A popular crypto strategist is updating his outlook on Aptos (APT) and Chainlink (LINK) while forecasting the near-term price action for the broader altcoin market.

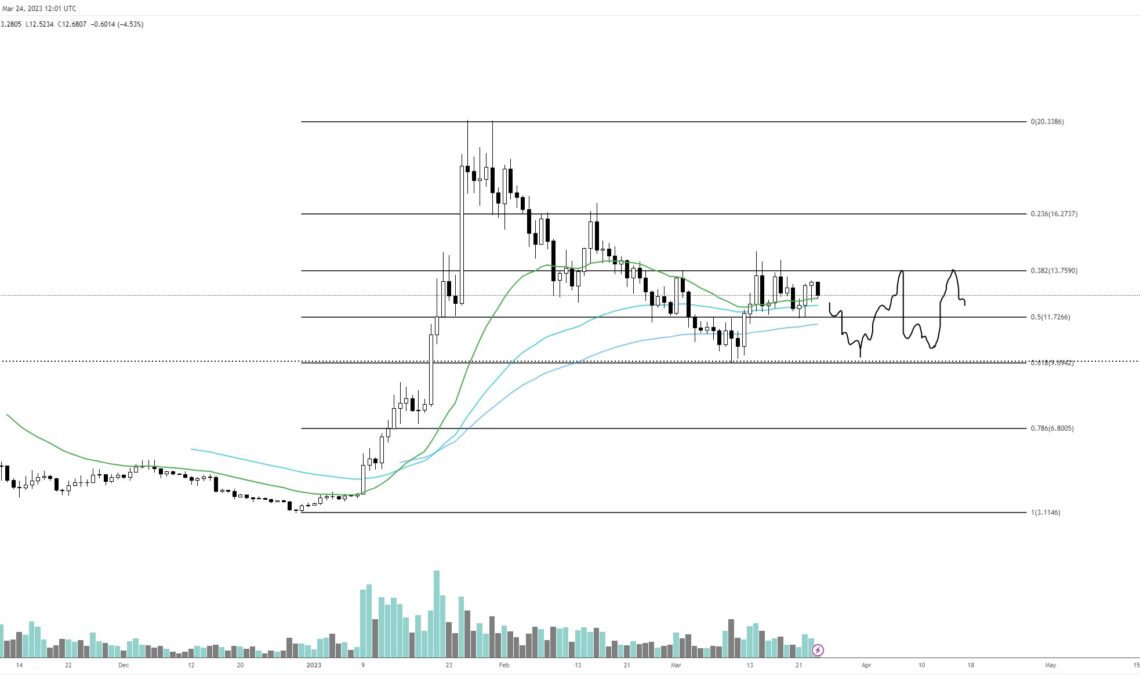

Pseudonymous analyst Altcoin Sherpa tells his 184,700 Twitter followers that layer-1 blockchain and Ethereum (ETH) competitor Aptos is likely going to see weeks of choppiness.

According to Altcoin Sherpa, APT could witness a burst to the upside once Bitcoin (BTC) takes a breather. In the short term, he expects Aptos to range trade between $10 to $13.75.

“APT: Expecting a lot of altcoins to look something like this. Chop fest and not really do a whole lot compared to Bitcoin. Once BTC takes a break, these altcoins fly (probably a few weeks).”

Aptos is trading for $12.22 at time of writing.

Next, Altcoin Sherpa says the decentralized oracle service Chainlink has spent nearly a year trading sideways between a high of about $9.50 and a low of $5.50. According to the analyst, he plans to accumulate LINK if it takes out the high of the range.

“LINK: this shitcoin has been ranging for nearly a year. I’m going to buy after the breakout, not a day before. I learned my lesson last time.”

Chainlink is worth $7.25 at time of writing.

