The global sentiment of the macro-economic landscape is muted following the news of a technical recession and a 75bp rate hike by the U.S. Federal Reserve. However, the crypto markets look more potent than they have been in some time, which may confuse investors.

This article will examine the factors affecting the traditional economy and how these may impact the crypto industry.

Recession

A recession is commonly understood to be a period of temporary economic decline during which trade and industrial activity are reduced. It is generally identified by a fall in GDP in two successive quarters, but the White House has recently pushed to ensure other economic factors are also considered.

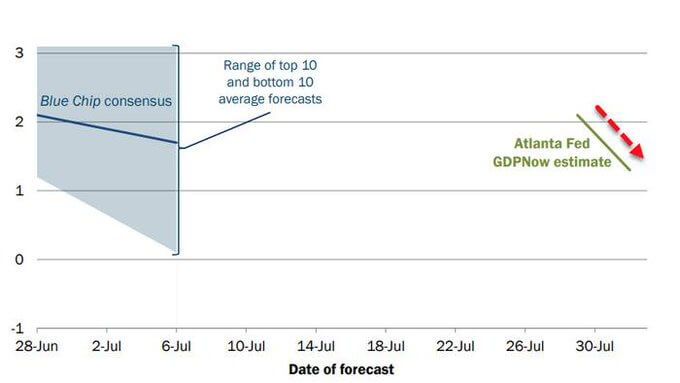

The first quarter of 2022 saw negative GDP growth, and the Atlanta Fed predicted another negative quarter of GDP before the official announcement on July 28 confirming the decline in GDP.

Following two consecutive quarters of negative GDP growth, the Atlanta Fed was modeling its third-quarter GDP forecast for the U.S. economy at +2.1%. However, the latest PMI, construction, and spending data points to an estimate of +1.3%. The same pattern occurred in the second quarter, with a positive outlook at the beginning of the quarter and a negative one at the end.

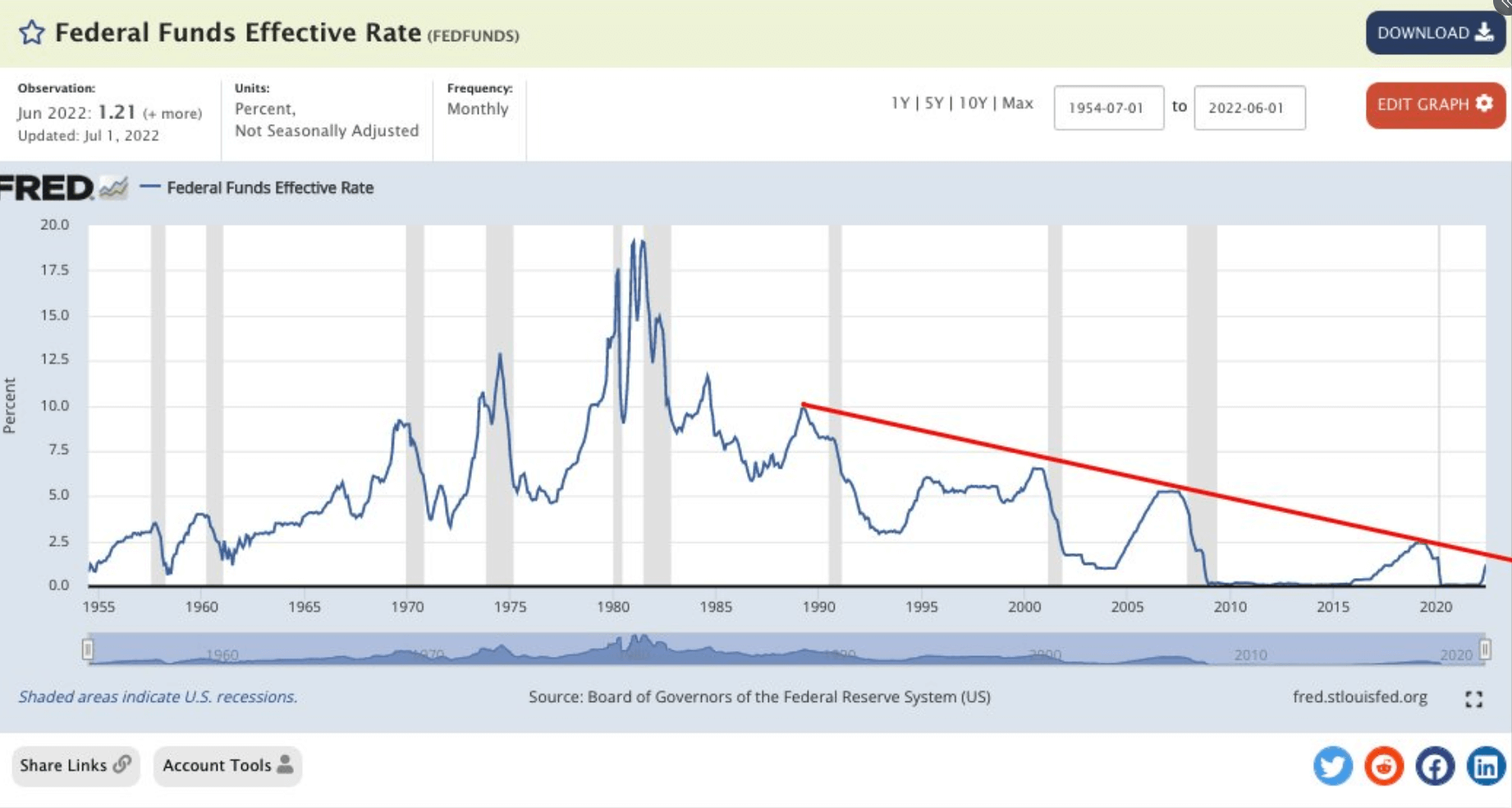

Following the FOMC meeting last week, the FED is tightening at its fastest rate of change to get rampant inflation under control. The question is, how much more can the markets take without something breaking?

According to the Federal Funds Rate, the market may only have the potential for one more rate hike until something breaks. Since 1987 every time the funds rate has hit the red line, the FED has backed off, creating a lower low in the process.

Severe Slowdown in the economy

There are several warning signs that we see a severe economic slowdown, and they could be the tip of the iceberg.

- The S&P Global Flash PMI Composite Output Index went negative for the first time since the last recession.

- Sales of previously owned homes dropped almost 6% during June, the fifth consecutive month of decline.

- 35% of small business owners in the U.S. “could not pay their rent in full or on time in June.”

- 45% of all small businesses in the U.S. have already decided to freeze hiring new workers.

- Personal savings is the lowest in over ten years, while revolving credit (credit card debt) is the highest in 22 years.

Consumer savings in the U.S. being at the lowest levels in over a decade with interest rates increasing alongside…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…