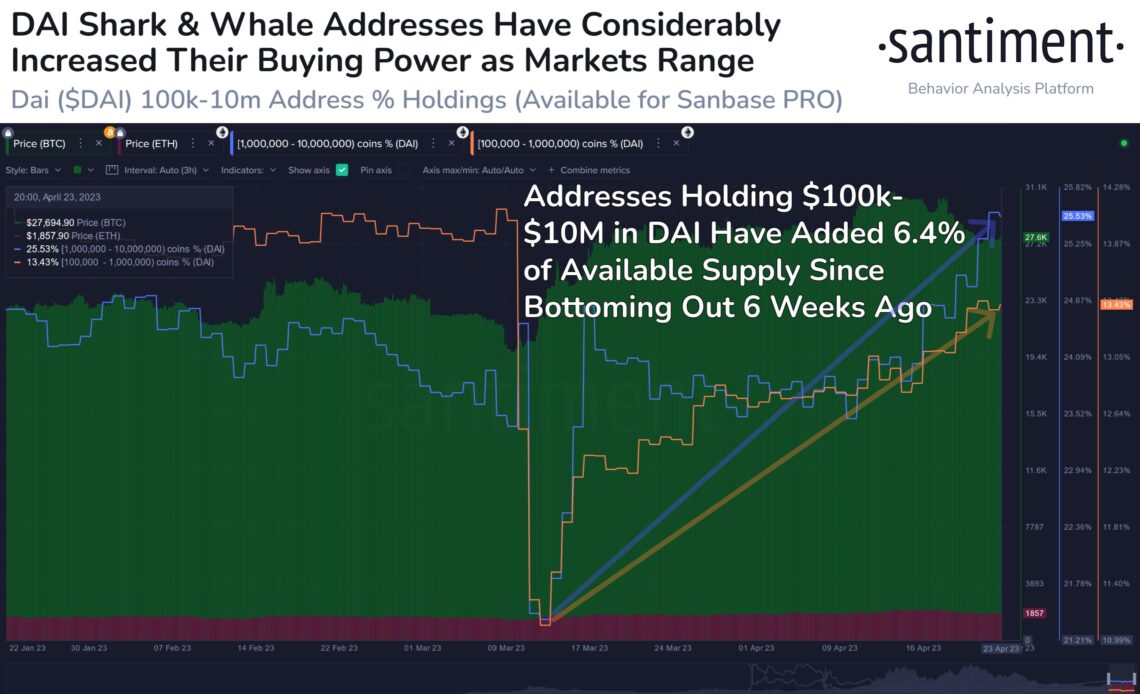

Large crypto addresses have been accumulating stablecoins amid the crypto volatility in April, according to the analytics firm Santiment.

Santiment notes that shark and whale wallets, or addresses holding between 100,000 and 10 million of the stablecoin Dai (DAI), have acquired 6.4% of the asset’s supply since their DAI holdings bottomed out six weeks ago.

According to Santiment, shark and whale addresses are increasing their dry powder as the crypto markets enter a period of consolidation.

DAI, the fourth-largest stablecoin, briefly lost its desired $1.00 peg over a three-day period in March and fell to an all-time low of $0.881.

The stablecoin recovered quickly and has largely maintained its $1.00 price since then, though it is trading at $0.997 at time of writing.

