Caradano’s native gas-paying token ADA received a big blow at the start of June when the SEC regarded it as a security in its lawsuit against Binance and Coinbase.

The lawsuit triggered a 42.5% drop in ADA’s price from $0.37 to a two-year low at $0.21 within a few days after SEC’s lawsuit.

Additionally, the token faced further downside selling pressure due to delisting on U.S.-based trading apps Robinhood and eToro.

However, under the hood, the network has been making progress with an uptick in DeFi activity after a scalability upgrade in May.

The technical and on-chain analysis of the token also shows potential for a positive recovery.

Cardano’s DeFi ecosystem is blooming

Over the years, Cardano has come under some criticism for continued delays and network updates.

Cardano’s founder, Charles Hoskinson, attributed these setbacks to “betting on the wrong technology and being a bit ambitious with the roadmap“ in an interview with Cointelegraph, acknowledging that 85% of the initial roadmap has been completed.

Nevertheless, the network recorded an uptick in activity after the implementation of long-waited scalability upgrade Hydra launched in the first week of May 2023.

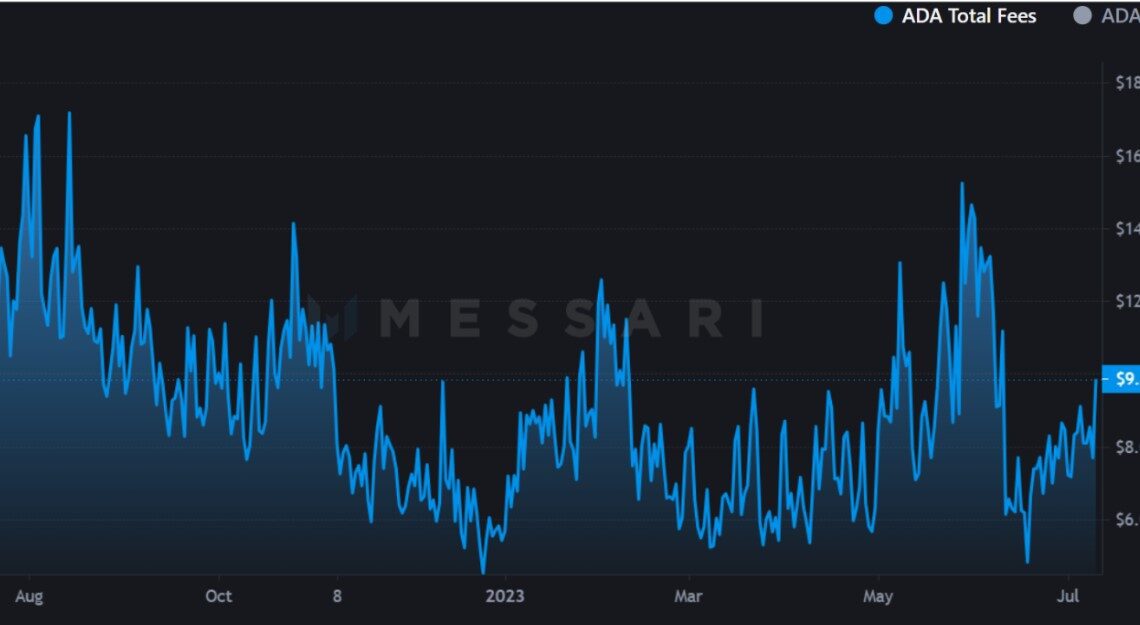

The total fees paid on Cardano surged to a one-year after the upgrade, before collapsing amid SEC’s lawsuit. However, the activity has been on a consistent uptrend over the last few weeks.

The total ADA deposited in DeFi application on Cardano has risen strongly, reaching two times its peak value during the bull market of 2021, per DeFiLlama data. The trading volumes on Cardano DEXs has also recorded a major uptick since May’s Hydra upgrade.

Hydra is a layer-2 scaling solution that is designed to increase the throughput and scalability of the Cardano blockchain by processing transactions on a sidechain.

Additionally, a Jarvis Labs report found ADA is one of the “decentralized L1s out there” based on the Nakamoto coefficient, which measures the minimum number of entities that collectively control 33.33% of all coins staked in the network.

A higher degree of decentralization will act in Cardano’s favor in deciding whether or not it is a security in the U.S.

Pseudonymous analyst Kodi from Jarvis Labs wrote in the report, “Cardano’s not dead, but very much alive, kicking, and ready to throw down in the next bull run.”

Click Here to Read the Full Original Article at Cointelegraph.com News…