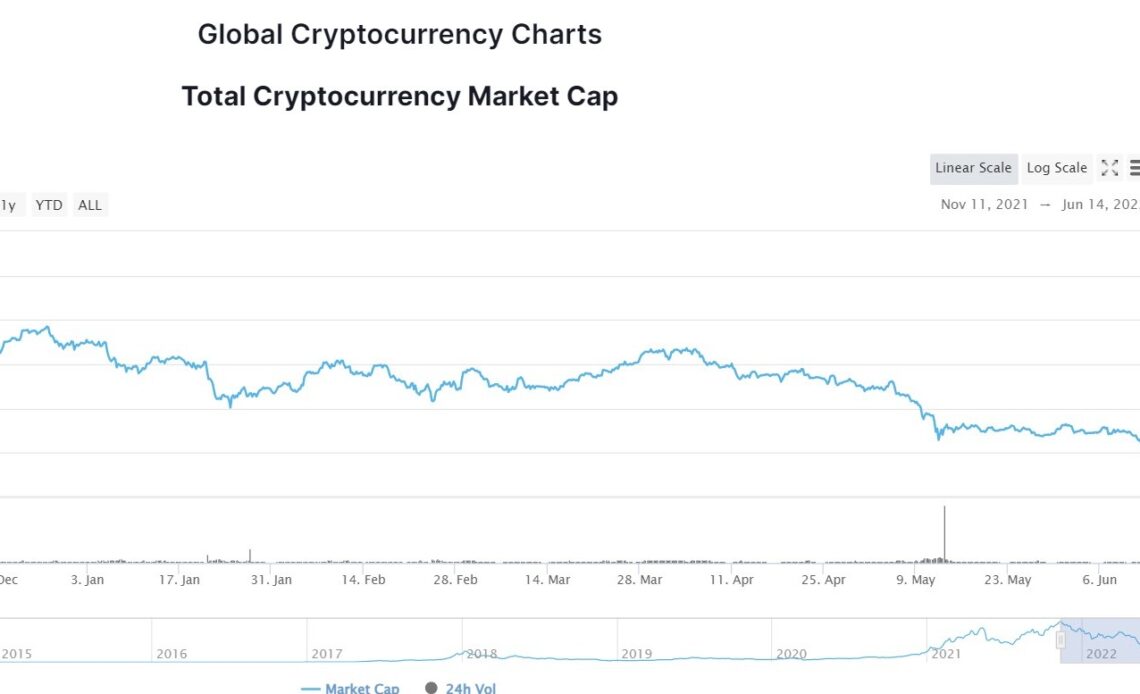

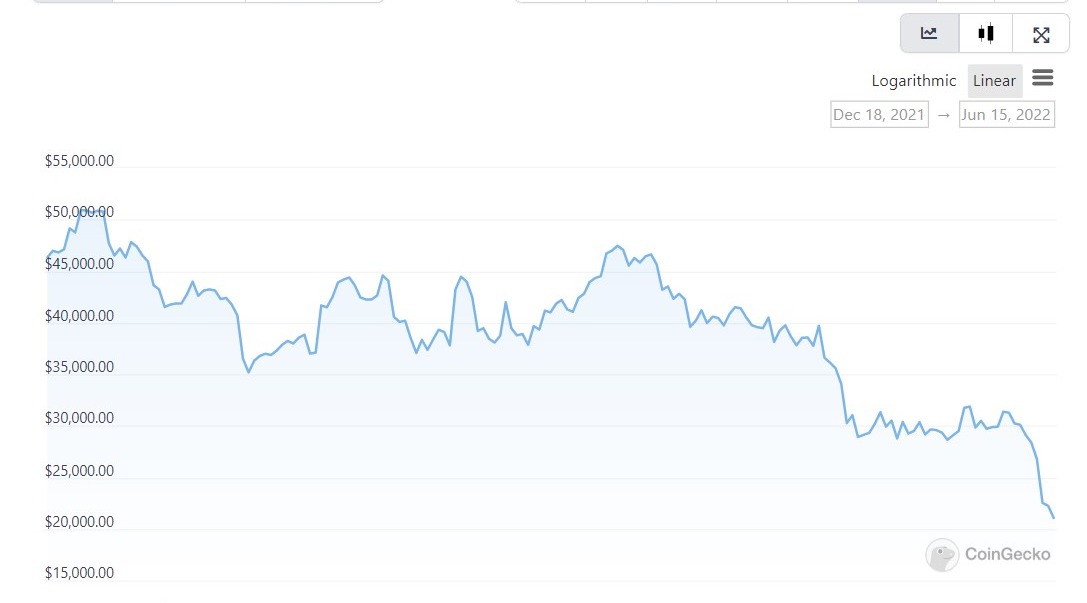

Crypto asset managers across Europe and the US manage billions of dollars worth of digital currencies. Grayscale alone has more than 600,000 Bitcoin under management. Due to its massive scale, the crypto asset management industry plays an important role in the growth of the crypto ecosystem. Amid the recent crypto winter that resulted in a market cap dip of more than $2 trillion, the value of global digital assets under management (AUM) has plunged.

