Crypto-based investment products market recorded $53.7 million in outflows during the week of May 1-7, with Bitcoin (BTC) based products accounting for almost all, according to CoinShares’ weekly report.

BTC and short-BTC-based products recorded a total of $54.9 million in outflows, as the CoinShares report noted.

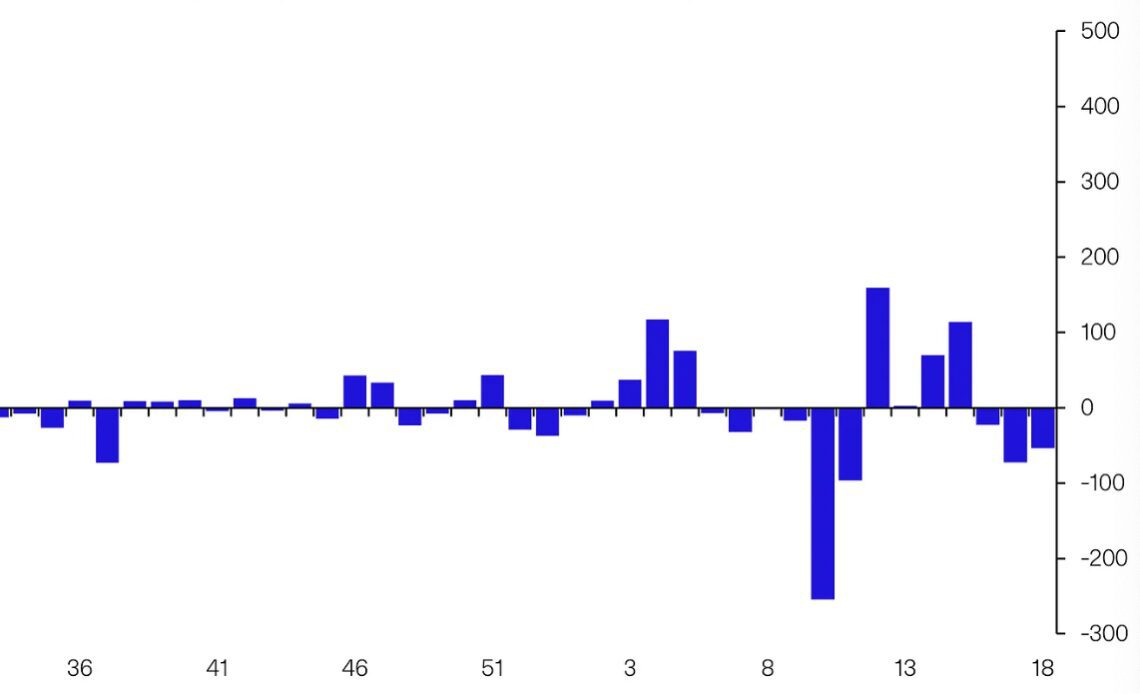

The week of May 1-7 also marked the third consecutive week of outflows for the crypto investment products market.

The market’s last outflows streak started in February and lasted six weeks straight. The aggregate value lost during this period reached $408 million, with the largest recorded during the week of Mar. 6 – 12 with $225 million.

