Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

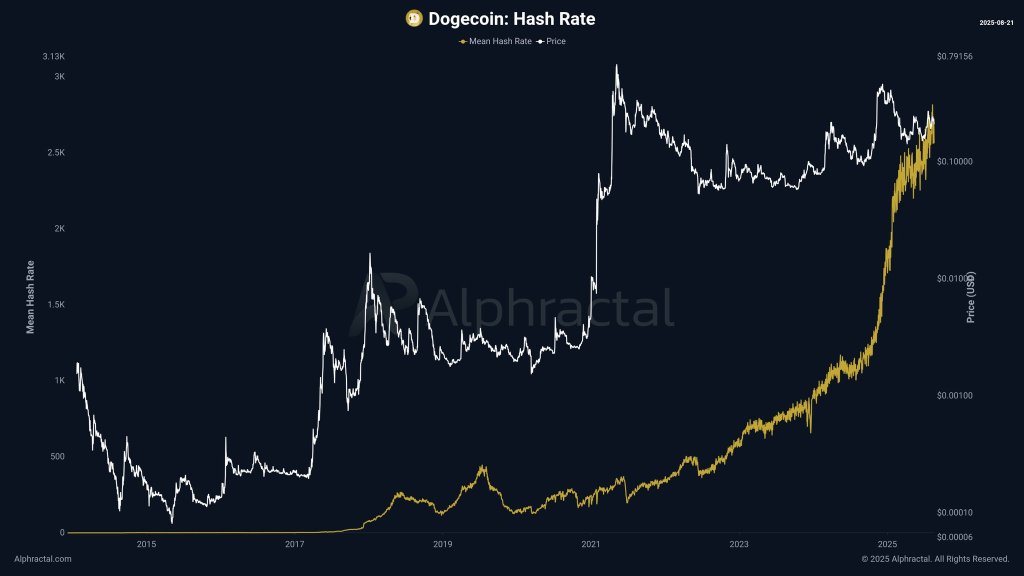

An emerging set of on-chain and market structure signals suggests Dogecoin could be coiling for a fresh advance, according to analytics platform Alphractal, which published a new chart pack and methodology notes on X on August 21. The firm argues that miner resilience, a stable “Network Stress Index,” and model-derived bands such as Alpha Price and CVDD have lined up in a way that historically preceded major DOGE trend accelerations.

$1 Dogecoin Back In Play?

“Dogecoin’s miners remain incredibly resilient, with hash rate activity pushing toward record highs,” Alphractal wrote, before posing the core question animating its latest study: “Could trading around True Market Mean Price and models like Alpha Price and CVDD pave the way for a potential new all-time high in DOGE?”

At the foundation of the call is a composite gauge the firm calls the Network Stress Index. It blends three dimensions of chain health and pressure—“Fee Stress (fees / market cap – 40% weight), Hash Stress (30-day hash rate volatility – 30% weight), [and] Supply Stress (7-day active supply volatility – 30% weight).”

Related Reading

As Alphractal summarizes the read-through: “Higher values suggest potential instability or major transitions. Lower values reflect a balanced network across economic, security, and activity dimensions.” In the current regime, the firm says the indicator “signals stability — showing no warning signs of network risk.”

Click Here to Read the Full Original Article at NewsBTC…