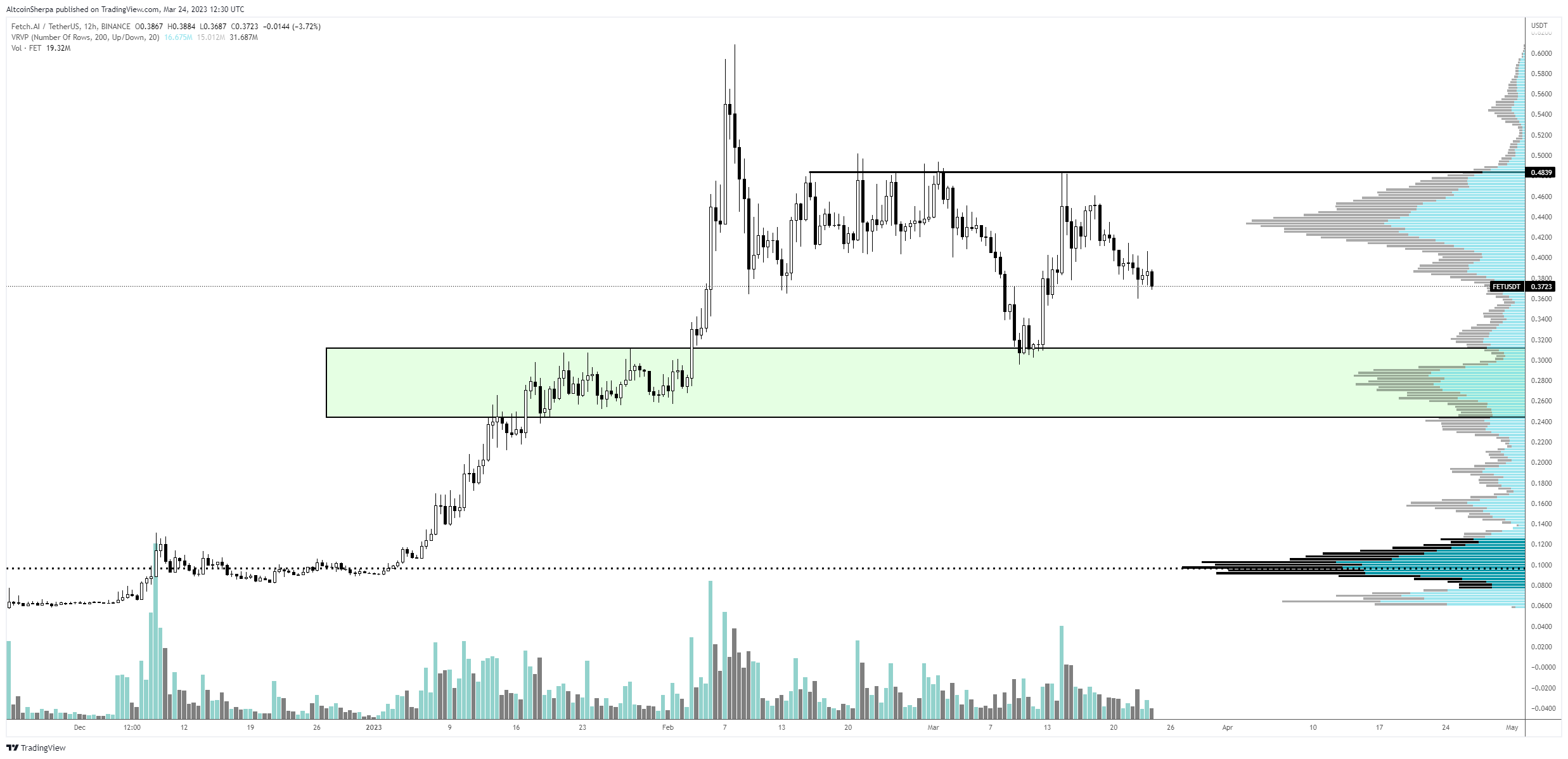

Altcoin Sherpa is also keeping an eye on Fetch.ai (FET), an AI-focused crypto project. The crypto trader believes that FET is currently facing bullish exhaustion and could see a significant devaluation.

“FET: I think this one goes to $0.26 or lower, that’s the next area of liquidity, in my opinion. Overall, trend looks tired. We shall see if the AI narrative has more legs.”

Fetch.ai is trading for $0.37 at time of writing.

Lastly, Altcoin Sherpa says the Bitcoin rally may cool off soon to build a stronger base of buyers before igniting the next leg up. According to the crypto strategist, a period of consolidation for BTC could open the door for altcoins to make some noise.

“Looking at volume profile, it actually looks like there *could* be an argument for a sooner altcoin run than we think. [BTC] price has a relative void between $25,000 and $30,000. Usually, you see price filling that out and trading happening there.

What does this mean? It means that when there is a big void in overall trading activity, traders like to ‘fill the gap’ a bit and trade in that area. We could see BTC range between $25,000-$30,000 to fill this area out and this would…

Click Here to Read the Full Original Article at The Daily Hodl…