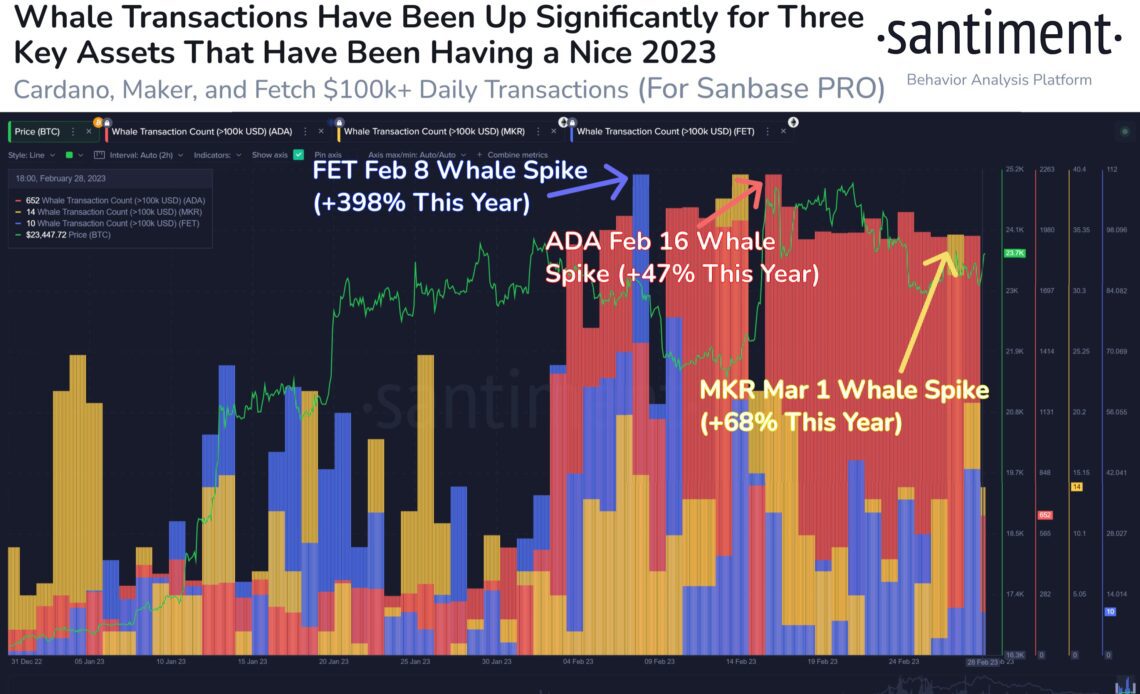

Crypto analytics firm Santiment is predicting price volatility for Cardano (ADA), Maker (MKR), and Fetch.ai (FET) after they have all soared this year.

Santiment says an increase in whale activity on the three projects, smart contract platform ADA, stablecoin issuer MKR and machine learning blockchain FET, signals large price swings are forthcoming.

“Cardano, Maker, and Fetch have all had their moments to shine in 2023. FET in particular, which has 5x’d since January 1st. But these three assets in particular have all seen steep increases in whale activity, and you can expect major swings from here.”

Fetch.ai had one of the strongest performances among altcoins in 2023, rising 527% from its 2022 close of $0.094 to a high in February of $0.59.

Fetch.ai is worth $0.46 at time of writing.

