The cryptocurrency market has witnessed a significant surge after a prolonged bear market and the intensified crypto winter caused by the collapse of crypto exchanges and firms during 2022 and part of 2023.

Notably, Bitcoin and other major cryptocurrencies have experienced substantial price surges, accompanied by renewed interest from institutional investors entering the market through recently approved spot Bitcoin exchange-traded funds (ETFs).

Adding to the industry’s positive outlook, asset manager and Bitcoin ETF issuer, Grayscale, believes that the current state of the market indicates that the industry is in the “middle” stages of a crypto bull run.

Grayscale recently released a comprehensive report detailing their key findings and insights into what lies ahead. A closer analysis of the report by market expert Miles Deutscher sheds light on the factors contributing to this assessment.

On-Chain Metrics And Institutional Demand

Grayscale’s report starts by highlighting several key signals indicating that the market is currently in the middle of a bull run. These include Bitcoin’s price surpassing its all-time high before the Halving event, the total crypto market cap reaching its previous peak, and the growing attention from traditional finance (TradFi) towards meme coins.

To understand how long this rally might sustain, Grayscale emphasizes two specific price drivers: spot Bitcoin ETF inflows and strong on-chain fundamentals.

Grayscale notes that nearly $12 billion has flowed into Bitcoin ETFs in just three months, indicating significant “pent-up” retail demand. Moreover, ETF inflows have consistently exceeded BTC issuance, creating upward price pressure due to the demand-supply imbalance.

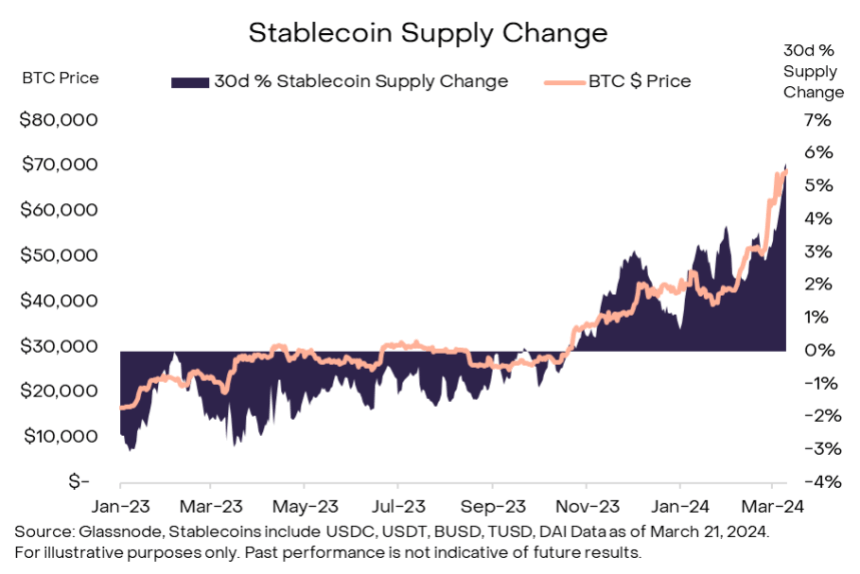

Grayscale’s research focuses on three critical on-chain metrics: stablecoin inflows, decentralized finance (DeFi) total value locked (TVL), and BTC outflows from exchanges.

According to Deutscher, the increase in stablecoin supply on centralized exchanges (CEXs) and decentralized exchanges (DEXs) by approximately 6% between February and March suggests enhanced liquidity, making more capital readily available for trading.

Furthermore, for the analyst, the doubling of the total value locked into DeFi since 2023 represents growing user engagement, increased liquidity, and improved user experience within the…

Click Here to Read the Full Original Article at NewsBTC…