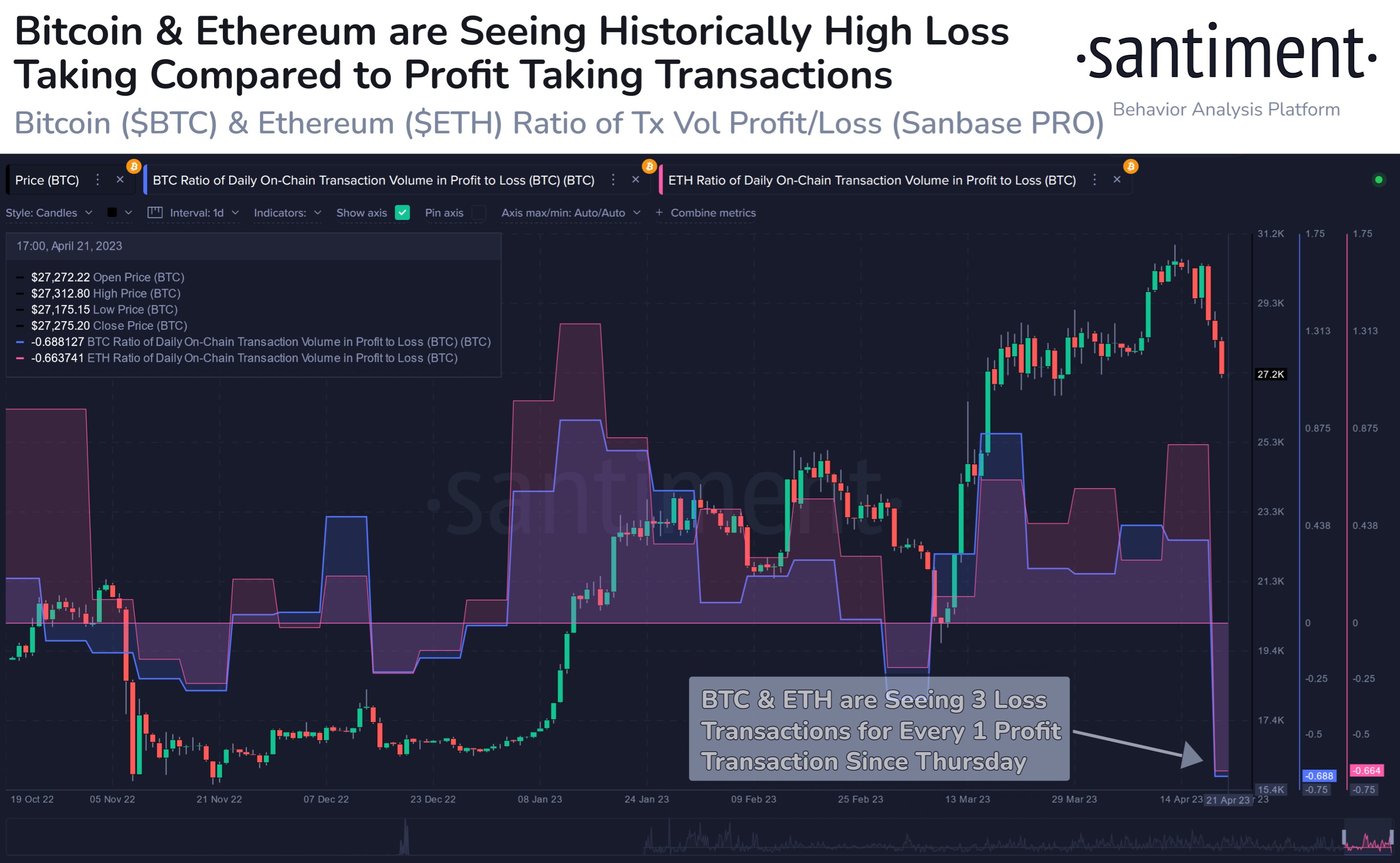

Santiment also notes that Bitcoin (BTC) and Ethereum (ETH) traders who were late to the rally are eating up losses as the two leading crypto assets moves below $30,000 and $2,000, respectively.

According to the analytics firm, BTC and ETH are witnessing “historically high” loss transactions, which it says could mark a local bottom for the crypto markets.

“Since Thursday, traders are moving coins below prices they obtained them at three times as often as above. Historically, when this ratio is below breakeven, it is a good sign of capitulation that will often mark (at least temporary) price bottoms.”

Bitcoin is trading at $27,529 at time of writing. The top-ranked crypto asset by market cap is down 0.65% in the past day.

Ethereum is trading at $1,841 at time of writing. The second-ranked crypto asset by market cap is down 1.4% in the past 24 hours.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Click Here to Read the Full Original Article at Ethereum News – The Daily Hodl…