Bitcoin (BTC) futures open interest at the Chicago Mercantile Exchange (CME) hit an all-time high of $3.65 billion on November 1. This metric considers the value of every contract in play for the remaining calendar months, where buyers (longs) and sellers (shorts) are continually matched.

Bullish momentum on CME Bitcoin futures, but cautious BTC options markets

The number of active large holders surged to a record 122 during the week of Oct. 31, signaling a growing institutional interest in Bitcoin. Notably, the Bitcoin CME futures premium reached its highest level in over two years.

In neutral markets, the annualized premium typically falls within the 5% to 10% range. However, the latest 15% premium for CME Bitcoin futures stands out, indicating a strong demand for long positions. This also raises concerns as some may be relying on the approval of a spot Bitcoin exchange-traded futures (ETF).

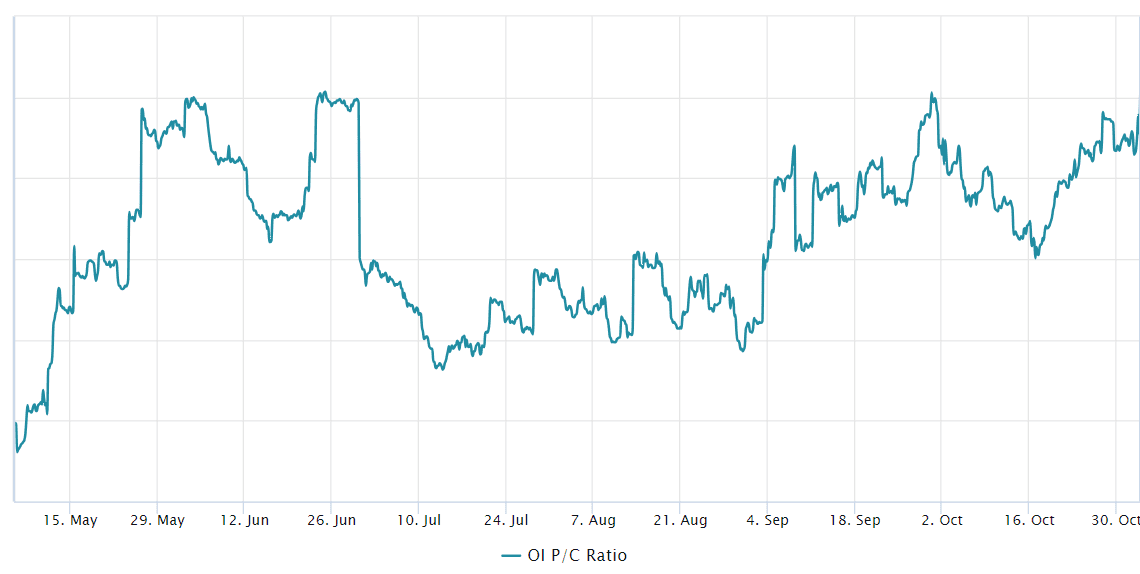

Contradicting the bullish sentiment from CME futures, evidence from Bitcoin options markets reveals a growing demand for protective put options. For instance, the put-to-call open interest ratio at the Deribit exchange reached its highest levels in over six months.

The current 1.0 level signifies a balanced open interest between call (buy) and put (sell) options. However, this indicator requires further analysis, as investors could have sold the call option, gaining positive exposure to Bitcoin above a specific price.

Regardless of demand in the derivatives market, Bitcoin’s price ultimately relies on spot exchange flows. For instance, the rejection at $36,000 on Nov. 2 led to a 5% correction, bringing the price down to $34,130. Interestingly, the Bitfinex exchange experienced daily net BTC inflows of $300 million during this movement.

The fourth biggest inflow of #Bitcoin to @bitfinex yesterday, was roughly $300M; as soon as the inflow started, #Bitcoin started to trend down.

Extremely bullish, significant sell pressure, and #Bitcoin is still above $34,000https://t.co/xVpZcXGAZW pic.twitter.com/I72N686HfH

— James V. Straten (@jimmyvs24) November 3, 2023

As analyst James Straten highlighted, the whale deposit coincided with the fading momentum of Bitcoin, suggesting a potential connection between these movements. However, the downturn did not breach the $34,000 support, indicating real buyers at that level.

Bitcoin’s latest correction occurred while the Russell 2000 Index futures, measuring mid-cap companies…

Click Here to Read the Full Original Article at Cointelegraph.com News…