Terra Classic (LUNC), the phoenix attempting to rise from the ashes of the infamous TerraUSD crash, is once again capturing investor attention. Coincodex analysts predict a modest 10.7% price increase by July 25th, while renowned crypto analyst Javon Marks throws a much bolder 1,500% surge into the ring. So, is LUNC poised for a bullish breakout, or is this just another mirage in the volatile crypto desert?

Related Reading

A Token Reborn: LUNC Capitalizes On Market Volatility

LUNC, once the backbone of the collapsed TerraUSD (USTC) stablecoin ecosystem, has defied expectations. While USTC lost its peg to the US dollar and spiraled into oblivion, LUNC has exhibited surprising resilience.

The past 24 hours saw an 82% price jump, showcasing continued investor interest in the controversial token. This resilience coincides with a broader market trend where investors, wary of traditional assets, are seeking refuge in digital currencies perceived as having strong recovery potential.

Analyst Divided: Measured Optimism Vs. Moon Shot

Coincodex paints a picture of cautious optimism. Their prediction of a 10.7% rise suggests LUNC may experience a slow and steady climb. This aligns with the “Fear & Greed Index” which currently sits at a moderate “Fear” level, indicating a cautious market.

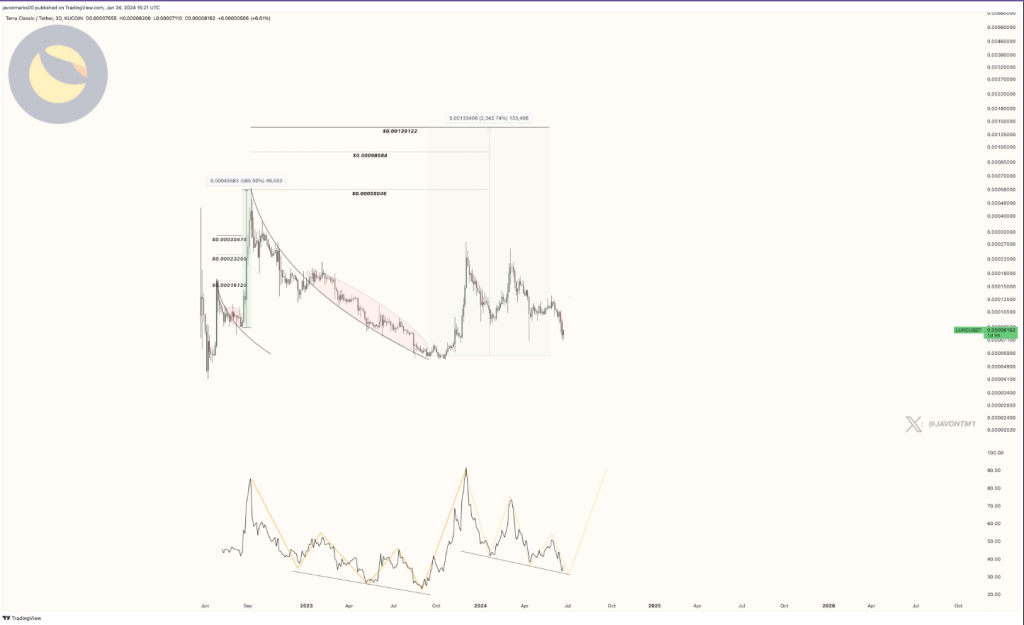

We remain here $LUNC (Terra Classic)’s first target at $0.00058046, implying a more than +594% upside from here to reach it in response to a long-standing breakout.

Trend-Wise, based on the previous breakout and climb, this level can be exceeded with heights of $0.00139122 being… https://t.co/rAbwsHIkqY pic.twitter.com/XOYdulvUc8

— JAVON⚡️MARKS (@JavonTM1) June 24, 2024

However, analyst Javon Marks throws a wrench into the mix with a far more audacious prediction. Marks posits a potential 1,500% price surge, targeting a price of $0.00139122. This bullish outlook hinges on the idea that LUNC is nearing a breakout phase, fueled by a combination of its recent price gains and historical data.

A Balancing Act Of Hype And Reality

While Marks’ prediction is certainly enticing, historical trends in the cryptocurrency market are littered with failed “moon shot” predictions. The extreme volatility inherent in the crypto space makes long-term price forecasting notoriously unreliable.

Additionally, technical indicators currently lean bearish, suggesting potential short-term price dips. Investors should also consider the ongoing legal battles…

Click Here to Read the Full Original Article at NewsBTC…