Bitcoin regained the psychologically important $40,000 level during the weekend after spending last week struggling to surpass $39,500. As of press time, it stands at just above $42,000, showing solid resilience at this level. This recovery positively affected the broader crypto market and the performance of public Bitcoin mining companies.

Despite being listed and traded on stock exchanges like Nasdaq, public Bitcoin mining companies are susceptible to changes in Bitcoin’s spot price and other developments in the crypto market. As most TradFi investors involved with the stocks see them as a proxy for trading and owning Bitcoin, increases in Bitcoin’s price automatically translate into increases in the stock value of these companies. Conversely, a decrease in the price of BTC leads to a reduction in revenues, adversely affecting their stock performance.

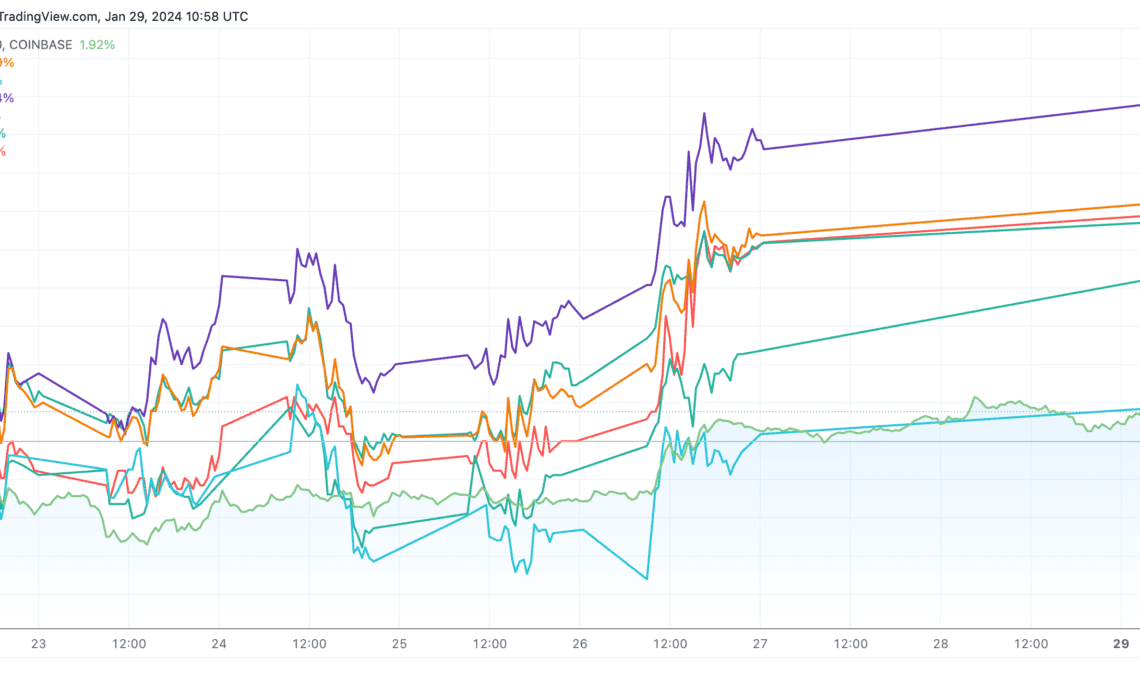

After experiencing a sharp slump in the first two weeks of January, public miners seem to have recovered most of their losses. Between Jan. 22 and Jan. 29, CleanSpark (CLSK) led the pack with a 23% increase, with Bitfarms (BITF) close behind with 18.27%. Marathon Digital (MARA), Riot (RIOT), and Hive (HIVE) grew by 17.29%, 14.71%, and 7.26%, respectively, with Iris Energy (IREN) posting the slightest growth of 3.93% during the period.

