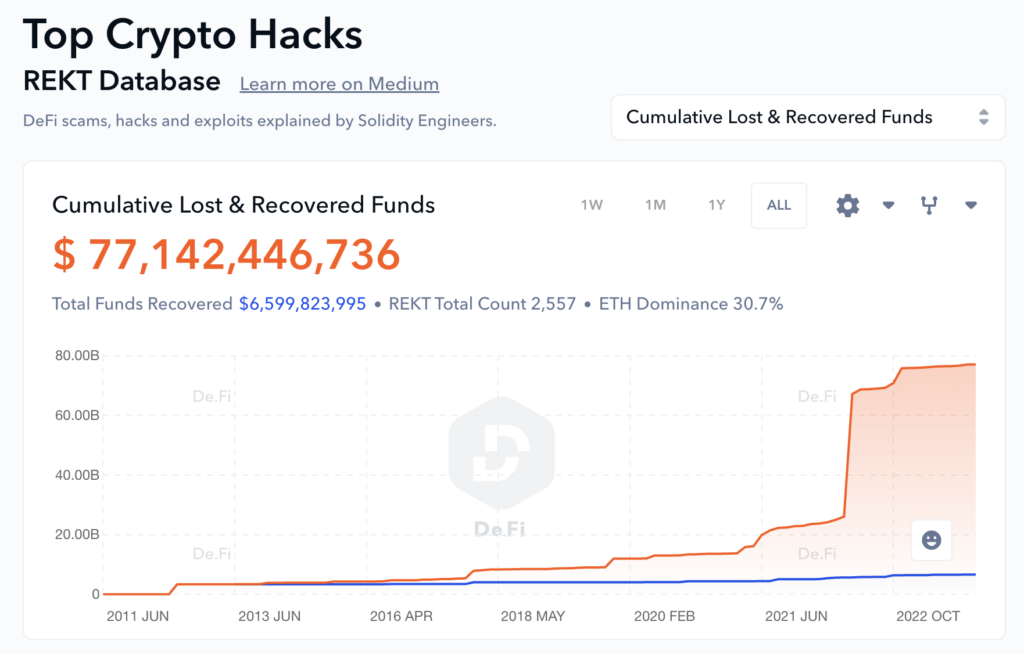

De.Fi’s Rekt Database reports that July saw $389.82 million in DeFi losses related to hacks and exploits, pushing the cumulative total value of all of to cross the threshold of $77 billion.

Ethereum emerged as the most targeted, losing $350 million across 36 incidents. Multichain, however, suffered the most severe single-case loss of $231 million due to an access control exploit, according to the De.Fi analysis.

Criminals’ diverse arsenal of exploits across DeFi.

Access control issues led to three significant cases resulting in a staggering loss of $287 million. Rugpulls, even though the most common with 38 reported cases, resulted in significantly lower losses totaling $36 million. Reentrancy attacks, although less frequent with six cases, still led to substantial losses of $58 million.

Among the different categories of targets, tokens were the most frequently attacked, with 39 cases reported leading to losses totaling $35.9 million. Borrowing and lending protocols were targeted once, with a loss of $3.4 million. The Bridge category was hit hardest, reporting a loss of $241 million from two incidents.

The Multichain exploit was at the top of the exploit list, with $231.1 million lost due to access control issues. The Vyper Compiler saw losses of $50.5 million due to a reentrancy attack, while the BALD Token lost $23.1 million due to a token rugpull. De.Fi provided CryptoSlate with a list of the top exploits in July, shown below.

| Rank | Platform/Token | Amount Lost | Type of Exploit |

|---|---|---|---|

| 1 | Multichain | $231.1m | Access Control |

| 2 | Vyper Compiler | $50.5m | Reentrancy |

| 3 | BALD Token | $23.1m | Token Rugpull |

| 4 | AlphaPo | $22.8m | CeFi, Access Control |

| 5 | Poly Network | $10.2m | Access Control |

According to the Rekt Database, the recovery of exploited funds in July was notably low. A mere $7 million was recouped from the vast loss, continuing the unfortunate trend of low recovery rates in recent months.

July marks the height of DeFi’s losses for 2023, with close to $1 billion now lost in total for the year. There…

Click Here to Read the Full Original Article at Ethereum (ETH) News | CryptoSlate…