Presently, there seems to be a general assumption that when the U.S. dollar value increases against other global major currencies, as measured by the DXY index, the impact on Bitcoin (BTC) is negative.

Traders and influencers have been issuing alerts about this inverse correlation, and how the eventual reversal of the movement would likely push Bitcoin price higher.

Analyst @CryptoBullGems recently reviewed how the DXY index looks overbought after its relative strength index (RSI) passed 78 and could be the start of a retrace for the dollar index.

This is literally the only thing you need to look at:

The $DXY is crazy overbought right now and due a correction. $BTC is the most oversold it ever has been on the monthly timeframe.

BITCOIN AND THE DOLLAR SHARE AN INVERSE CORRELATION. $BTC will rise and fiat will fall. pic.twitter.com/MpZniivpj0

— The London Crypto (@SerLondonCrypto) September 6, 2022

Moreover, technical analyst @1coin2sydes presents a bearish double top formation on the DXY chart, while simultaneously Bitcoin forms a double bottom, a bullish indicator.

Very beautiful Inverse Correlation between the Dollar Index DXY and Bitcoin BTC!

As #DXY forms a Double top (which maybe a reversal of its Trend) – Heading Down!#BTC forms a Double Bottom (which may serve also as a trend reversal) – Heading UP!#2sydes pic.twitter.com/A4eZSfJG82

— 2sydes.eth (,) (@1coin2sydes) September 12, 2022

Correlation changes over time, despite the general inverse trend

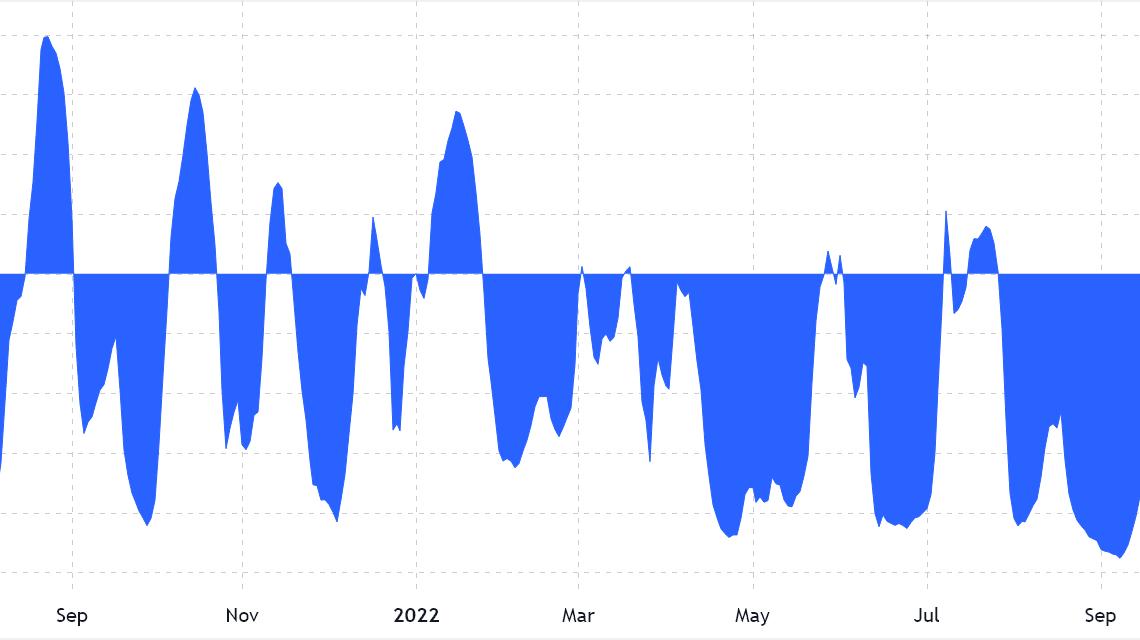

The periods of inverse movements between Bitcoin and the DXY index have never exceeded 36 days. The correlation metric ranges from a negative 1, meaning select markets move in opposite directions, to a positive 1, which reflects a perfect and symmetrical movement. A disparity or a lack of relationship between the two assets would be represented by 0.

The metric has been below negative 0.6 since Aug. 19, indicating that both DXY and Bitcoin have generally followed an inverse trend. In fact, the longest-ever period of inverse correlation has been April 14 to May 20.

Saying that Bitcoin holds an inverse correlation to the DXY index would be statistically incoherent since it had a negative 0.6 or lower in less than 30% of the days since 2021.

The dollar strengthened after the FOMC minutes

On Aug. 17, officials at the United States Federal Reserve indicated that additional interest rate hikes would be needed until inflation eased substantially,…

Click Here to Read the Full Original Article at Cointelegraph.com News…