Chainlink has seen its open interest spike significantly in the month of February, so much so that it has reached new all-time highs. This trend has not waned despite the decline in the price of the cryptocurrency, which could paint a rather bullish picture for the LINK price going forward.

Chainlink Open Interest Crosses $450 Million

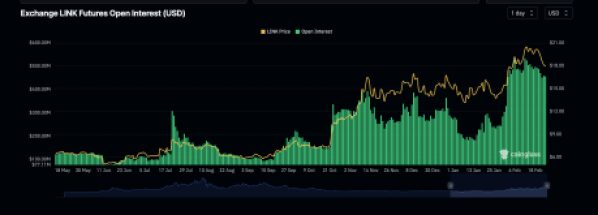

The Chainlink open interest ended the month of January on a high note and carried this trend into the month of February. A major jump was seen between January 31 and February 3 when the open interest went from below $250 million to more than $320 million.

In the days following this, the open interest continued to rise, and eventually hit a peak of $533 million. This was significant because it was not just the highest point for the year but it is the highest that the open interest has ever been for the asset.

Source: Coinglass

As expected, the price would quickly rise to keep up with the open interest as investors continued to place their bets on the price. There has been a retracement in the open interest. However, Chainlink has continued to maintain more than $450 million in open interest since February 12.

Currently, Coinglass data shows that the Chainlink open interest is $456 million as of February 23, continuing to maintain a high level. Given this, it might be prudent to look at how the LINK price has reacted in the past when open interest remained elevated.

Historical Performance Of The LINK Price

While the Chainlink open interest is at record levels, there have been times in the past where the open interest had been elevated for a period of time like it is now. So, how the price reacted during those periods could provide a pointer for how it might perform now.

The last time that the open interest was this elevated for a long period of time was back in October-November 2023 when open interest more than doubled. It would maintain this elevated level for almost a month, but at the end of it, the LINK price would react positively and saw a price surge from $11 to $15, which was a 36% increase in price.

If this scenario were to repeat now, then a 36% increase would send the LINK price to $24. This is not particularly hard to believe, given that the LINK price had topped out at $52 in the last bull market. So, such a move would still leave it 50% below its all-time high levels.

On the flip side of this, the open interest levels could also taper off, as was seen in November 2023. This…

Click Here to Read the Full Original Article at NewsBTC…