Despite the decentralized finance (DeFi) market suffering a 74.6% market cap decline in Q2, user activity has remained relatively resilient, says CoinGecko.

In a report published by the crypto data aggregator on July 13th, CoinGecko reported that the overall DeFi market cap fell from $142 million to $36 million over the second quarter, due mainly to the collapse of Terra and its stablecoin TerraUSD (UST) in May.

CoinGecko also noted a rise in decentralized finance DeFi exploits in the quarter contributed to the fall, including Inverse Finance and Rari which suffered hacks of $1.2 million and $11 million respectively.

“These attacks have negatively impacted token prices as investors lose faith in these hacked protocols.”

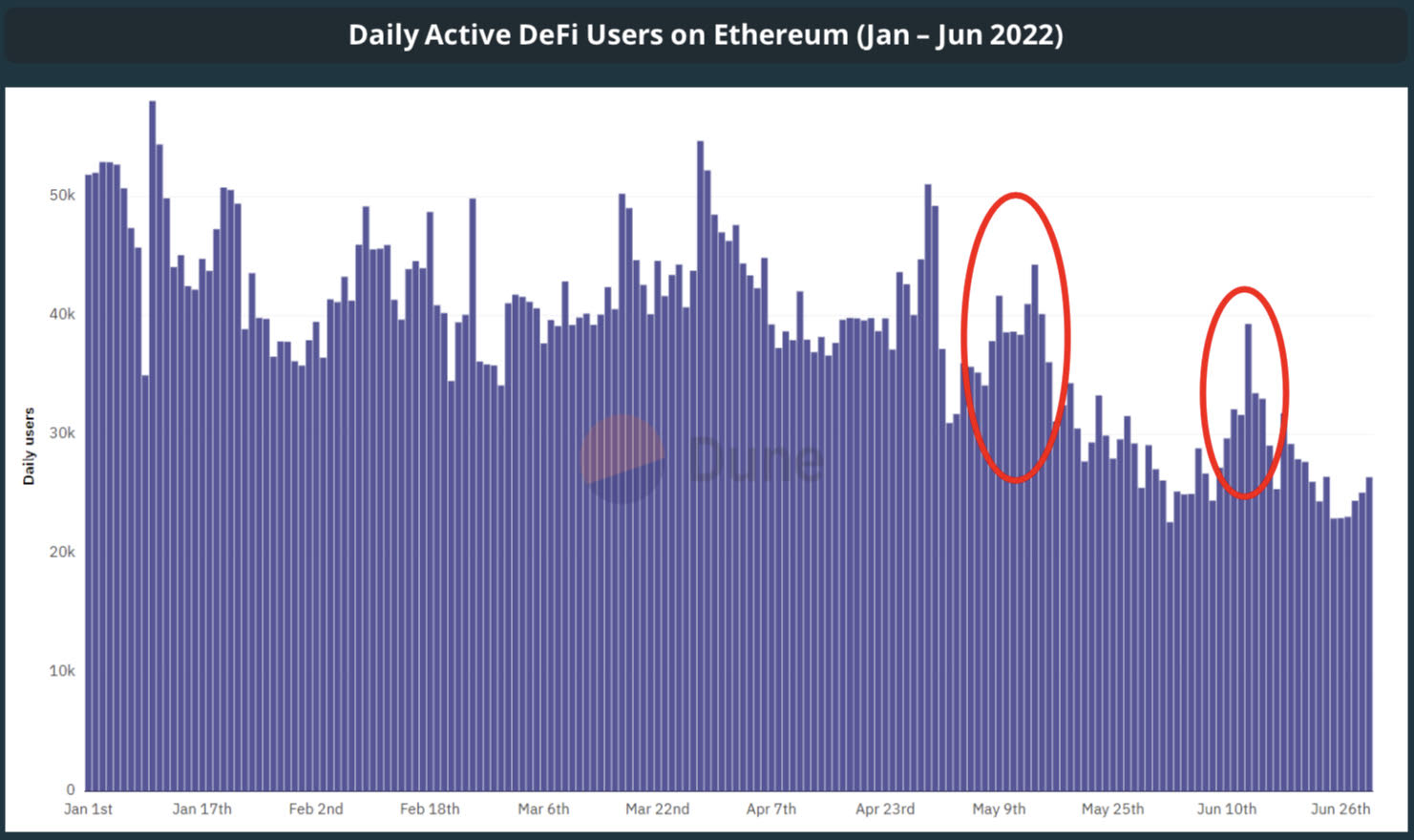

However, CoinGecko also noted that while on-chain activity slowed down, the DeFi industry has managed to retain most of its daily active users.

