Key Takeaways

- Grayscale’s Ethereum ETF has seen over $2.6 billion in outflows since its conversion.

- Regulatory uncertainty around staking features affects investor interest in Ethereum ETFs.

Share this article

The nine US exchange-traded funds (ETFs) tracking the spot price of Ethereum (ETH) have been struggling to attract new capital since their strong start in late July.

Outflows from the Grayscale Ethereum Trust have contributed largely to the daily negative performance, with sluggish demand for other competing ETFs also playing a role.

In this article, we discuss the current challenges facing spot Ethereum ETFs, their circumstances compared to spot Bitcoin ETFs, and how they can be successful with increased institutional adoption and regulatory developments.

Spot Ethereum ETF performance: a snapshot

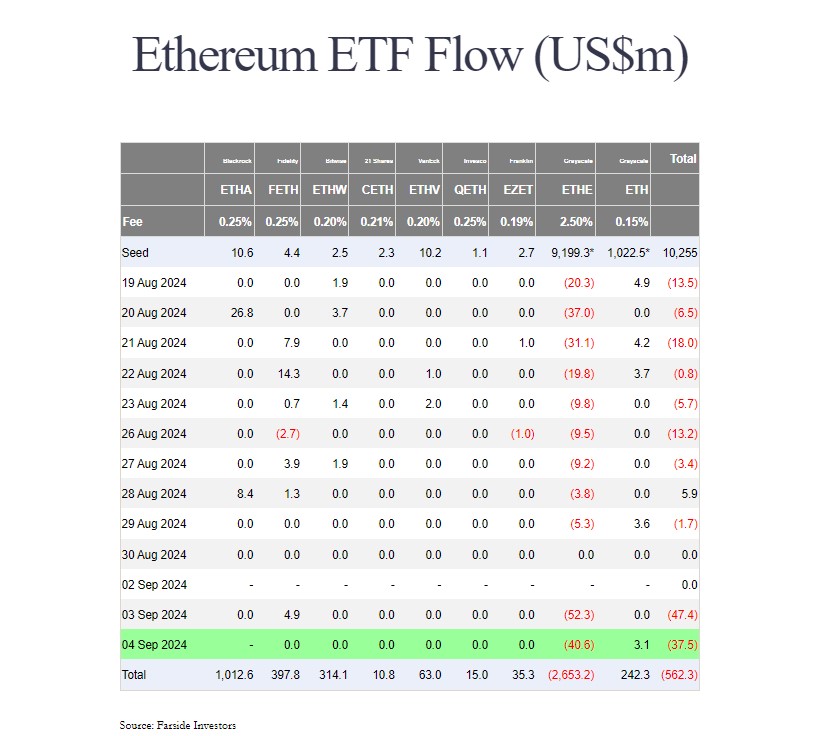

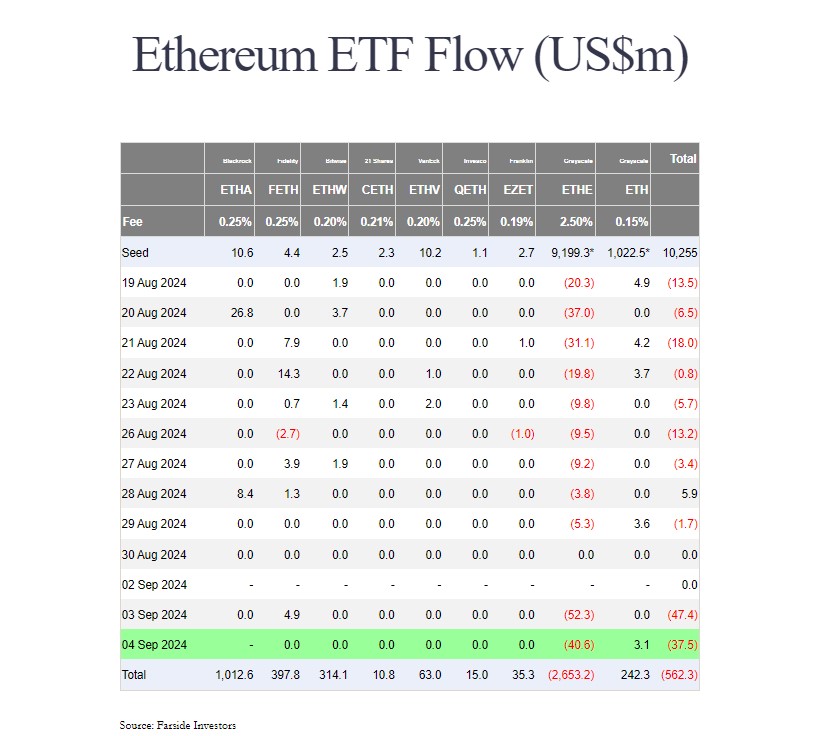

According to data from Farside Investors, Grayscale’s Ethereum fund, also known as ETHE, has seen over $2.6 billion in net outflows since it was converted into an ETF.

Grayscale has maintained a 2.5% fee for its Ethereum ETF, which is about ten times more expensive than other newcomers. Competitors like BlackRock and Fidelity charge around 0.25%, while others like VanEck and Franklin Templeton charge even less.

Yet, the fee structure is not the only factor that matters. Grayscale has offered a low-cost version of ETHE but it is still far from competing with BlackRock’s Ethereum ETF.

BlackRock’s iShares Ethereum Trust (ETHA) has logged…

Click Here to Read the Full Original Article at Education Archives – Crypto Briefing…