Looking back, 2023 was unmistakably a year of transition for the emergent asset class. Positioning, leverage and the speculative excesses from the previous market cycle were swept away in 2022, allowing for the seeds of the next cycle to sprout in 2023. What persisted and remains is a market with increased interoperability across protocols and projects, with builders and market participants catering to regulated institutional investors with an eye towards greater real-world utility.

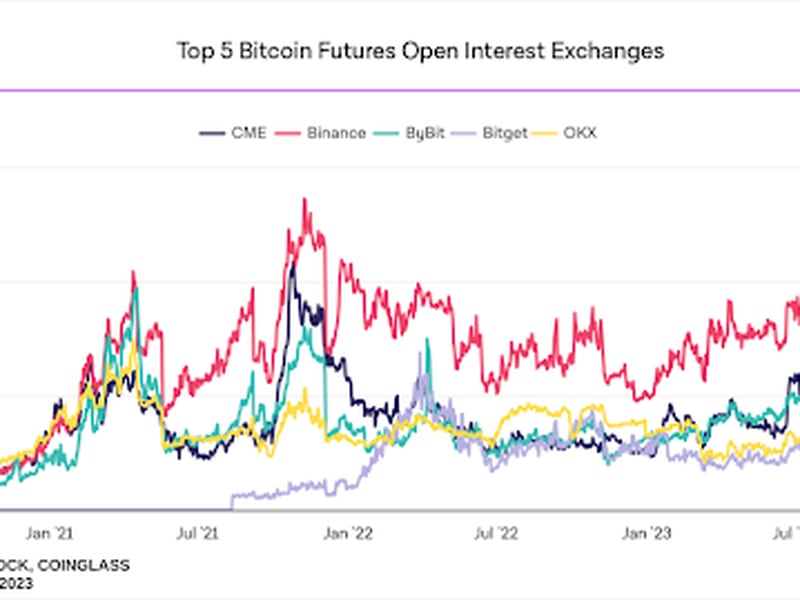

Once prominent crypto exchanges like FTX and Binance have seen changes in leadership, with more regulated players like Coinbase, Bullish (now owner of CoinDesk), and EDX leading the market. Meanwhile, traditional futures exchanges like CME are seeing growing volumes for bitcoin and ether-linked futures contracts (see chart below), which now exceed Binance in bitcoin futures open interest.

We also witnessed renewed efforts in the U.S. to list spot token ETFs, with Blackrock surprising the market with its application to the SEC in June. This encouraging institutional development helped support the demand for bitcoin as a real asset and a currency debasement hedge for a financial system awash with fiat liquidity and supportive stimulus, strengthening the narrative of broader adoption for digital assets.

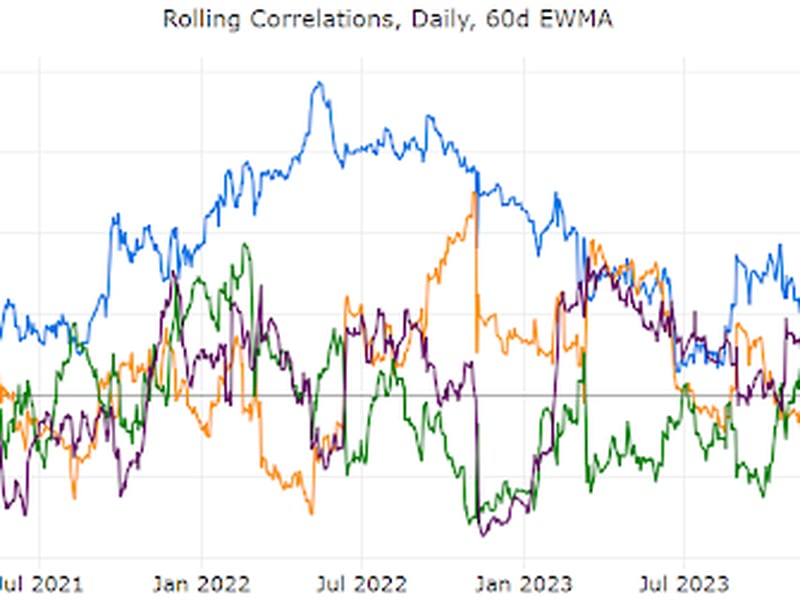

The 2023 period was also one of reduced macroeconomic correlations across digital assets. Crypto was allowed to be crypto, and mostly decoupled from US equities and gold over the year (see rolling correlation chart above), albeit with lower levels of realized volatility than in prior years. Surprisingly, ether realized nearly the same level of volatility as bitcoin in 2023, breaking from the historical norm of generally realizing ~20% higher, with bitcoin’s volatility dropping towards levels akin to single stock volatility, and more in line with traditional asset classes.

Collectively, these developments signal a maturation of the crypto market and an ongoing transition to an institutional landscape. This transition and broadening of the ecosystem towards more traditional, more regulated market participants is expected to lie at the core of the narrative for the next market cycle.

Outlook for 2024

We expect 2024 will see further maturation of the crypto market towards institutional investors. This…

Click Here to Read the Full Original Article at Cryptocurrencies Feed…