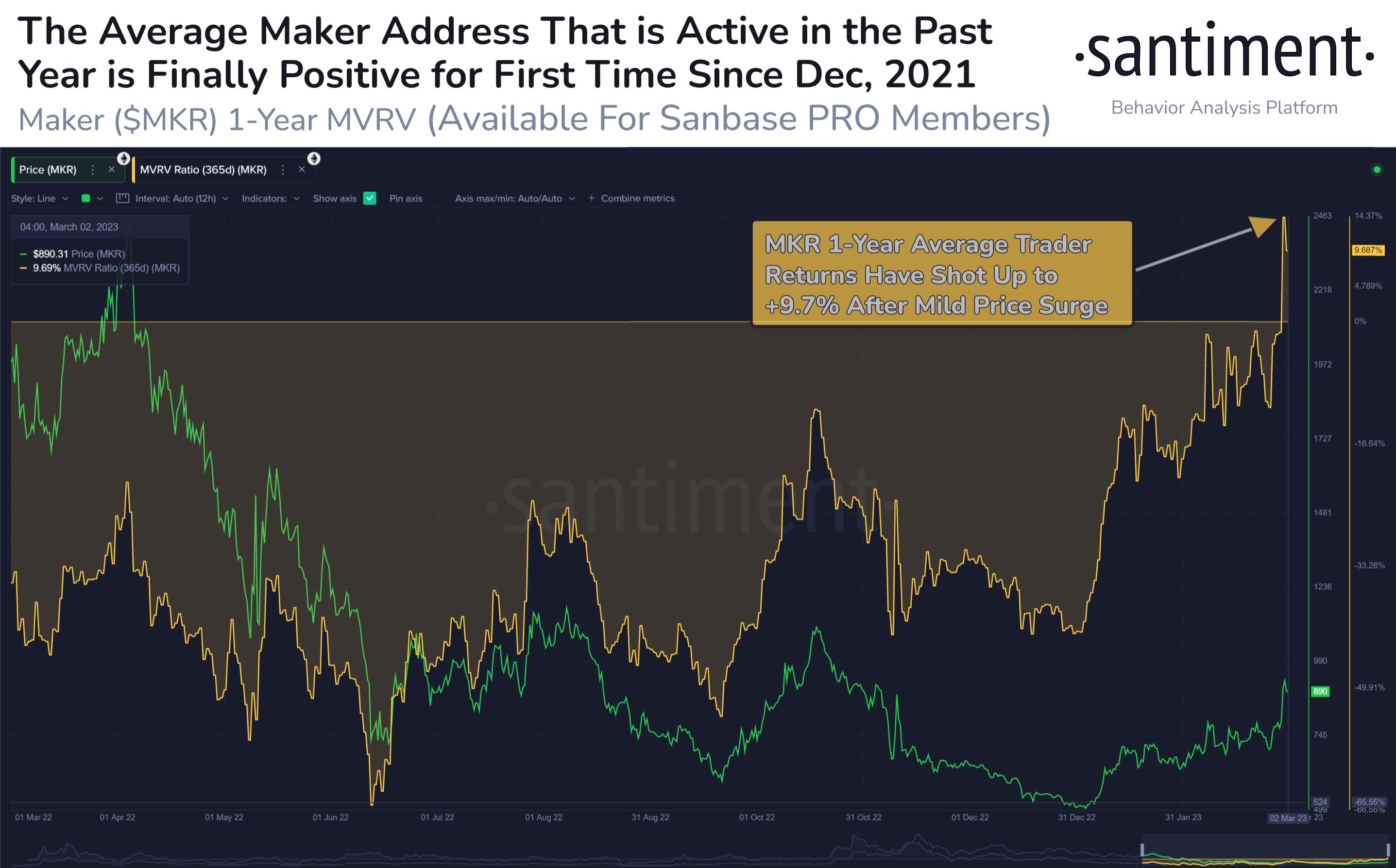

Santiment says Maker has gone on a strong enough rally to finally bring the average holder above water for the first time since December 2021. Maker is trading for $887.88 at time of writing.

“Traders who have invested in Maker over the past year are finally above water. Our latest community insight takes a look at MKR’s 13% increase in supply on exchanges, increased sell pressure, and what this all means for future price performance.”

