a “Nice pump after the creation of the XPayments account,” suggesting that the market is speculating about ‘X’ possibly integrating Dogecoin as a payment option. Despite the positive momentum, Skew emphasized that for a sustainable uptrend, DOGE needs to “properly reclaim the 1W pivot ($0.08750) & Yearly open there after.”

He stressed the importance of the price trend aligning with the 4-hour Exponential Moving Averages (EMAs) and a Relative Strength Index (RSI) consistently above 50. “Systematically, I’m looking for price to trend with 4H EMAs & RSI above 50 to sustain a real uptrend,” he stated.

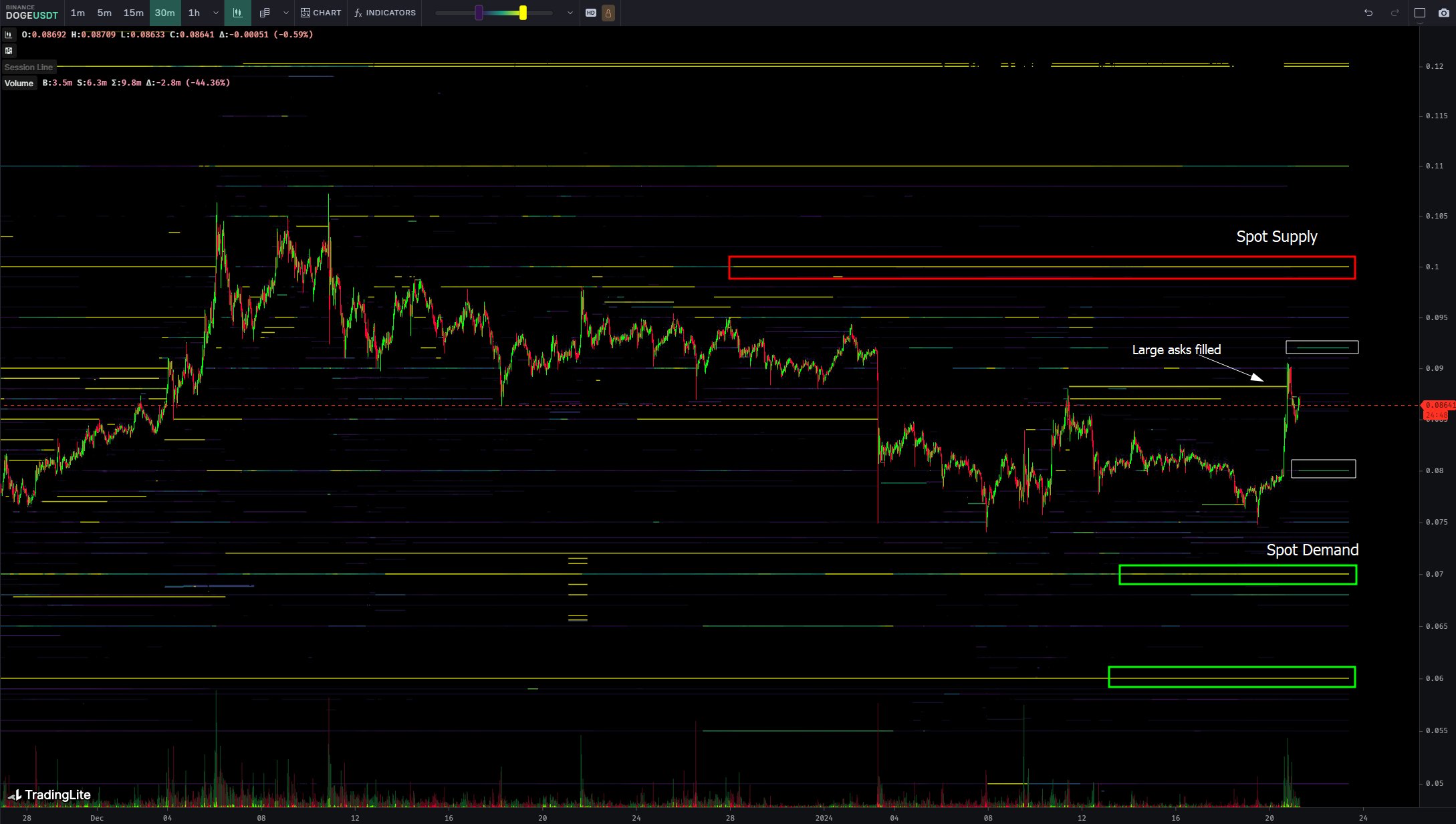

On the DOGE Binance spot market, Skew highlights a new price range formation, noting a significant spot demand zone around $0.07 and a large supply wall at $0.1. He pointed out: “New range being quoted here so far & clear larger range between current spot supply & demand.” Notably, large bids were filed during the recent move above $0.09

Regarding the Open Interest (OI) and Delta on Binance and Bybit for DOGE, Skew observed a “substantial OI increase on this +13% price move & more perp volume seen than spot volume.” He suggested monitoring spot market flows for bullish indicators such as a spot premium leading price, spot limit bids on dips, and neutral funding rates to anticipate further gains.

Skew reflected on the previous DOGE rally linked to ‘X’, noting that “Clean systematic confirmations prior to narrative pump” were evident, but the rally faltered due to “loss of narrative buyers” after the DOGE logo was removed. For a significant DOGE rally, Skew…

Click Here to Read the Full Original Article at NewsBTC…