ATOM has ascended to the summit of network activity within the inter-Blockchain ecosystem. However, upon closer inspection, the narrative surrounding Cosmos unveils a more nuanced story. Despite the accolade of being at the forefront of blockchain network activity, a discerning analysis reveals a dip in actual user engagement and transaction volumes.

Surprisingly, against the backdrop of these statistics, Cosmos has witnessed a remarkable 13% surge in its token price over the past week, prompting a deeper inquiry into the factors propelling its momentum.

Digging Deeper: Beyond Buzzwords

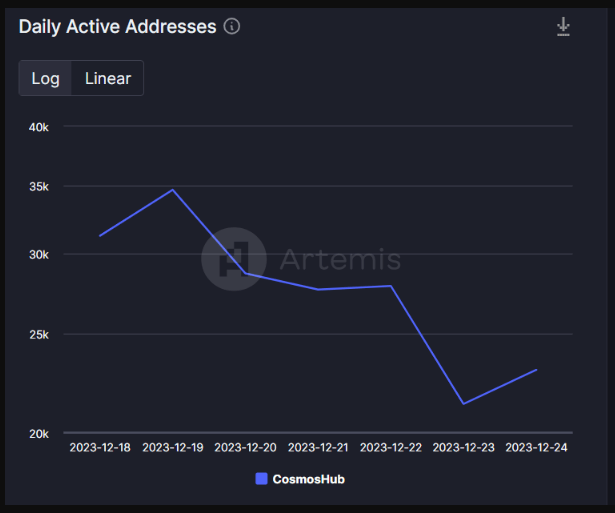

Although Cosmos received accolades for its network activity, the narrative quickly unravels when scrutinizing actual user statistics. Daily Active Addresses and Transactions for ATOM, tracked by Artemis, experienced a noticeable decline, painting a different picture than the headline numbers suggest. Similarly, fees and revenue for the Cosmos network dipped during this period, further dampening the celebratory mood.

Source: Artemis

Despite the declining activity metrics, ATOM’s price defied the trend, showcasing a 6% gain over the last 24 hours, data from Coingecko shows. This disconnect highlights the influence of factors beyond user engagement, including the broader market bullishness and potentially, speculation fueled by a spike in ATOM’s MVRV ratio, a profitability indicator.

The Power Of Partnerships And Policy: Catalysts For Growth

While the overall market sentiment played a role, key developments within the Cosmos ecosystem also contributed to ATOM’s ascent. The recent merger between Osmosis and UX Chain solidified their foothold within the Cosmos landscape, bolstering cross-chain DeFi capabilities.

ATOM market cap currently at $4.58 billion. Chart: TradingView.com

Additionally, the Cosmos Hub’s governance decision to reduce ATOM’s inflation rate from 14% to 10% addressed concerns surrounding stability and security, potentially attracting further investment.

Despite the recent rally, ATOM’s technical indicators paint a somewhat cautious picture. The daily chart presents a bearish MACD signal, and the Chaikin Money Flow’s sideways movement suggests a potential extension of the current price consolidation.

The Road Ahead: A Balancing Act

Cosmos faces the challenge of bridging the gap between headline-grabbing network activity metrics and actual user engagement. The recent decline in transactions and addresses raises…

Click Here to Read the Full Original Article at NewsBTC…