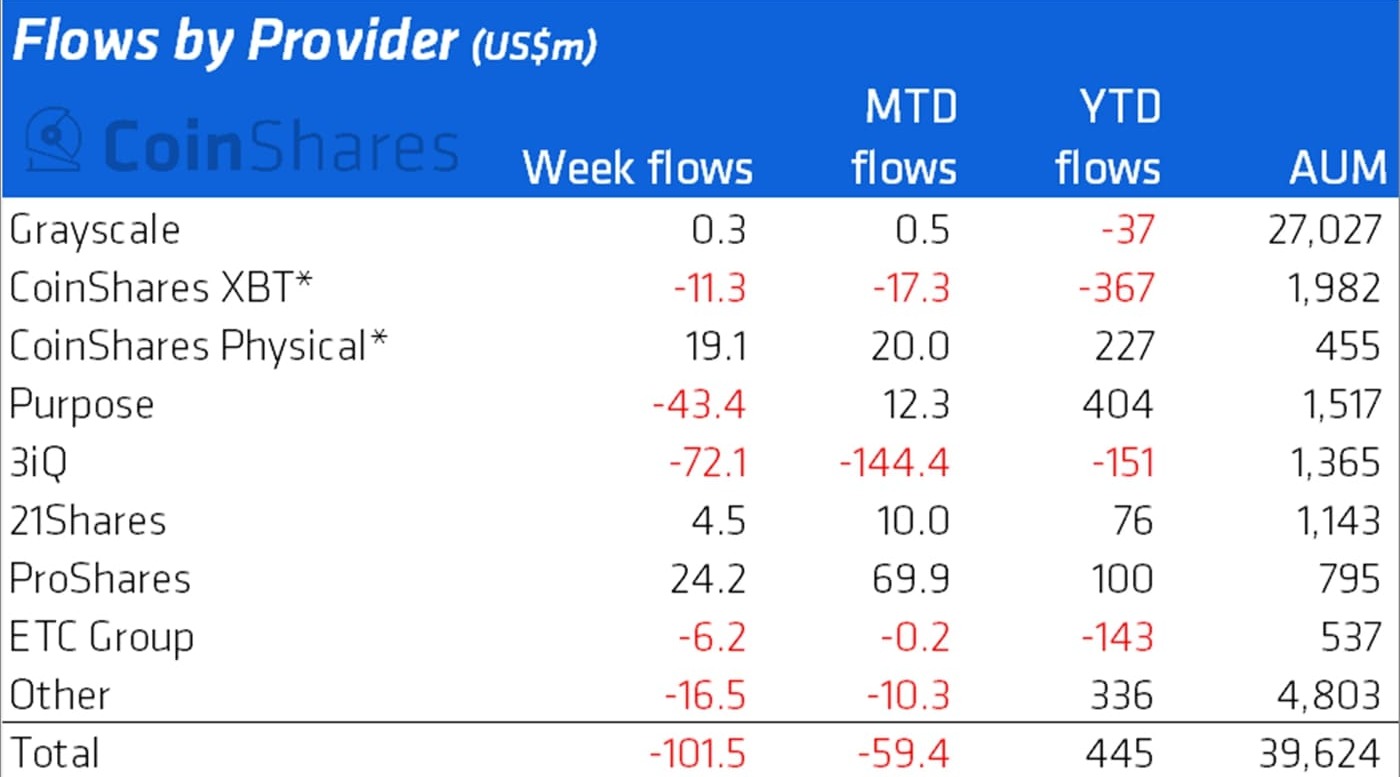

In November last year, the value of crypto AUM stood at around $65 billion, compared to $39 billion during the first week of June 2022. Unlike traditional mutual fund and hedge fund industries where ‘asset diversification’ plays an important role in balancing the portfolio of clients, crypto asset managers rely heavily on the performance of a selected set of digital assets. A consistent rise in outflows from crypto investment products since the Luna crash has raised concerns over the sustainability and survival of many crypto asset management companies.

“Many smaller crypto funds and asset managers will face existential issues after the latest downturn as they don’t have enough assets under management to survive. I expect many niche strategies funds focusing on DeFi and small-cap tokens will disappear as they