Since El Salvador adopted Bitcoin (BTC) as legal tender in September 2021, there have been a number of quick judgments issued declaring this move a failure, with some pundits going as far as to suggest that Bitcoin is somehow responsible for the economic challenges that existed in El Salvador well before Bitcoin was even created. But the traditional financial experts, talking heads and even representatives from the International Monetary Fund (IMF) espousing this point of view are missing the point entirely.

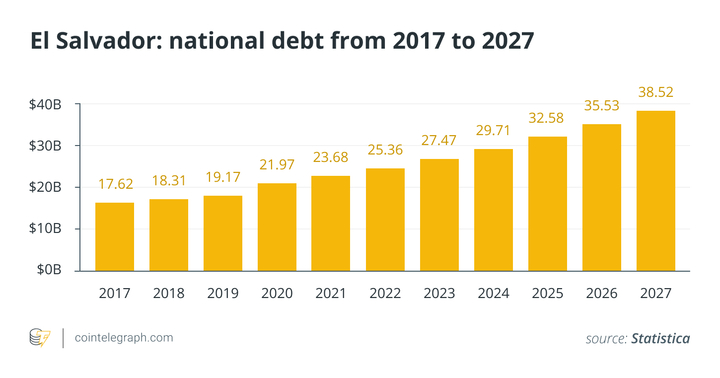

After Salvadoran President Nayib Bukele announced his plan in July to offer to repurchase publicly held bonds maturing between 2023 and 2025, El Salvador’s sovereign debt totaled more than $20 billion. Admittedly a massive amount relative to the Salvadoran economy, it was unrelated to the decision to accept Bitcoin as legal tender.

Rather, myriad factors play into El Salvador’s debt. In 1982, 39 years before the legalization of Bitcoin, El Salvador borrowed $85 million from the IMF, adding extensive fiscal debt and providing negligible benefits to its citizens during a time of civil war. After that, the country’s 2001 decision to make the United States dollar its official currency further limited its ability to manage its own finances. With USD as its base currency, El Salvador was unable to implement its own monetary policy to pay for domestic costs like social programs or infrastructure. Instead, it was forced to increase public sector borrowing to pay for these vital programs.

El Salvador’s debt-related challenges are not a result of the country’s investment in new financial technologies, like Bitcoin. Instead, El Salvador’s adoption of Bitcoin is a move toward regaining its monetary sovereignty, providing its citizens with access to financial services and opportunities, and addressing the kinds of systemic problems that have historically disenfranchised Salvadorans.

Since making Bitcoin legal tender last year, El Salvador has spent a little more than $100 million on Bitcoin. The new law stipulated that all businesses in the country would accept Bitcoin as payment. Around the same time, the government also created a trust with $150 million dollars in public funds to facilitate dollar conversions and launched its digital wallet “Chivo Wallet,” granting $30 in Bitcoin to citizens who download it.

Related: Falling Bitcoin price doesn’t affect El Salvador: ‘Now it’s time to buy more’

By legalizing Bitcoin as legal tender, setting…

Click Here to Read the Full Original Article at Cointelegraph.com News…