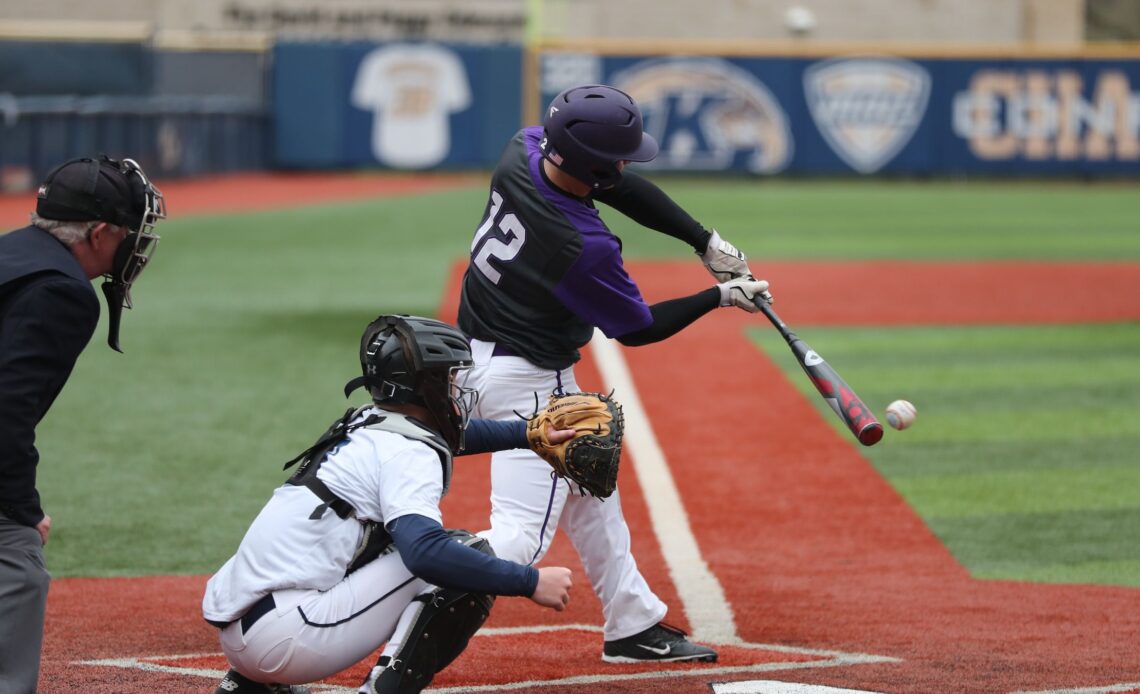

Flipping through the channels this past weekend, I landed briefly on this year’s Major League Baseball draft. Believe it or not, as the event progressed, thoughts of digital assets crossed my mind.

Admittedly, baseball and crypto don’t have the most tangible (or even tangential) of connections, but that’s how my mind works sometimes. (I’m also an avid sports fan.)

At any rate, anyone familiar with drafts knows that teams select players based on what they believe they will accomplish later. This happens in essentially every sport that graces the television screen.

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

Baseball differs from some of its professional league counterparts because players drafted today may not see a major league field for 3-4 years – if not longer. Between draft day and debut day, years are spent in lower leagues, for development.

While bitcoin (BTC), ether (ETH) and other established digital assets are like veteran stars, altcoins are like recently drafted players. They are, for all intents and purposes, prospects, with a long road ahead before they find success – if they ever do.

But how does one evaluate a prospect in cryptocurrencies? What’s even worth looking at, and where does one start?

For better or worse, my starting point for this is developer activity. I view that as a sign of protocol growth and a signal of where developers have chosen to allocate their intellectual capital. The general thesis being that where development occurs, value accrual and price appreciation may follow.

My source data comes via venture capital firm Electric Capital’s developer report, which aims to “quantify the developer activity” happening across crypto and Web3 ecosystems.

Here’s what I found:

New developers are leaving crypto

Before you can evaluate a prospect, it helps to see if anyone is even interested in the game. A quick look at Google search trends shows that searches for both “bitcoin” and “cryptocurrencies” are half as prevalent as they were a year ago. Also, there’s been a 22% decline in active developers across the entire space since over the past year and an 8% contraction since January, according to Electric…

Click Here to Read the Full Original Article at Cryptocurrencies Feed…