On Aug. 1 a significant event occurred within the financial world: Fitch, a reputable credit rating agency, demoted the credit rating of the U.S. government from the pristine AAA to AA+. This downgrade signaled diminished confidence in the U.S. government’s ability to handle its fiscal responsibilities effectively.

The downgrade nudged investors into a cautious stance, leading many to move their money out of assets like stocks, silver, oil and long-term bonds. Instead, they favored cash and short-term instruments which are perceived as safer options in uncertain times.

As evident from the above chart, the reaction to Fitch’s decision to downgrade the U.S. government’s credit rating was broad-based, affecting commodities, fixed income and equities alike. This has implications for various financial institutions and investment portfolios, including Bitcoin (BTC).

Traders are now contemplating if Bitcoin’s digital scarcity and censorship resistance can offer refuge from the widespread “flight to safety” movement, instigated by the deteriorating credit score of the world’s largest economy.

The downgrade had little impact on markets

A Moody’s Analytics report from May hinted at a potential domino effect, where a downgrade of U.S. Treasury debt could lead to further downgrades in the financial sector. Notably, only Fitch and S&P have marked U.S. debt as AA+, while Moody’s still holds it at AAA with a stable outlook.

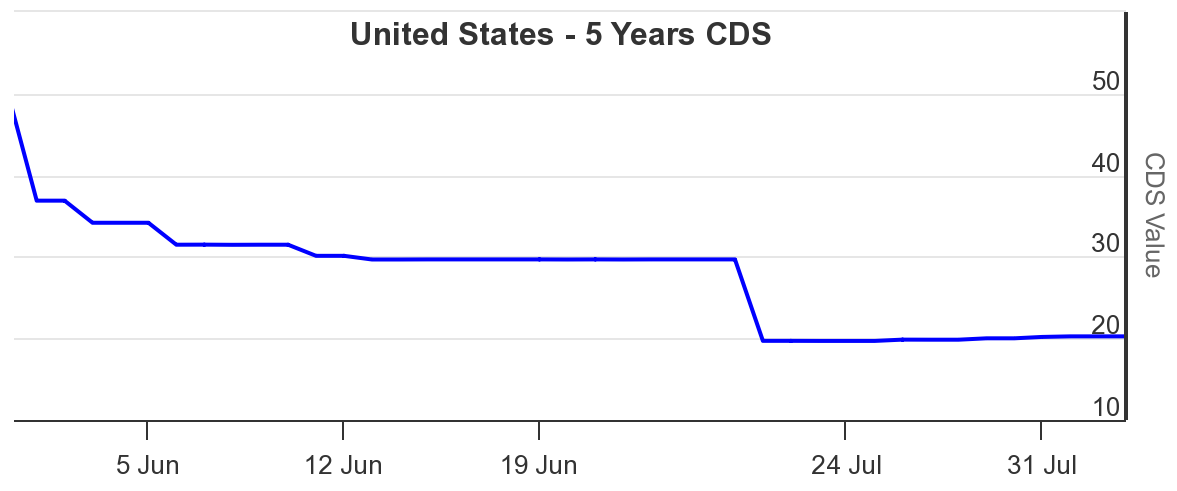

Interestingly, the cost of insuring U.S. sovereign debt against default, as indicated by credit default swaps (CDS), has largely remained stable post-downgrade, a surprising development in the face of such significant news.

This financial instrument protects against the risk of default on debt, working similar to an insurance policy, where investors pay a premium to receive compensation if the issuer of the debt (in this case, the U.S. government)defaults.

This stability indicated that investors were not panicking about the immediate impact of the downgrade. A potential reason is that the U.S. Treasuries are considered one of the safest investments globally because they are backed by the U.S. government. The issuer guarantees that it will repay the debt on the specified maturity date, including interest.

Click Here to Read the Full Original Article at Cointelegraph.com News…