Crypto market capitalization has reached a new all-time high of $3.12 trillion — and is now close to surpassing France’s gross domestic product (GDP).

On Nov. 11, total crypto market capitalization soared 7% over 24 hours, due mainly to a sudden surge in Bitcoin, which rallied to $89,500.

If the crypto market were a country, it would be the eighth largest in GDP terms behind the United States, China, Germany, Japan, India, the United Kingdom and France.

Meanwhile, Bitcoin’s market cap alone is now over $1.77 trillion — larger than Spain’s GDP, according to the International Monetary Fund.

The last time the total crypto market cap was at $3 trillion was Nov. 15, 2021, shortly after Bitcoin reached its previous all-time high of $69,000 in the 2020-2021 bull market, according to CoinGecko, which tracks 15,129 coins from 1,149 crypto exchanges.

Change in the crypto market cap over the last month. Source: CoinGecko

The crypto market cap is now larger than that of tech giant Microsoft and is closing in on Nvidia and Apple, the world’s two most valuable companies, Google Finance data shows.

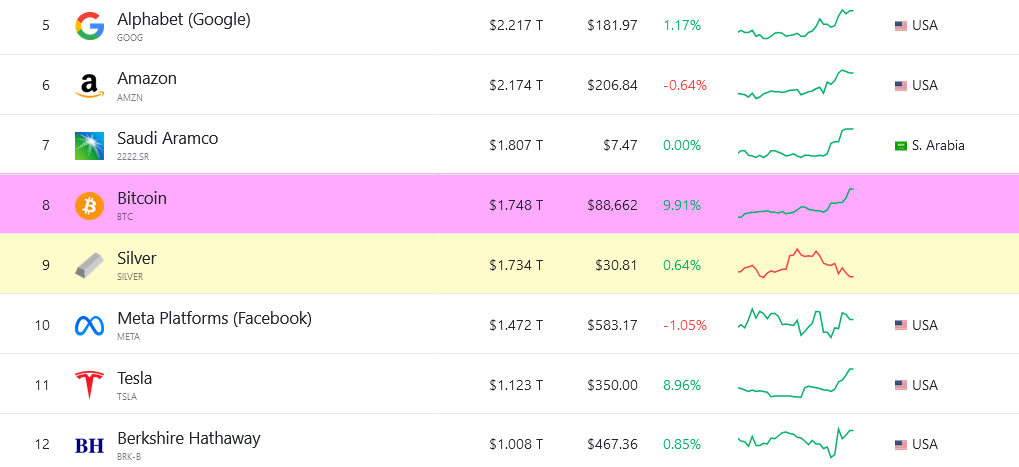

The Bitcoin price rally also pushed its market cap above that of silver again on Nov. 11.

The 5th to 12th largest assets by market cap. Source: Companies Market Cap

Speaking to Cointelegraph, founder of 10x Research Markus Thielen expects Bitcoin dominance to “remain strong” as the crypto market cap moves toward $4 trillion.

Related: Bitcoin price will hit $1M, but at what cost? — Michaël van de Poppe

“We anticipate Bitcoin’s dominance to remain strong, with the current rally primarily centered on Bitcoin and extending toward Ethereum and Solana.”

“We firmly expect Bitcoin to reach $100,000 before year-end.”

A Bitcoin price tag of $100,000 would take its market cap to nearly $2 trillion.

Thielen also believes a few Solana-based tokens to outperform the market and expects many high-performers from the 2020-2021 bull cycle may underperform.

Bitcoin is currently priced at $89,478 — up 11% over 24 hours and within striking distance of crossing the $90,000 mark.

Magazine: DeFi and Ethereum are the ‘new narrative’: Michaël van de Poppe, X Hall of Flame

Click Here to Read the Full Original Article at Cointelegraph.com News…