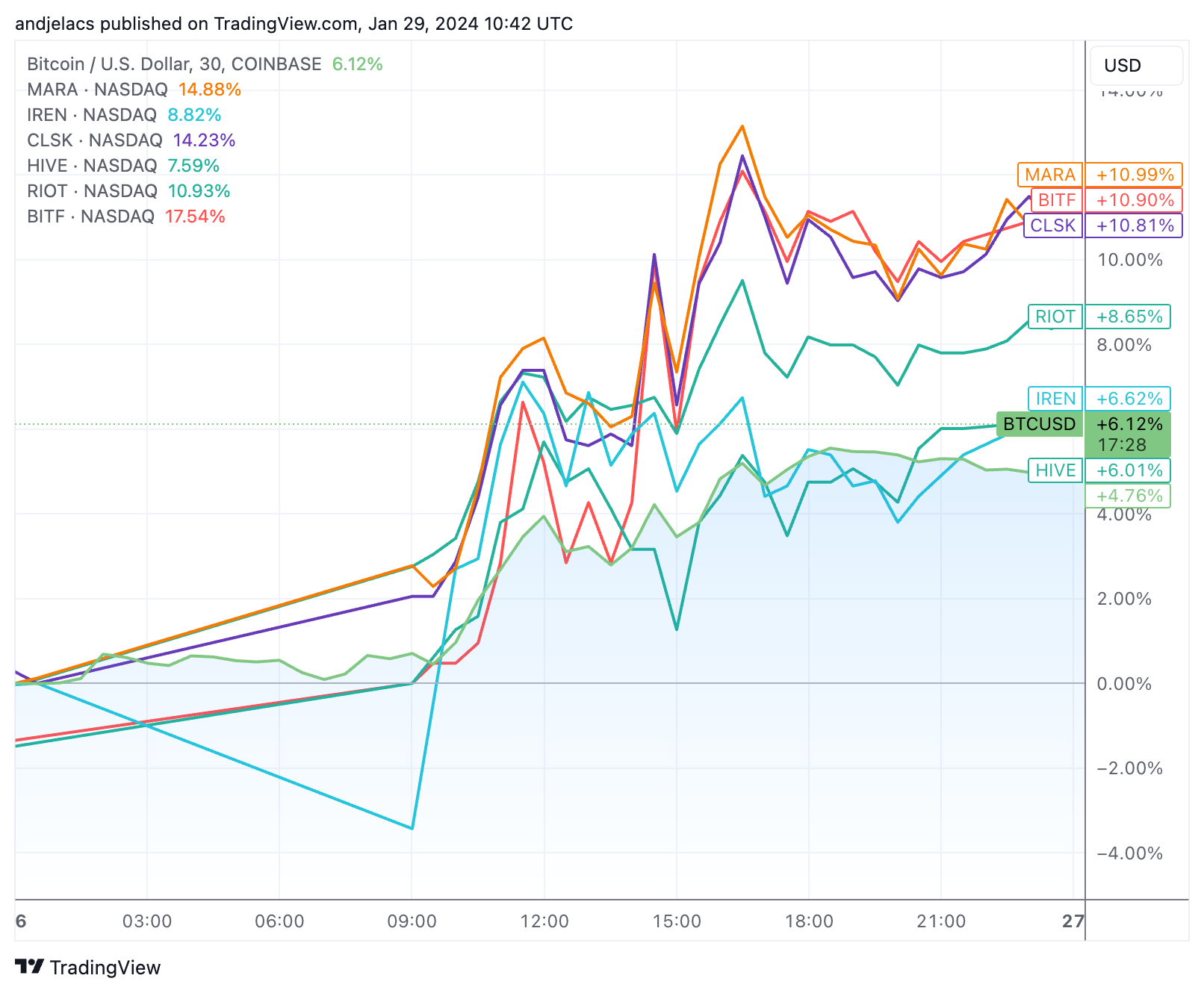

This upward trend was extremely pronounced on Friday, Jan. 26, when almost all of the mentioned stocks outperformed Bitcoin’s growth of 6.12%, with MARA, BITF, and CLSK all showing increases of over 10.80%.

On Jan. 29, as of press time, there has been a lack of response from Bitcoin mining stocks to Bitcoin’s price movement. This lag is due to the different trading hours between the crypto market, which operates 24/7, and traditional stock exchanges like Nasdaq, which operates only on weekdays and where most of the mining stocks are listed. This discrepancy often results in a delayed reaction in mining stock prices to Bitcoin’s weekend price movements. Given Bitcoin’s rise past $42,000 over the weekend, we could see further growth in mining stocks as the market opens on Jan. 29 and adjusts to the development in the coming week. Stocks such as RIOT, MARA, and CLSK are up 3%, 3.9%, and 4.2%, respectively, so far in pre-market trading.

The…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…