couldn‘t protect investors from the actual downturn,” Marc P. Bernegger, the Co-Founder of the Crypto Fund AltAlpha Digital, said.

Darkest Crypto Phase

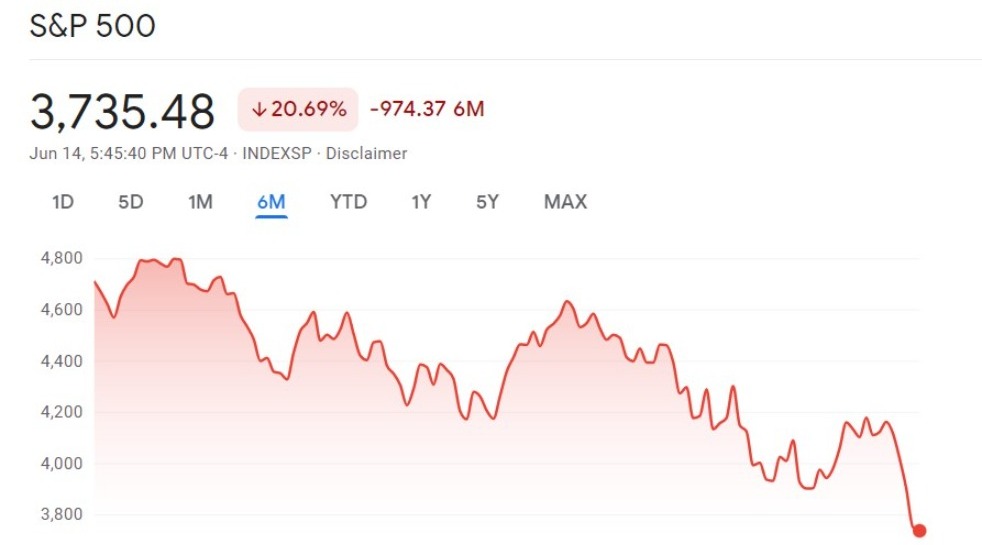

Cryptocurrencies witnessed several corrections in the past few years. However, a market that differentiates itself from other traditional financial markets has followed a similar correction pattern this time.

“In the first half of the year, the correlation of bitcoin with US technology stocks reached a record. The 40-day correlation coefficient between cryptocurrency and the Nasdaq 100 tech index has reached almost 0.66. According to Bloomberg, this is the highest figure since 2010. A similar correlation with the S&P 500 also hit a record. And little has changed in the current downturn,” Maria Stankevich, Chief Business Development Officer at EXMO, said.

Jason…