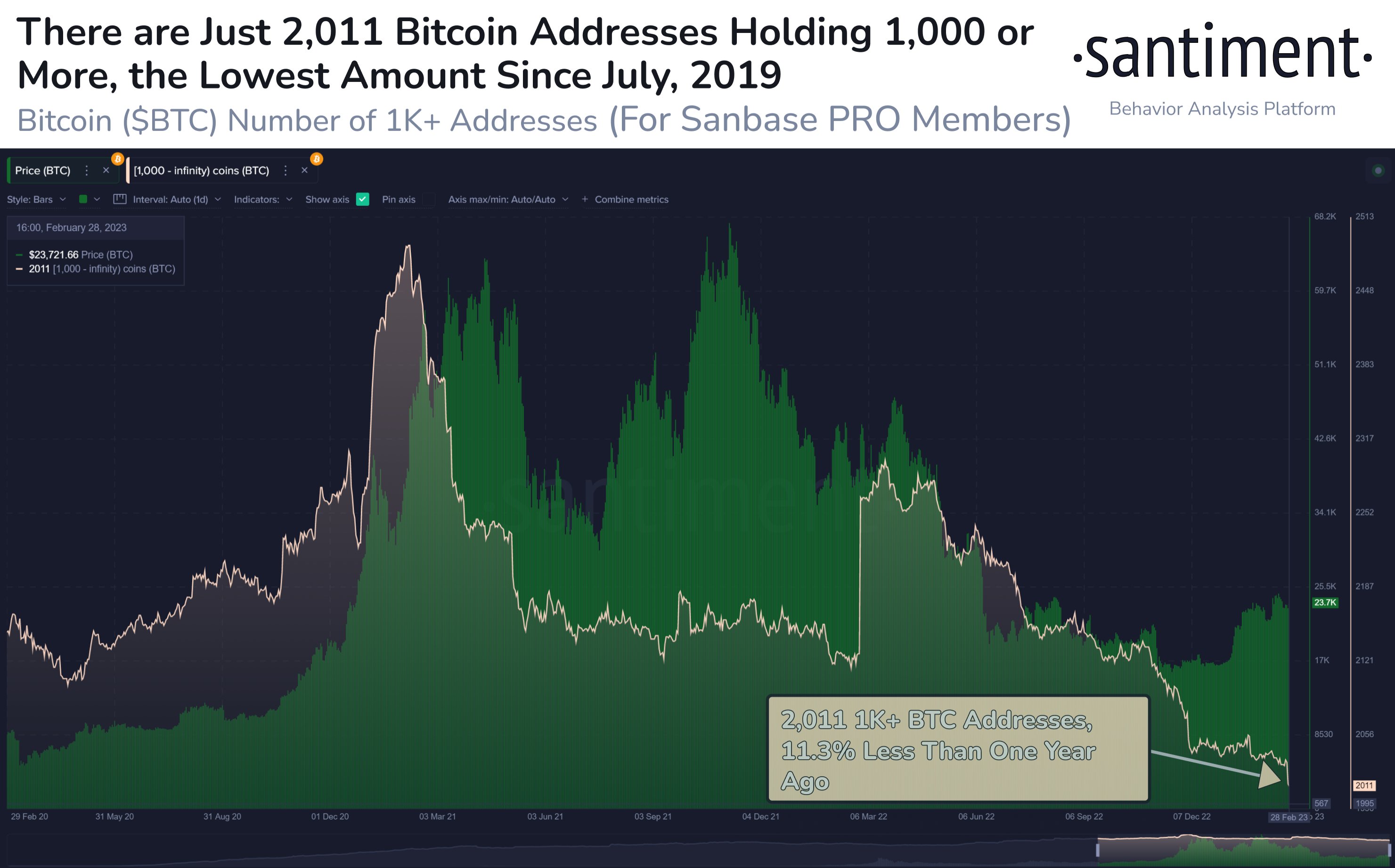

Looking at king crypto Bitcoin (BTC), Santiment says the whale addresses are on a decline from their all-time high of 2,489 on February 8th.

“The amount of existing whale Bitcoin addresses are continuing to sink, with 2,011 existing compared to 2,266 that existed one year ago today. 2,489 was the All Time High set on February 8th, where prices jumped +70% in the following 10 weeks.”

Lastly, Santiment says the metaverse platform The Sandbox (SAND) is setting the stage for a price correction after a token unlock.

“The Sandbox had 20% of tokens unlocked on February 4th, in line with tokenomics. Prices, however, have been stagnant.”

In a Santiment Insights blog post, the analytics firm dives deeper into an unusual pattern seen in SAND.

“However, between February 20th and 22nd, an unusual pattern emerged where more tokens entered the exchange markets, even at lower higher-higher values. This increase in supply indicates that prices will likely correct soon. Similar patterns were observed during previous token-unlocking events in August-September 2022. Where the prices plunged after a month of token unlocking.”

Click Here to Read the Full Original Article at Bitcoin News – The Daily Hodl…