Coinbase has announced it has secured regulatory approval as a virtual asset service provider (VASP) in Ireland, according to a company blog post published on Dec. 21. According to the company, Coinbase has been approved by Ireland’s central bank which means the company can “provide products and services to individuals and institutions in Europe and internationally, from Ireland.”

Coinbase Approved to Be a Regulated VASP by the Central Bank of Ireland

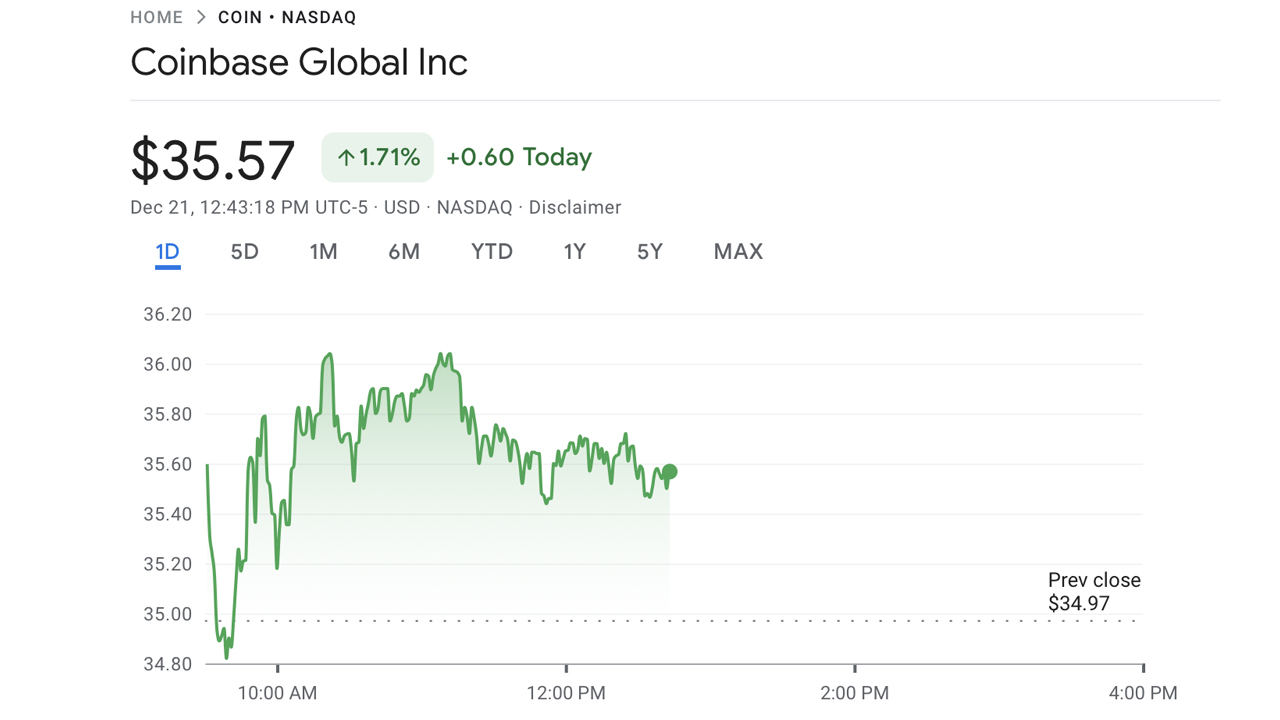

On Dec. 21, 2022, Coinbase (Nasdaq: Coin) informed the public that it has been granted regulatory approval by the Central Bank of Ireland, a member of the European System of Central Banks. The news follows Singapore’s central bank giving Coinbase “in-principle approval” last October so the trading platform can operate as a VASP and provide products and services in the island state.

Ireland’s central bank has approved Coinbase’s VASP registration as well, and the trading platform can continue to provide digital asset products and services to “individuals and institutions in Europe and internationally, from Ireland.” Coinbase must also adhere to regulatory policies, the exchange noted on Wednesday.

“This VASP registration means that Coinbase Ireland will be subject to the Criminal Justice Money Laundering and Terrorist Financing Act 2010 (as amended), demonstrating our commitment to the highest standards of compliance,” Coinbase disclosed. According to the firm, the VASP registration approved by Ireland’s central bank covers two Ireland-based entities, which include Coinbase Europe Limited and Coinbase Custody International Limited.

Ireland’s central bank has published multiple warnings about investing in virtual currencies (VCs) and dealing with unregistered VASPs. In April 2021, Ireland’s central bank issued a warning that said “VCs such as bitcoin and ether are unregulated VCs that can be used as a means of payment.” Ireland’s central bank also issued another statement in March 2022 which summarizes a “fresh warning on the risks of investing in crypto assets.”

Derville Rowland, Ireland’s director general of financial conduct said at the time:

While people may be attracted to these investments by the high returns advertised, the reality is that they carry significant risk — People should also be aware that if things go wrong, you do not have the protections you would have if you invested in a regulated product.

In addition to getting regulatory approval…

Click Here to Read the Full Original Article at Regulation Archives – Bitcoin News…