One widely followed crypto analyst is getting granular about the phases of a Bitcoin (BTC) halving.

Every four years, BTC rewards for miners are cut in half, an event known as the halving.

BTC’s most recent halving occurred just one week ago on April 19th. BTC’s price has changed little in the seven days since.

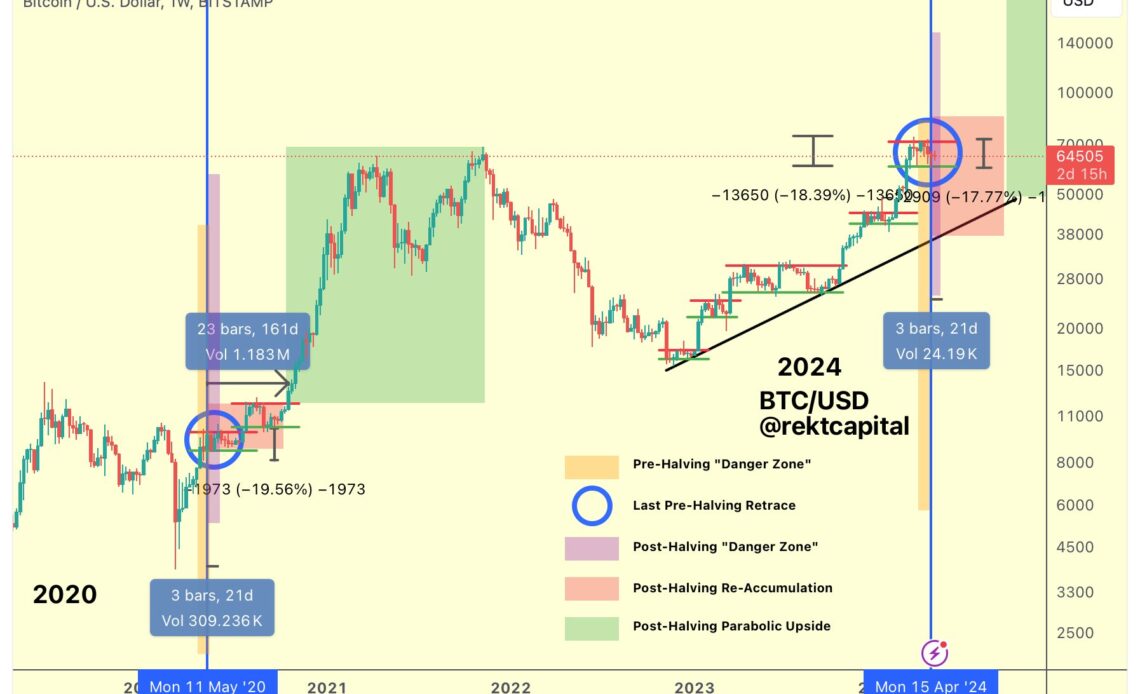

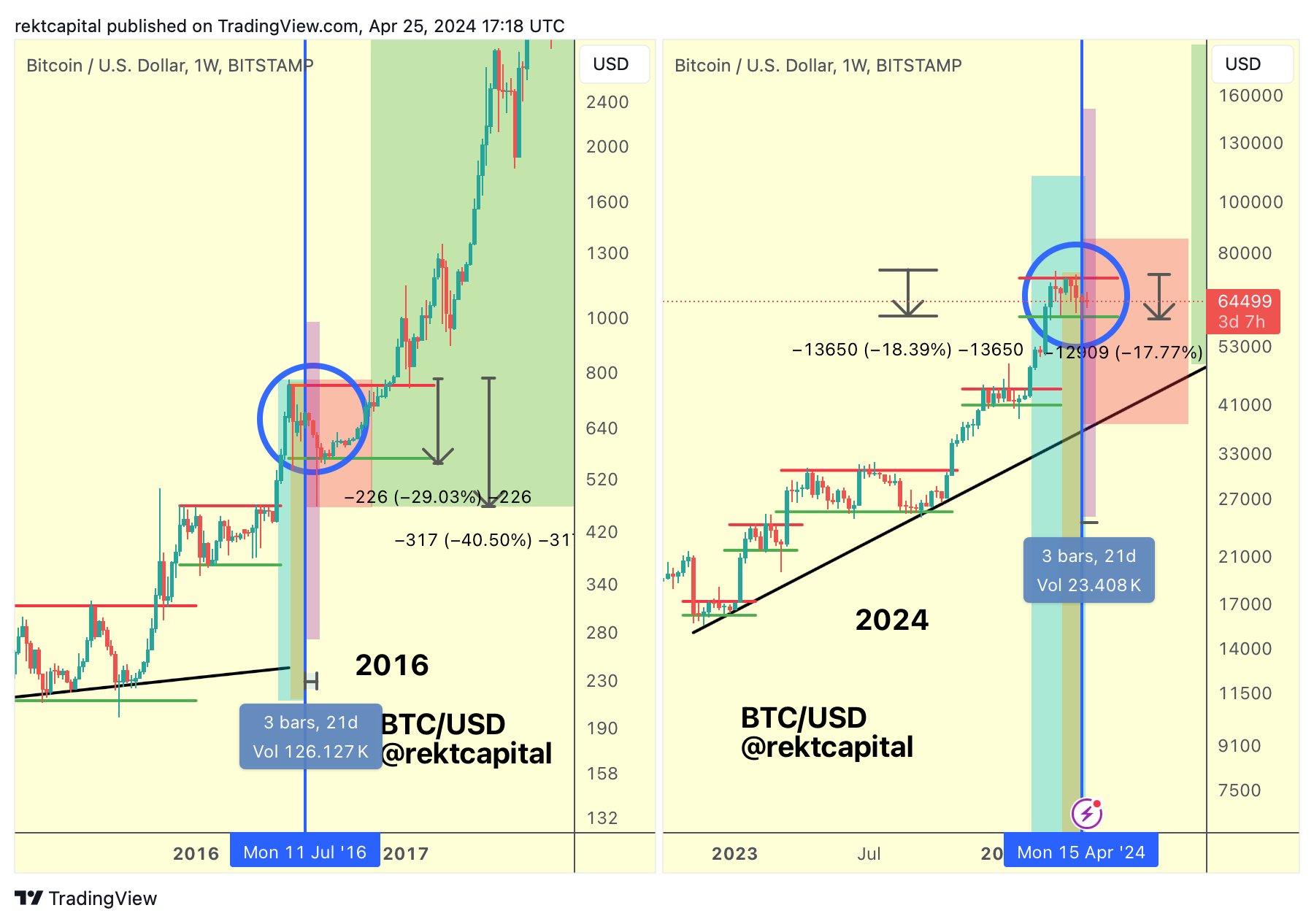

According to pseudonymous crypto trader Rekt Capital, we are still in phase one of the three phases of a halving. First, there’s the transitional phase, where BTC finds itself today, followed by the re-accumulation and parabolic upside phases.

“The Transitional Phase consists of three sub-phases:

- 1a) The Pre-Halving ‘Danger Zone’ (orange)

- 1b) The Final Pre-Halving Retrace (dark blue circle)

- 1c) The Post-Halving ‘Danger Zone’ (purple)”

In a lengthy post, the analyst tells his 456,600 followers on the social media platform X that BTC is specifically in the post-halving “Danger Zone.”

“If this 2016 history were to repeat in 2024, Bitcoin could potentially produce one last flash downside wick over the next upcoming two weeks

The Pre-Halving ‘Danger Zone’ (orange), Final Pre-Halving Retrace, and Post-Halving ‘Danger Zone’ (purple) all set up the next major phase in the Bitcoin Halving Cycle…”

According to the crypto analyst, the next step, the re-accumulation phase, could last up to 150 days, or about five months.

However, the trader sees a light at the end of the tunnel – the parabolic upside phase.

“Once Bitcoin breaks out from the re-accumulation area breakout into the parabolic uptrend (green)

It is during this phase Bitcoin experiences accelerated growth into a parabolic uptrend

Historically, this phase has lasted just over a year (~385 days) however with a potential Accelerated Cycle occurring right now, this figure may get cut in half in this market cycle.”

BTC is worth $63,529 at time of writing, down 1.5% in the last seven days.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The…

Click Here to Read the Full Original Article at The Daily Hodl…