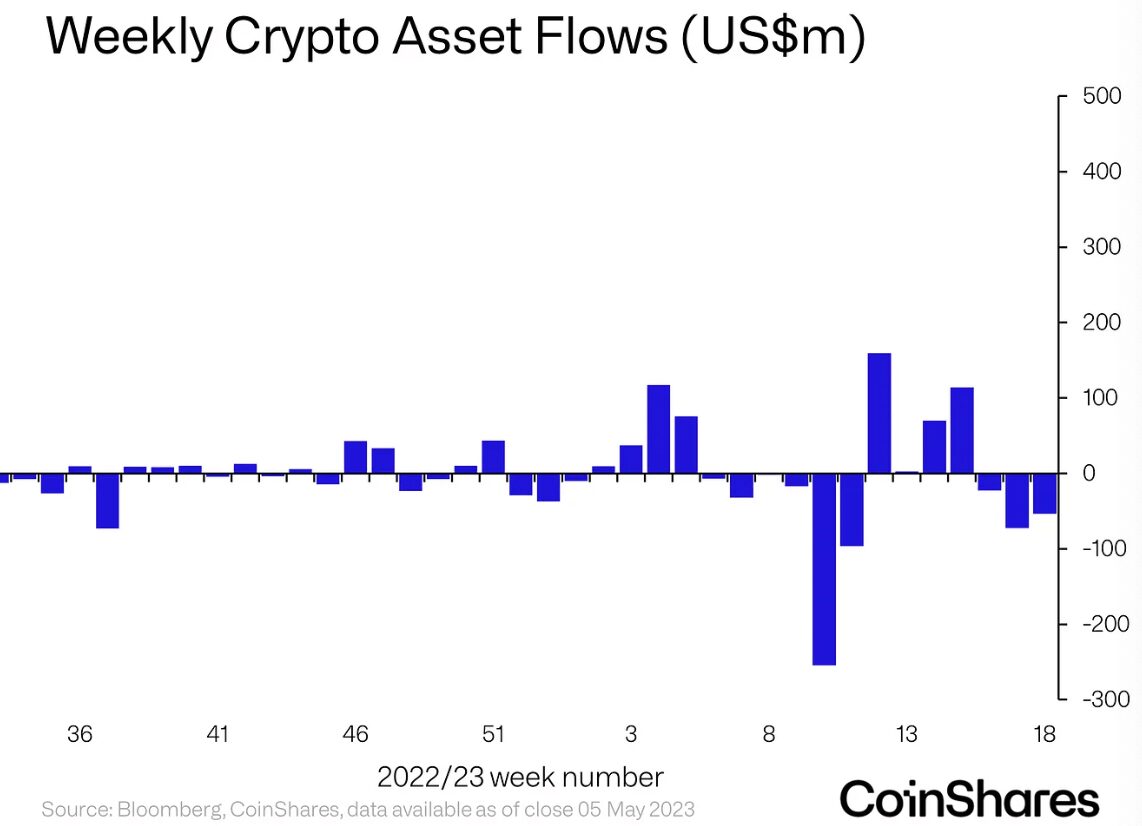

Flows by asset

BTC and Short-BTC-based products were almost entirely responsible for the weekly outflows. Within seven days, BTC lost $31.8 million, while short-BTC products saw $23.1 million in withdrawals.

This is particularly unusual for short-BTC products. Even when the market was on its six-week-outflows streak, short-BTC products recorded inflows almost every week. Acknowledging this irregularity, the CoinShares report stated that this was the “largest weekly outflows from short-bitcoin on record of US$23m.”

Other than BTC, Ethereum (ETH) also closed the week on the negative by recording $2.3 million in withdrawals. In return, multi-asset and Solana (SOL)-based products saw inflows worth $100,000 and $3.4 million, respectively, bringing the overall market score to -$53.7 million.

