By Matthew Hayward, Senior Market Analyst at PrimeXBT

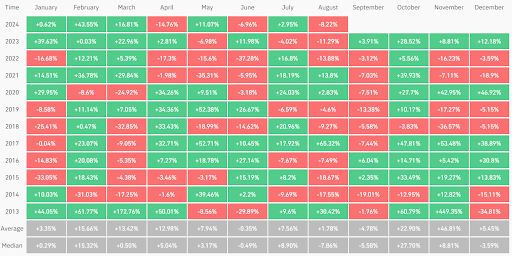

Historically, Bitcoin and the broader cryptocurrency market tend to experience a downturn in the month of September. This month has typically led to bearish price action movements, with both Bitcoin and other cryptocurrencies seeing consistent negative returns. However, this September has been unusually eventful, with heightened price activity driven by shifts in the macroeconomic landscape and signals from central banks regarding potential policy adjustments. These factors have created a “perfect storm” of volatility within risk assets, particularly in cryptocurrencies. As seen from the past decade of data, September consistently ranks as the worst month for trading Bitcoin.

Source: Crypto.ro

Bitcoins Seasonality and the Crypto Cycle Theory

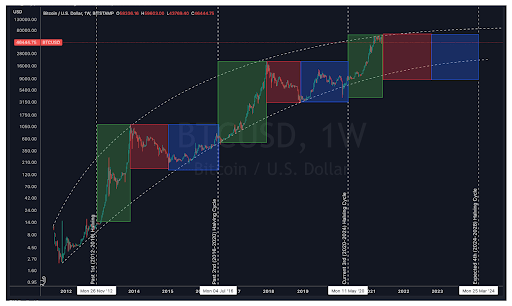

Traditionally Bitcoin and the broader cryptocurrency market have closely followed the “cycle theory,” particularly aligning with Bitcoin’s four-year halving cycle. So, how does this cycle relate to the current market performance? Following the most recent halving event, we have seen months of consolidation, with prices fluctuating within a range and market sentiment remaining predominantly bearish. This sentiment has directly influenced current market behaviour, keeping prices stable and reflecting the cautious outlook of traders and investors during this phase of the cycle.

Source: Tradingview, Bitcoin Mathematics

Uncertainty in the Macro-Landscape

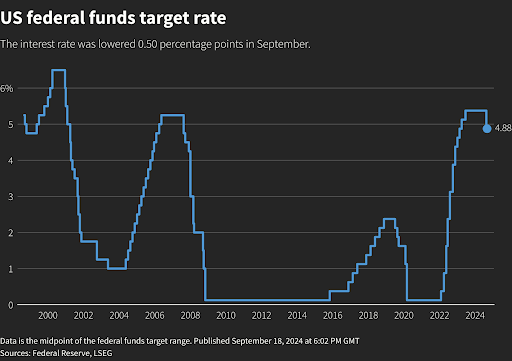

The macroeconomic landscape is becoming increasingly dynamic, marked by heightened uncertainty around central bank policies, something we haven’t seen in years. This uncertainty raises critical questions: will we face a recession, or will the economy continue to grow? With central banks navigating challenging economic conditions, the market is anticipating potential shifts in policy. This environment, combined with September’s historical tendency for consolidation and lower price movements, sets the stage for increased trading volume and volatility. As we approach key monetary policy decisions, especially with the U.S. elections on the horizon, we can expect an extended period of heightened volatility in the cryptocurrency market.

Source: Reuters

Big move from the FED and their Interest Rate decision

This month we have already seen the Federal Reserve surprise markets by implementing a 50 basis point…

Click Here to Read the Full Original Article at NewsBTC…