After the weekend’s depegging of the stablecoin, Circle, which issues USDC, has declared that substantially all the minting and redemption backlogs have been resolved.

The company reported that they redeemed $3.8 billion USDC and minted $0.8 billion USDC since Monday, and they have also shifted their banking partner due to the Silicon Valley Bank (SVB) collapse.

Update: As of close of U.S. banking operations Wednesday, March 15, we have cleared substantially all of the backlog of minting and redemption requests for USDC. Get the details: https://t.co/5WEAgPps0E

— Circle (@circle) March 16, 2023

The company’s founder and CEO, Jeremy Allaire, recently appeared on an episode of the Bankless podcast, where he discussed the wild weekend that followed USDC’s depegging.

“Everyone was talking about how we need to save the banks from crypto, but now we’re talking about trying to save crypto from the banks,” Allaire told the podcast. “But now USDC is the most secure cash-backed digital dollar on the internet.”

“I’m a very deep believer in full-reserve banking,” Allaire said. “This idea that we don’t need to have a fractional reserve, where the base layer in government obligation money, and the payment system innovation is built on the internet using software in these new ways,” then lending can happen outside that, he said.

Circle’s re-peg

Following the events of last weekend, Circle had accumulated backlogs of USDC withdrawal requests. However, they have resolved the issue by switching their banking partners to prevent any operational disruptions.

According to the stablecoin issuer, “On March 14th, Tuesday, we implemented a new transaction banking partner for domestic US wire transfers. Today, we launched the same partner for international wire transfers to and from 19 countries. Additionally, we have started using an existing transaction banking partner for international wire transfers.”

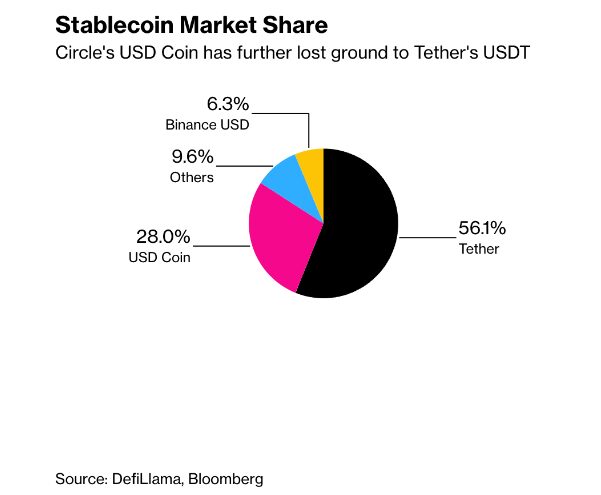

Although USDC has managed to restore its peg, it has lost ground to its rival stablecoin USDT following last week’s turmoil. A Bloomberg report indicates that USDC’s circulating supply has decreased by 5.9 billion tokens, while USDT has increased its supply by 2.5 billion tokens.

During the previous weekend, USDC experienced a nearly 12% drop in value, trading at 0.88, resulting in a loss of over $6 billion in market capitalization, when Circle disclosed its exposure to SVB. However, on Monday, it was once again redeemable to…

Click Here to Read the Full Original Article at Stablecoins News | CryptoSlate…