Blockchain games are mostly played for entertainment, but some developers within the industry think the games could eventually evolve into a form of employment where players can grind out a living wage.

Video games using blockchain tech allow players to earn native crypto or nonfungible tokens (NFTs) by playing and participating in activities within the virtual world. Users can then trade or sell their rewards to others and convert them to fiat currency or other crypto, such as Bitcoin (BTC) and Ether (ETH).

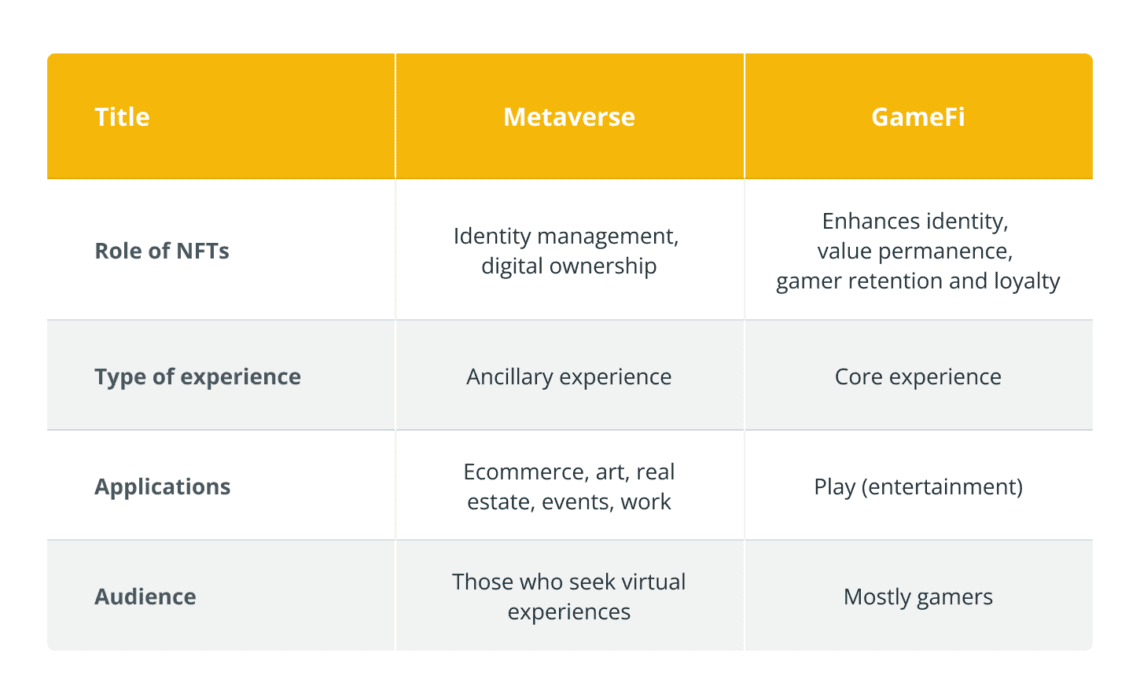

Known as GameFi and play-to-earn (P2E), these gaming mechanics have seen some places, like a small community in the Philippines, turn playing blockchain games into employment; however, it’s unclear how existing worker protections and labor laws would apply.

Many countries have laws entitling employees to certain rights, such as minimum wages, a safe workplace, compensation, a pension fund and other protections.

A whole new unregulated frontier

Gip Cutrino, an entrepreneur and chief operating officer of Web3 platform Runiverse, told Cointelegraph that the concept of using blockchain games to grind out a living has already made an impact, especially in countries with lower wages.

According to Cutrino, because of the relatively new technology, the laws around the concept have not yet been made clear, but he expects regulations will be on the horizon as more mainstream audiences join the space.

“We’re building products and creating solutions that haven’t been accounted for by existing laws, which can become particularly complicated when we consider the global and connected nature of blockchain gaming spread across different countries and legal jurisdictions,” Cutrino said.

“There aren’t global labor laws addressing this specific situation, but we can expect increased regulation as GameFi evolves further,” he added.

Recent: Minecraft, GTA may yet change their tune on blockchain: GameFi execs

He notes that, from his perspective, there is more concern around blockchain games and income law implications, specifically how regulators might decide to define this category of income for gamers.

“Some countries have begun drafting laws that would classify any token invested with an expectation of profit and any project stimulating liquidity pools as securities,” Cutrino said.

The United States Securities and Exchange Commission has sent shockwaves through the crypto space with multiple enforcement actions against crypto projects and companies…

Click Here to Read the Full Original Article at Cointelegraph.com News…