It noted that the number of daily active users in DeFi decreased only 34.5% from 50,000 to 30,000 in Q2, added there were also multiple instances that caused a spike in DeFi activity.

The first spike was observed in May following Terra’s collapse, leading to users moving to Curve Finance and Uniswap on mass to sell their falling LUNA and UST.

Related: Terra crash highlights stablecoin risk to financial stability: ECB

Similarly, another spike in DeFi user activity took place in June according to CoinGecko, when crypto lending platform Celsius enforced withdrawal restrictions citing financial difficulties. Celsius filed for bankruptcy on July 13.

“In both events where centralized entities have failed, users have flocked to enjoy DeFi’s permissionless nature.

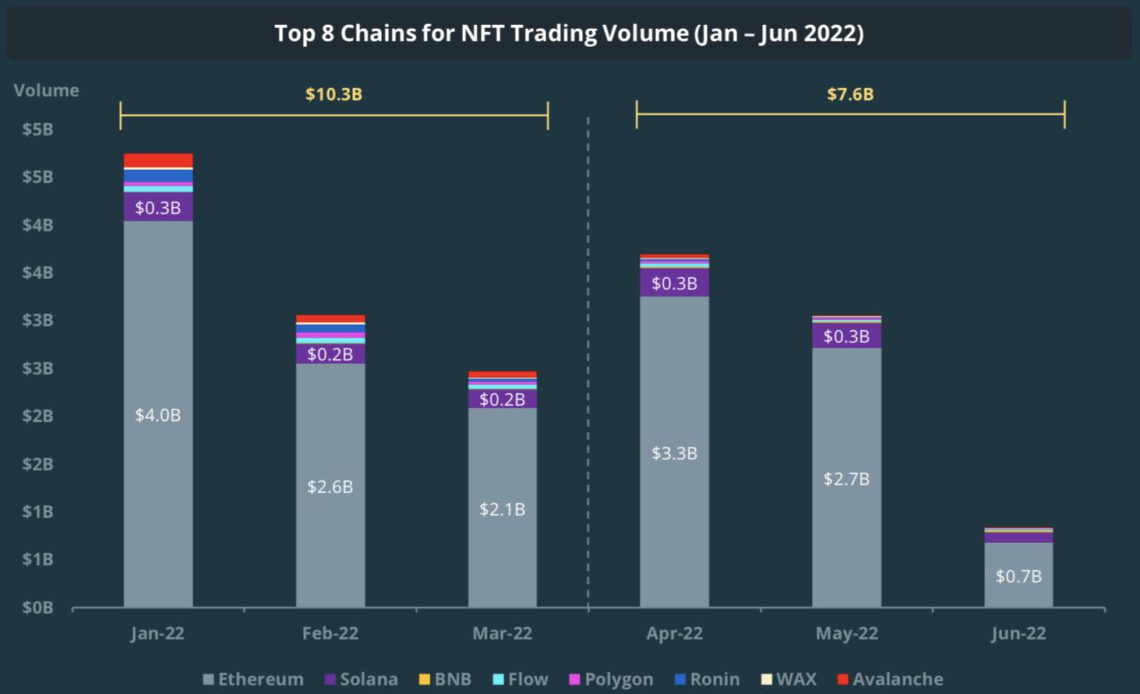

NFT trading volume down

The report also found that trading volume for non-fungible tokens (NFTs) fell 26.2.% from its peak in June 2021 to $7.6 billion in the quarter, led mainly by a decline in the trading volume of NFTs offered on the Ethereum network.

June 2022 also saw the lowest trading volume in 12 months, with NFT trading volume reaching $830 million, coinciding with a collapse of the floor price of NFTs.

Click Here to Read the Full Original Article at Cointelegraph.com News…