Cardano is currently facing a stark contrast between its promising development trajectory and the significant losses incurred by ADA holders.

Recent price analysis has revealed that the losses are nearing an astonishing 90%, sending waves of concern through the cryptocurrency community. The once-active addresses have dwindled, further accentuating the unease surrounding ADA’s price trend.

In an accompanying chart in the analysis that lays bare the current situation, it becomes evident that nearly 4 million ADA addresses find themselves in the unfortunate position of holding the cryptocurrency at a loss. This staggering figure represents approximately 89.7% of all ADA holders at the time of this report.

This unsettling statistic raises pertinent questions about the reasons behind this mass erosion of value, shedding light on potential market dynamics and investor sentiment.

Source: IntoTheBlock

Cardano Unique Funding Approach

Cardano has consistently been a pioneer in revolutionizing the blockchain landscape, consistently introducing groundbreaking developments. One such innovation is their novel approach to funding decentralized applications (dApps) – a departure from the traditional reliance on venture capital or initial coin offerings.

Cardano’s introduction of undercollateralized loans introduces a fresh paradigm that could reshape the way blockchain projects are financed and sustained, offering a glimpse into the future of decentralized funding models.

ADA’s Fluctuating Value

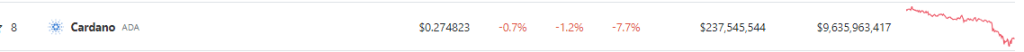

Despite the advancements, ADA’s recent price performance has sparked concerns. With a current value of $0.274 according to CoinGecko, the cryptocurrency has experienced a decline of 1.2% in the last 24 hours alone. A more prolonged seven-day slump paints a bleaker picture, with a decline of nearly 8%.

ADA price action today. Source: Coingecko

Navigating ADA’s Future

As Cardano’s development trajectory continues to impress with its forward-looking innovations, the prevailing challenges in ADA’s price trend and holder losses should not be underestimated.

The decline in active addresses further compounds the existing worries, potentially signaling shifts in user engagement and interest.

ADA hits a market cap of $9.6 billion today. Chart: TradingView.com

While the undercollateralized loan approach holds promise for the ecosystem’s future, addressing the concerns surrounding ADA’s price and holder losses remains a…

Click Here to Read the Full Original Article at NewsBTC…