The Central Bank of Canada published a staff note on Decentralized Finance on Oct. 17, assessing the innovations that made it popular and the challenges and risks associated with its use.

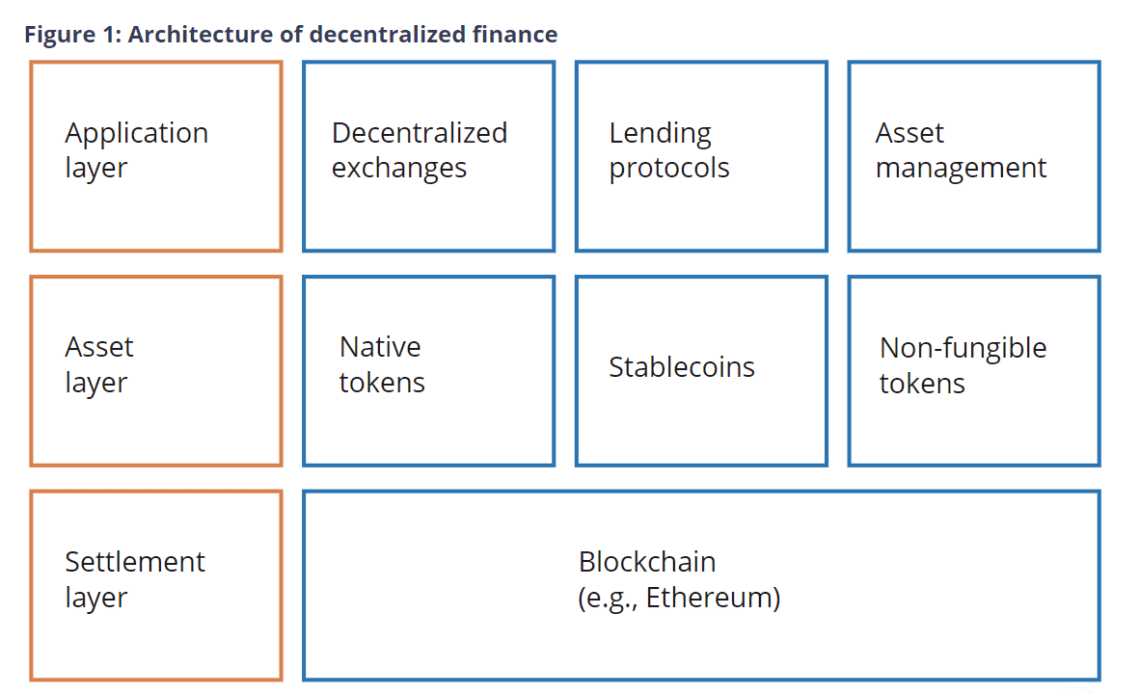

The staff note described DeFi as a multi-layered structure with the Ethereum blockchain serving as the bottom layer (or settlement layer). Developers construct a variety of tools and services on top of the main blockchain including tokenization, lending and borrowing services, and much more.

The staff note shed light on the rise in popularity of the DeFi ecosystem starting in 2020 and how it became an integral part of the crypto economy with billions in volume over the next few years. The popularity of the ecosystem took a dip starting in 2022 with the collapse of multiple key crypto platforms with significant DeFi exposure including Terra-Luna.

Talking about the key features of the decentralized ecosystem, the staff note lauded DeFi’s “composability,” which allows the apps and services in the ecosystem to interconnect. The Bank of Canada note highlighted three of the key areas where DeFi can transform the financial system

- Frictionless financial service offering: A decentralized ledger-based system reduces frictions experienced in the legacy system and expands the scope of financial services currently being offered.

- Open competition: The DeFi ecosystem is open to everyone to build and access given the open-source nature thus it makes way for increased competition offering better options for the end user.

- Transparency: The use of programable smart contracts eliminates intermediaries and increases transparency in the system as everything is accessible to people analysing.

Apart from the key DeFi innovations that can transform the traditional financial system, the staff note also talked about the challenges and risks associated with the DeFi ecosystem claiming that “despite its innovations and possibilities, the overall economic benefits of DeFi remain limited.”

Related: Bank of Canada emphasizes need for stablecoin regulation as legislation is tabled

The note lists three key challenges that the DeFi system faces today: The lack of real-world tokenization, the higher concentration of interconnection within and its dependence on the unregulated centralized finance ecosystem.

The note also highlighted the regulatory challenges posed by the DeFi ecosystem and the rise in vulnerabilities in the ecosystem leading to several hacks and…

Click Here to Read the Full Original Article at Cointelegraph.com News…