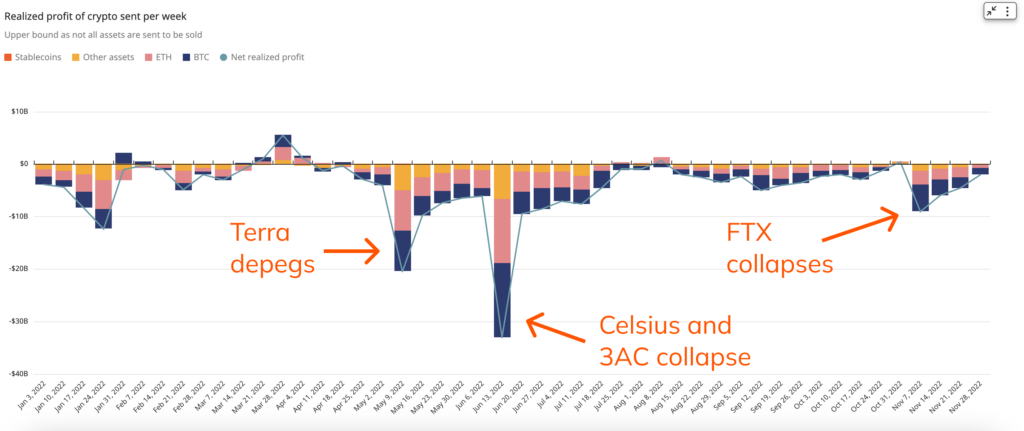

FTX’s collapse resulted in around $9 billion in realized losses for crypto investors, according to a Chainalysis report.

Chainalysis noted that this loss paled compared to Terra’s UST depeg, which caused a loss of $20.5 billion. The implosion of crypto firms like Celsius and Three Arrows Capitals led to $33 billion in realized losses.

According to Chainalysis, weekly realized loss and gain are calculated based on the value of assets in a wallet at the time they were acquired minus the value of the portion of the assets transferred from the wallet at the time of recording the data.

While the transfer of assets from a wallet does not necessarily imply a sale, it gives an insight into how those events affected investors. The data shows that many investors had already lost significantly more value before the FTX crash.

However, the data does not account for those who lost their deposits on the FTX exchange.

CryptoSlate reported that realized Bitcoin (BTC) losses reached a yearly high of $4.3 billion following FTX’s collapse.

Reports revealed that over one million creditors were affected by the FTX collapse, with at least $8 billion in missing funds. The crypto exchange founder Sam Bankman-Fried was arrested in the Bahamas and faced criminal charges in the United States.

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…