The value of open interest for Chicago Mercantile Exchange (CME) Bitcoin (BTC) futures is on the upswing, suggesting institutional interest in the top crypto asset.

Data from cryptocurrency derivative data analytics platform CoinGlass indicates the value of open interest (OI) for CME Bitcoin futures has reached $4.07 billion, surpassing Binance’s Bitcoin futures OI and taking the top spot in exchange rankings for that metric.

OI represents the total number of outstanding Bitcoin futures contracts.

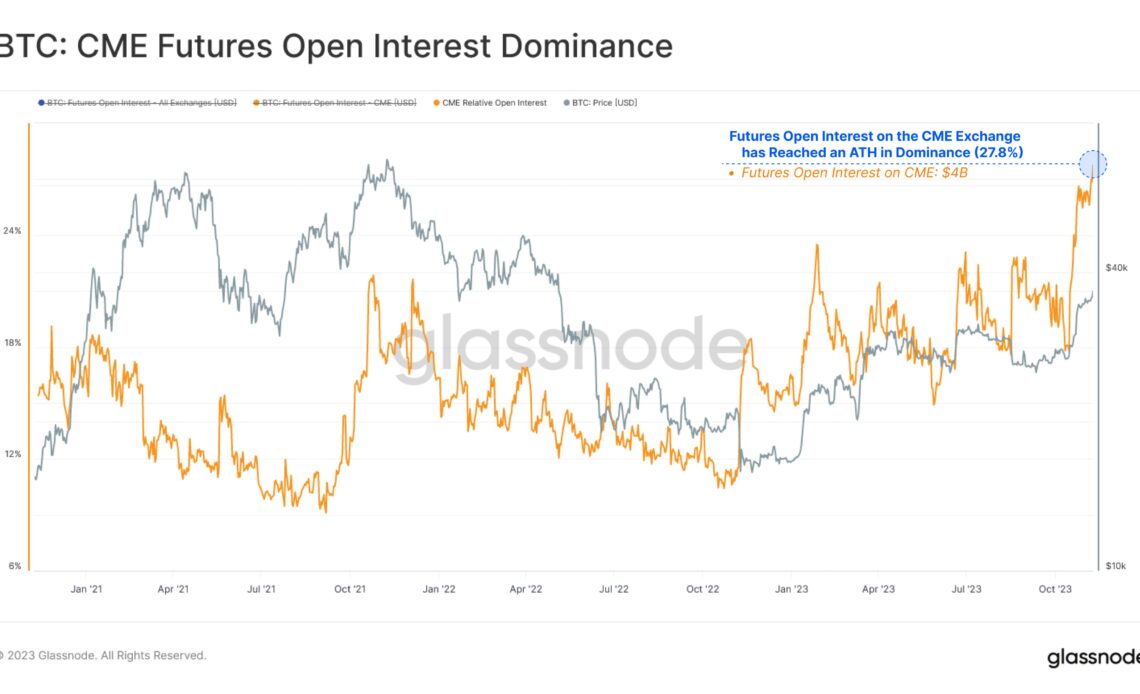

Crypto analytics firm Glassnode also notes that the CME Group’s Bitcoin futures open interest has reached a 27.8% relative dominance level over the sector, an all-time high.

Explains the firm,

“This suggests a growing presence of institutional investors within the [Bitcoin] derivative space.”

The CME Group also offers Bitcoin options, micro Bitcoin futures, Ethereum (ETH) futures and options, and micro ETH futures and options.

Binance clocks $3.86 billion in total Bitcoin futures open interest at time of writing, according to CoinGlass. The United Arab Emirates-based crypto exchange Bybit ranks third, with $2.69 billion in OI, and Seychelles-based exchange OKX is fourth with $1.81 billion.

Bitcoin is trading at $37,369 at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Click Here to Read the Full Original Article at Bitcoin News – The Daily Hodl…