HodlX Guest Post Submit Your Post

According to the latest report, digital currency transactions are expected to explode in the near future.

The technology’s supporters point to increased convenience, while its opponents worry it will give the government too much power and erode privacy.

What evidence is there to support the claims of both sides of the debate? Let’s delve a little deeper to see what’s underneath.

According to Statista data, between 2023 and 2030, there will be an astonishing 260,000% increase in the number of transactions processed through CBDCs (central bank digital currencies).

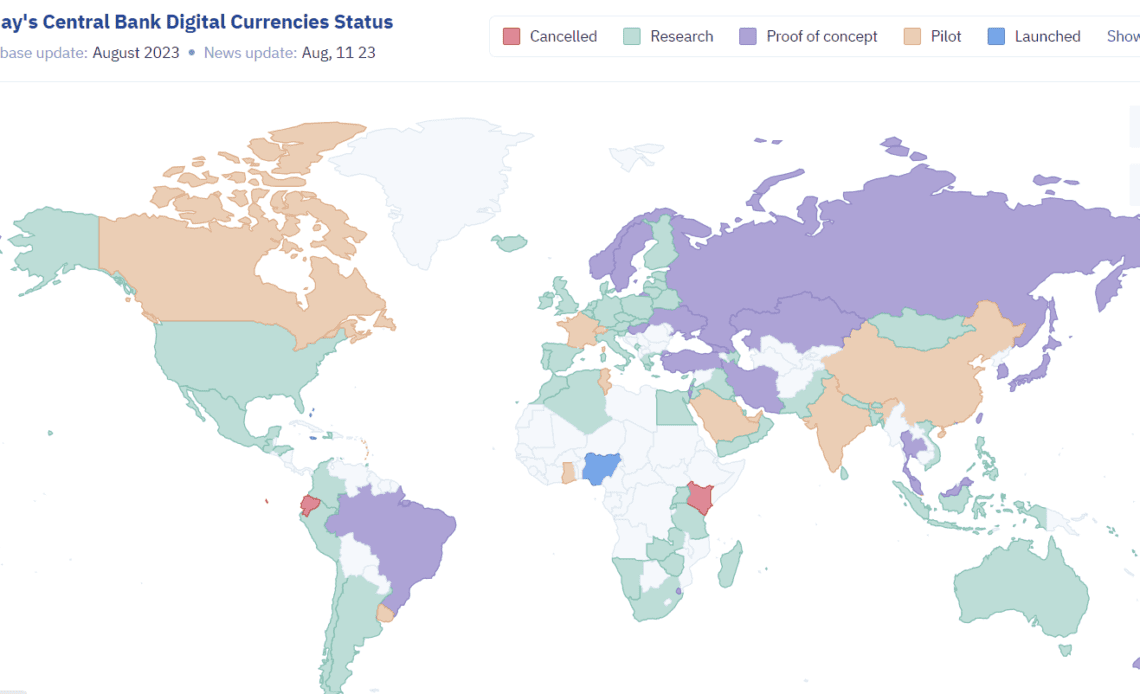

In 2023, 105 countries are working on this kind of currency. That may or may not be good news to you, but so far only a handful have fully implemented it and we have the first half of 2023 behind us.

These countries are Nigeria, the Bahamas, Jamaica and the Eastern Caribbean Currency Union.

Source: Cbdctracker.org

In case you missed what CBDCs are, they are merely digital versions of existing fiat currencies that come from central banks.

While cryptos were created to reverse the power back to the public, CBDCs are government-issued digital currencies, enabling the central bank to monitor your identity, location and spending data.

Under the current system, commercial banks are required to keep all information about their customers confidential, unless a legal requirement requires them to do so.

Once CBDCs are up and running, central banks will use a blockchain most likely a private one to keep track of who spends money where and how.

The bank could limit the ways in which money can be spent or even ban you.

Assume another lockdown is in place, and you can only buy things within walking distance of your home and only on certain days.

It wouldn’t be technically impossible for you to buy a ticket and get out of there. Doesn’t that make you think of a dystopian future?

All this boils down to one question do central banks really want to give us a safer digital payment environment or do they simply want to monitor our spending habits and control us even more?

CBDCs make central banks nervous as well

Studies have shown that CBDCs could have a negative impact on retail, wholesale and cross-border payments.

Retail CBDCs can cause portfolio changes in the public’s relative holdings of cash and deposits, disintermediating bank deposits and increasing volatility in bank reserves at the central bank.

If substantial, these outcomes…

Click Here to Read the Full Original Article at The Daily Hodl…