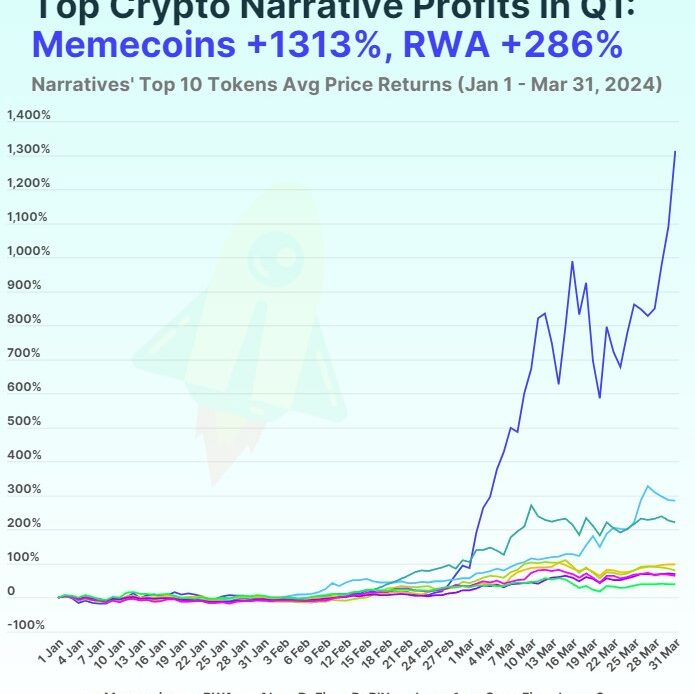

In the first quarter of 2024 (Q1), memecoins emerged as the most profitable crypto narrative, delivering massive average returns of 1312.6% across its top tokens, according to a recent study and report conducted by CoinGecko.

This figure far surpassed the returns of other narratives, highlighting the growing popularity and frenzy surrounding memecoins in the cryptocurrency market.

RWA Vs Memecoins

Three newly launched tokens were among the top 10 memecoins by market cap at the end of the quarter: Brett (BRETT), BOOK OF MEME (BOME) and Cat in a dogs world (MEW).

BRETT generated the highest returns since its launch with a gain of 7727.6%, closely followed by dogwifhat (WIF) with a gain of 2721.2% during the quarter. Notably, the memecoin narrative outperformed other crypto narratives by a significant margin.

Compared to the second most profitable narrative, RWA, memecoins were 4.6 times more profitable, and their returns were 33.3 times higher than those of the Layer 2 narrative, which experienced the lowest gains in Q1.

The RWA narrative, which stands for “Real-World Assets“, returned 285.6% in Q1. Although it briefly held the title of the most profitable narrative in early February, memecoins and artificial intelligence-based (AI) tokens outperformed RWA in terms of returns. However, RWA managed to regain its position ahead of the AI narrative by the end of March.

Notable winners in the RWA category included MANTRA (OM) and TokenFi (TOKEN), which posted quarter-to-date (QTD) returns of 1074.4% and 419.7% respectively. XDC Network (XDC) was the only RWA token to decline, falling 15.6% for the quarter.

Artificial intelligence closely followed RWA as the only other narrative to deliver three-digit returns, reaching 222.0% in Q1. All large-cap AI tokens experienced gains, with AIOZ Network (AIOZ) leading the pack at 480.2% and Fetch.ai (FET) following closely at 378.3%.

Even the lowest gainer in the AI category, OriginTrail (TRAC), returned a respectable 74.9% during the quarter, indicating the overall interest in AI-related tokens.

Layer 1 Tokens Trail Behind

The decentralized finance (DeFi) narrative delivered moderate returns of 98.9% in the first quarter. In late February, DeFi returns were boosted by the Uniswap (UNI) fee switch proposal. DeFi tokens that performed well included Jupiter (JUP) with gains of 125.7%, Maker (MKR) with 121.2%, and The…

Click Here to Read the Full Original Article at NewsBTC…