Key Takeaways

- All crypto transactions must be reported on 2024 tax returns as per IRS.

- Use Form 8949 and Schedule 1 or C for reporting crypto gains and income.

Share this article

Here’s what you need to know about reporting crypto on your 2024 taxes:

- The IRS treats crypto as property, not currency

- You must report all crypto transactions, even small ones

- Taxable events include selling, trading, and using crypto to buy goods

- Use Form 8949 to report crypto gains/losses

- Report crypto income on Schedule 1 or Schedule C

Key steps for crypto tax reporting:

- Gather all transaction records

- Calculate gains/losses for each transaction

- Fill out Form 8949 and Schedule D

- Report any crypto income

- Answer the digital asset question on Form 1040

Common pitfalls to avoid:

- Not reporting all transactions

- Incorrect cost basis calculations

- Misclassifying transaction types

Use crypto tax software to simplify reporting. Stay updated on IRS rule changes for 2024, including new reporting requirements for exchanges.

Transaction types and their tax treatment

- Buying crypto: not taxable.

- Selling crypto: subject to capital gain or loss.

- Trading crypto: subject to capital gain or loss.

- Receiving as payment: treated as regular income.

- Mining rewards: treated as regular income.

When in doubt, consult a tax professional familiar with crypto regulations.

Basics of crypto taxation

Understanding how cryptocurrencies are taxed is key for anyone using digital assets. The IRS has rules for taxing crypto, and knowing these rules helps you follow the law and avoid penalties.

