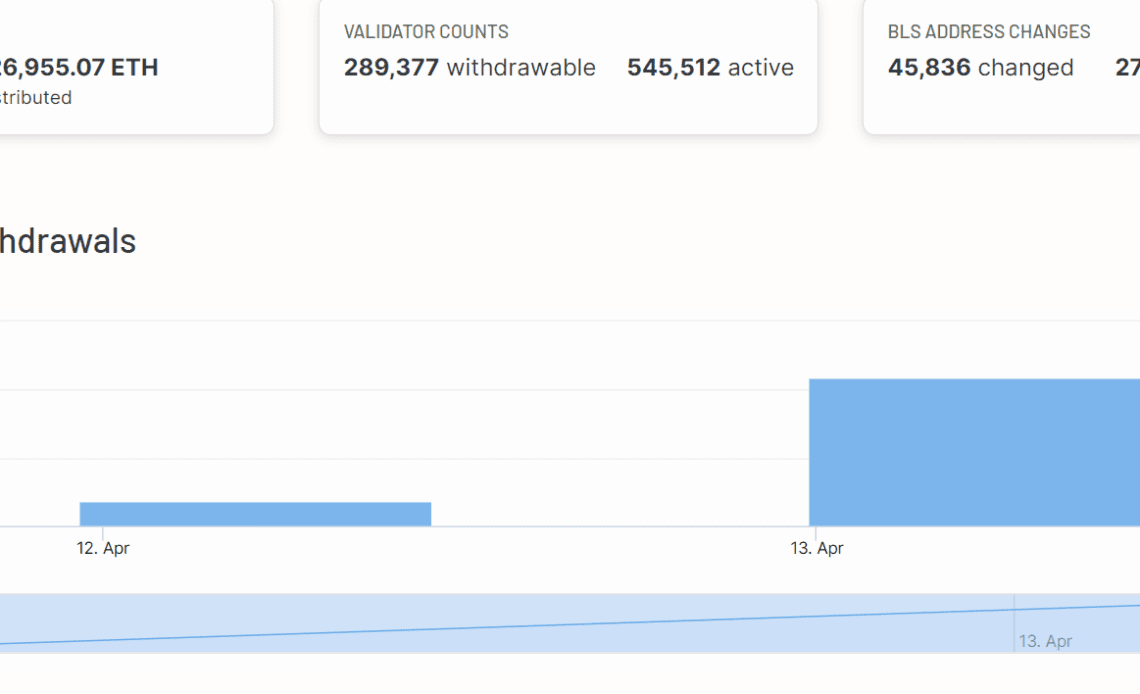

Ethereum mainnet successfully completed the Shapella upgrade on April 12. The successful execution of the Shapella upgrade means Ethereum validators can finally withdraw their staked Ether on the Beacon chain.

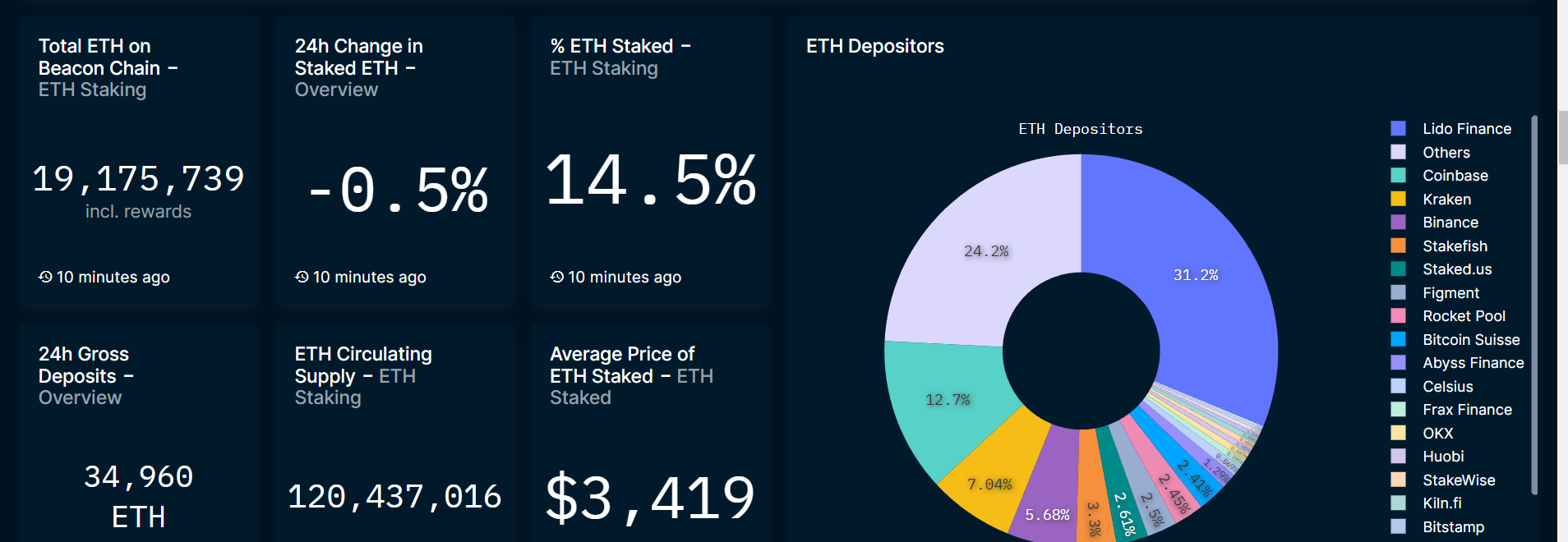

A total of 126,955.07 ETH were withdrawn by validators at the time of writing. Presently, 248,043 out of the 559,549 active validators, or about 44% of them, have the ability to request a partial or full withdrawal. The majority of withdrawals currently vary between 2.8- 3.2 ETH, indicating the majority of the validators are only withdrawing their staking rewards.

The average price of staked ETH is $3,149 and it could be another reason why validators are not withdrawing the whole amount. The ETH price is currently trading just under $2,000 with the price acting as key resistance.

Major crypto exchanges have announced their support for the ETH unstaking with several exchanges already processing withdrawal requests. Coinbase, the world’s first publicly listed crypto exchange announced that ETH unstaking is now live on their platform.

The Shapella Upgrade is complete. Congratulations to the @Ethereum community! ETH unstaking is now enabled on https://t.co/bCG11KNnW0. https://t.co/JcTxAVphGZ

— Coinbase (@coinbase) April 12, 2023

BitGo’s chief operating officer Chen Fang took to Twitter to announce that the exchange has upgraded to Shapella successfully and ETH withdrawals are now live on the platform.

Kraken on the other hand started withdrawing validators for their United States customers on April 11 and began processing withdrawals of ETH after the completion of the Shapella upgrade. The early withdrawal of validators by the exchange is caused by the U.S. Securities and Exchange Commission action brought against Kraken’s Ethereum staking product back in February.

For clarity:

Validators are currently able to exit but the associated 32 ETH stake and consensus layer rewards are not able to be withdrawn (aka moved around) until Shapella goes live in around 12 hours

What Kraken is doing right now is exiting their validators

— sassal.eth (@sassal0x) April 12, 2023

Related: Upcoming Shapella upgrade fuels liquid staking growth — AMA with Swell

Kraken Australia Managing Director Jonathon Miller told Cointelegraph that even though such a high quantity of ETH unstaking might cause some price volatility it will bring users to the ecosystem in the long…

Click Here to Read the Full Original Article at Cointelegraph.com News…