By Cesare Fracassi, Chief Economist, Coinbase Institute

TL;DR: How should we evaluate the recent highs and lows of crypto prices? In taking a market efficiency view, crypto prices are a reflection of the market’s assessment of the future prospects of digital assets. This view can help us understand the historical trends in crypto prices and its correlation with the overall financial markets:

- Over the last 5 years, crypto markets saw very large returns due in part to adoption by institutional and retail investors, and the laying of the foundations of web3.

- Whereas crypto markets were originally uncorrelated to the financial markets, the correlation has risen sharply since 2020. Thus, the market expects crypto assets to become more and more intertwined with the rest of the financial system.

- Nowadays, the risk profile of crypto markets is similar to those of oil prices and technology stocks.

- The recent decline in crypto markets can be attributed for ⅔ to worsening macro-factors, and for ⅓ to a weakening of the outlook for cryptocurrencies.

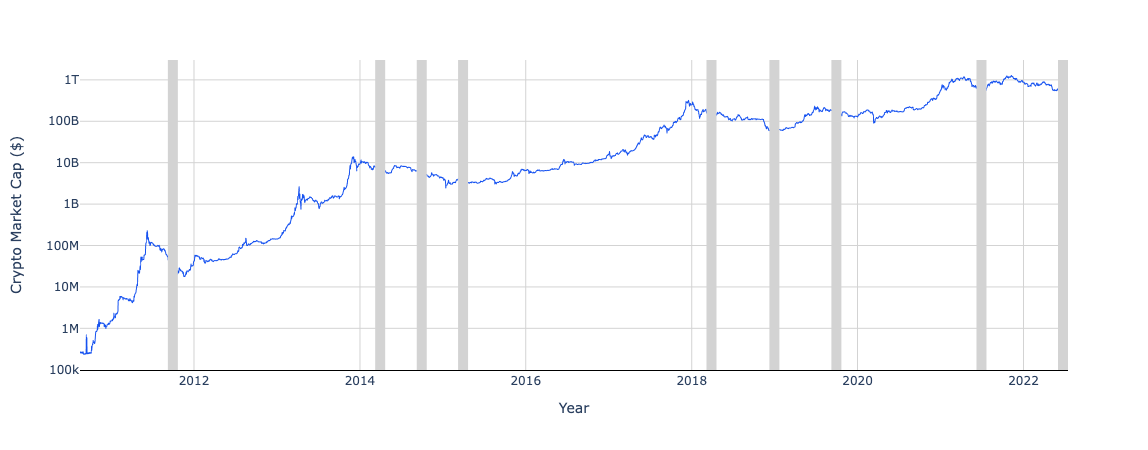

Over the last eight months, the market capitalization of all cryptocurrencies went from a peak of $2.9T to a current level of less than $1T, a decline of over two thirds. This is not unusual in crypto markets: Since 2010, total crypto market capitalization experienced a quarterly decline of 20% or more (a typical measure of bear market conditions) nine times.

Each time a sharp decline in crypto prices occurs, media and expert commentaries usually take one of two forms:

(i) the “Crypto is dead” response, where crypto is painted as a gigantic Ponzi scheme fueled by the desire not to be left out of great returns (Fear of Missing Out, or FOMO in short) followed by anxiety and despair when prices decline (Fear, Uncertainty, and Doubt, or FUD in short). The price drop is the sign that the bubble bursted, and we should run for the exits before prices go down to zero.

(ii) the “HODL” response, where crypto is seen as a groundbreaking technology. Crypto winters and summers are a feature, not a bug, of disruptive innovations, like national banks in the early 18th century, railways in the mid 19th century, and the internet and artificial intelligence in the late 20th century. We should hold and ride through the volatility, as crypto prices will resume their rise in the near future.

However, neither of these explain both the historical trends we have seen in crypto and how we are seeing the correlation with overall stock…

Click Here to Read the Full Original Article at The Coinbase Blog – Medium…