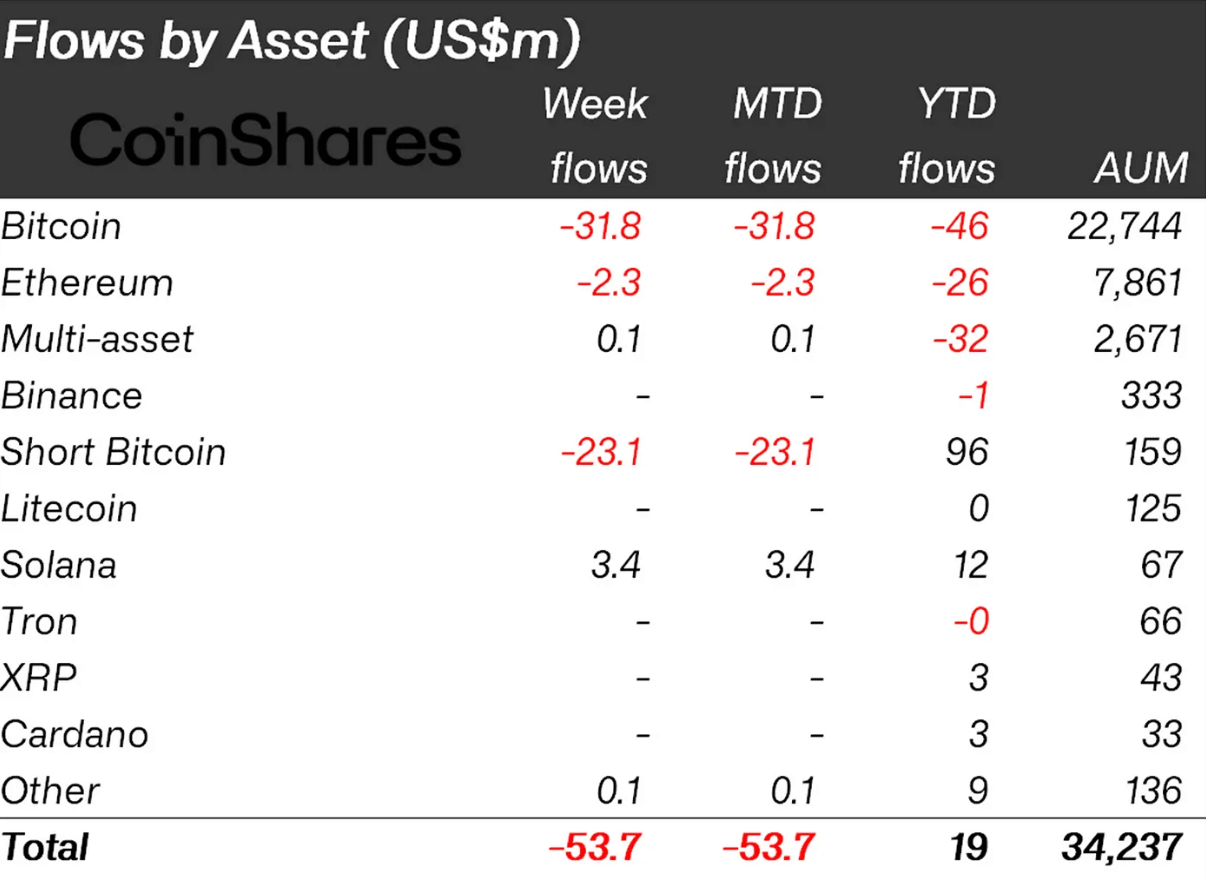

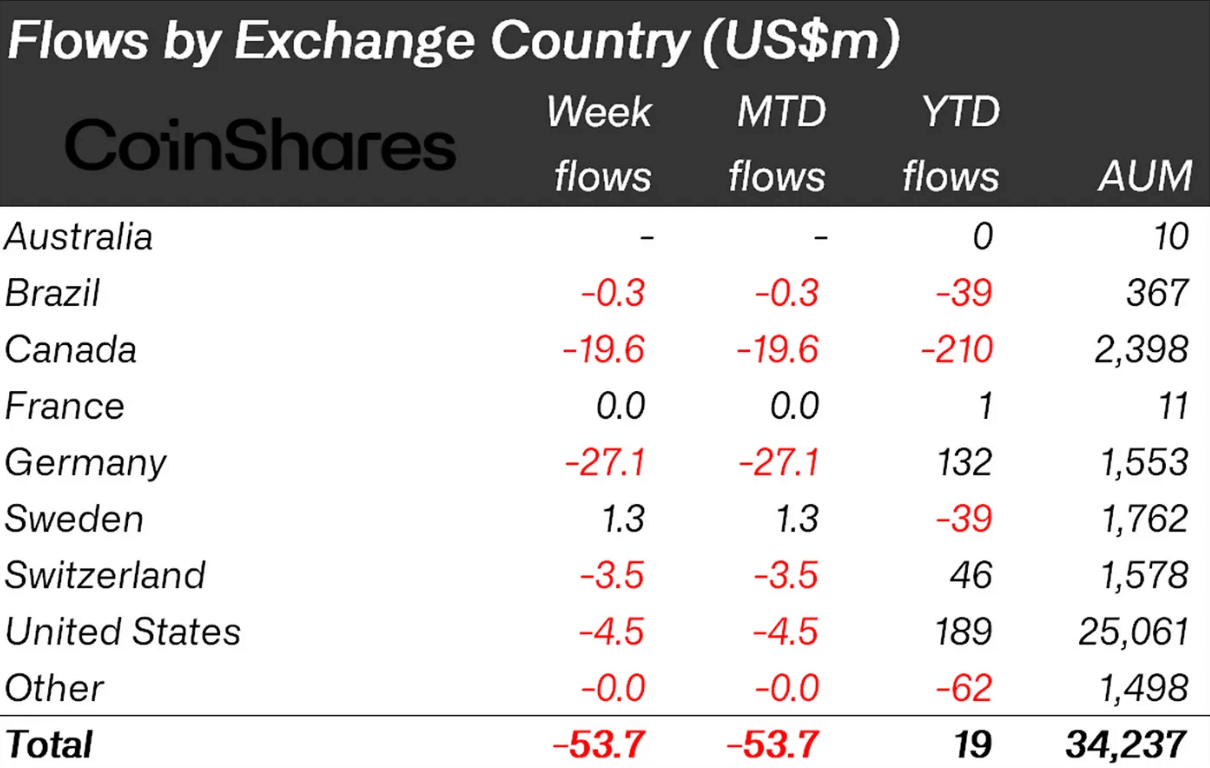

Flows by country

Looking at asset movements on a geographical basis Germany and Canada comes forward by recording the most significant outflows of the week. Germany saw $27.1 million in withdrawals, while Canada recorded $19.6 million in outflows. The two nations accounted for 86% of the total outflow amount of the week.

The US, Switzerland, and Brazil also contributed to the withdrawals by recording $4.5 million, $3.5 million, and $300,000 in outflows, respectively. On the other hand, only $1.3 million worth of inflows were brought to the market by Sweden.

When the movements are filtered based on the providers, only Purpose Investments comes forward with $1 million in inflows. 3iQ, CoinShares, and ProShares recorded $19.4 million, $13.4 million, and $5.4 million in outflows, respectively.

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…