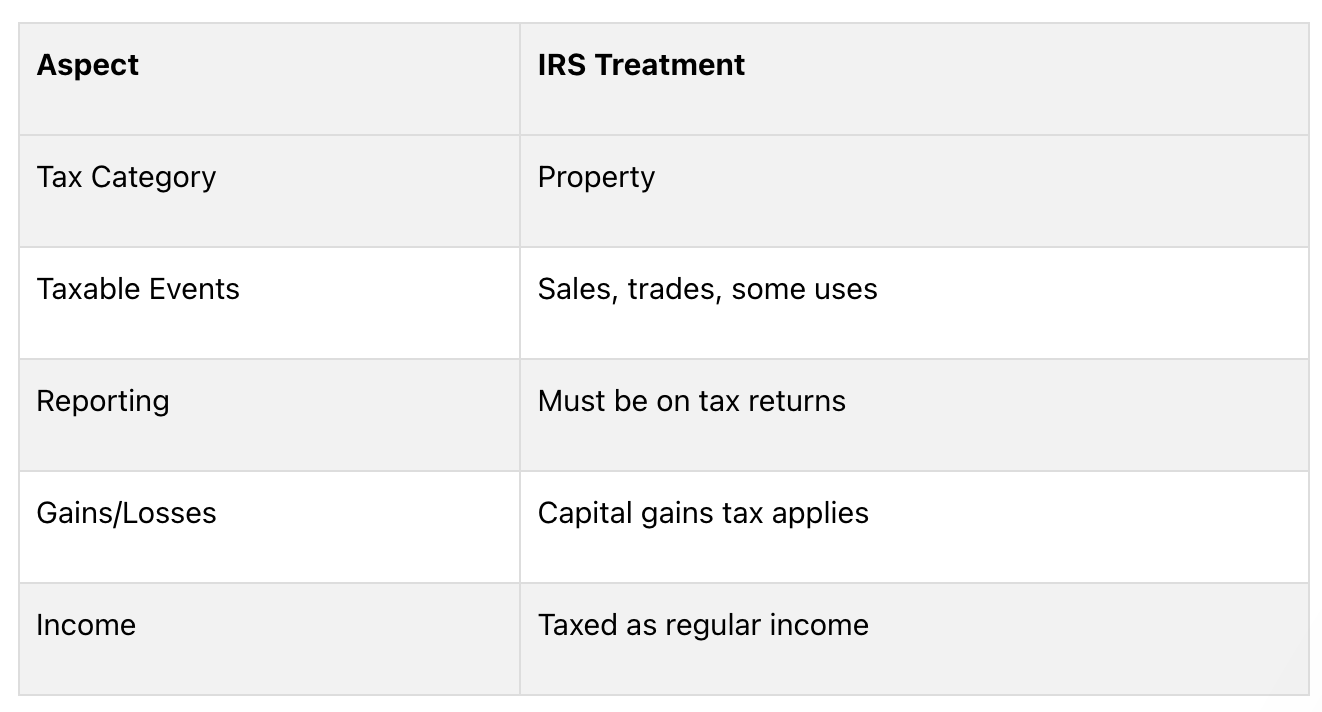

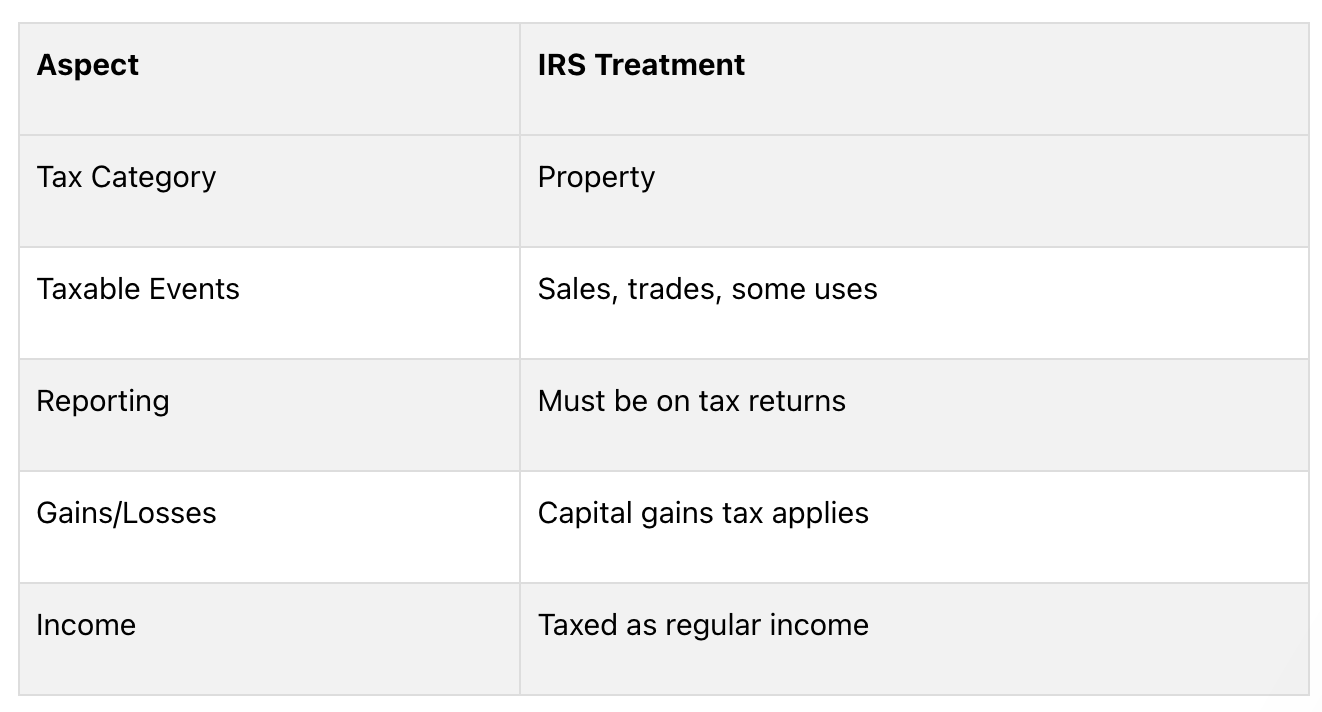

How the IRS views crypto

The IRS treats crypto as property, not money. This affects how they’re taxed:

Because tokens are property, the IRS uses the same tax rules for them as for other property. This means you need to report any gains or losses from crypto on your taxes.

Taxable vs. non-taxable events

Knowing which crypto activities are taxable is important for correct reporting. Here’s a simple breakdown:

Taxable events

- Selling crypto for regular money

- Trading one token for another

- Buying things with crypto

- Getting paid in crypto

- Mining…

Click Here to Read the Full Original Article at Education Archives – Crypto Briefing…