The difference between Bitcoin’s realized cap and market cap is an underrated indicator of the phases of Bitcoin’s price cycles. The realized cap shows Bitcoin’s value based on the last price each coin moved, showing the actual capital invested into the asset.

When the market cap, which reflects the value of all existing coins based on the current spot price, significantly diverges from the realized cap, it shows a shift in sentiment. These shifts have historically aligned with phases of either euphoria or fear.

A high market cap relative to the realized cap shows that investors hold unrealized gains. While this is an unambiguous sign of a bullish sentiment in the market, it can also precede potential overextension. Conversely, when the market cap dips below the realized cap, it signals widespread capitulation and undervaluation of the asset.

The current discrepancy between Bitcoin’s market cap and realized cap reflects the overwhelming bullish sentiment that has dominated the market this month.

Bitcoin’s price increase was driven by optimism surrounding the US presidential election. On Nov. 5, President Donald Trump’s win sparked a rally in the crypto market, as his upcoming administration is expected to introduce concrete, Bitcoin-focused policies.

The outcome of the election created a bullish momentum, with investors gearing up for a much more favorable regulatory environment for crypto. This sentiment drove Bitcoin’s price to over $90,000, establishing a new ATH.

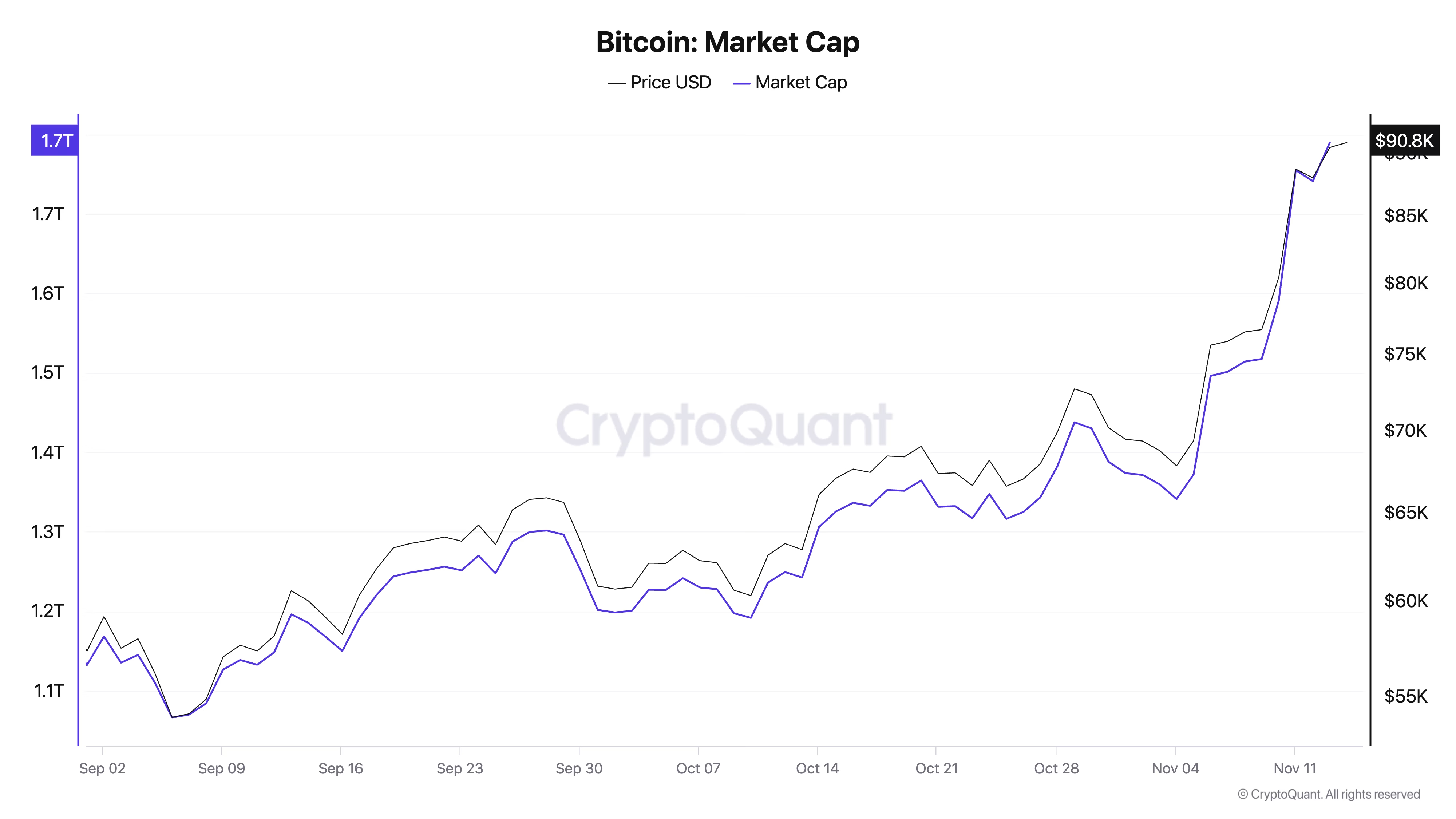

The price spike was mirrored in Bitcoin’s market cap, which increased from $1.132 trillion at the start of September to $1.789 trillion by mid-November. Most of this increase occurred in the days following the election, indicating heightened buying activity and a rush of capital into the market.

While the surge definitely reflects the market’s enthusiasm and confidence in Bitcoin’s long-term potential under the Trump administration, the price itself also likely fueled speculative buying. Such rapid growth in market cap, particularly after a major event like a national election, is often a sign of heightened speculation.

While the market cap grew significantly, Bitcoin’s realized cap grew much slower. Moving from $621.691 billion on Sep. 1 to $679.281 billion on Nov.13, the realized cap’s rise clearly shows that new capital continues to enter the market.

This upward trend in realized cap shows…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…