Bitcoin (BTC) briefly broke above $24,000 on July 20, but the excitement lasted less than two hours after the resistance level proved more challenging than expected. A positive is that the $24,280 high represents a 28.5% increase from the July 13 swing low at $18,900.

According to Yahoo Finance, on July 19, Bank of America published its latest fund managers survey, and the headline was “I’m so bearish, I’m bullish.” The report cited investors’ pessimism, expectations of weak corporate earnings and equity allocations at the lowest level since September 2008.

The 4.6% advance on the tech-heavy Nasdaq Composite Index between July 18 and July 20 also provided the necessary hope for bulls to profit from the upcoming July 22 weekly options expiry.

Global macroeconomic tensions eased on July 20 after Russian President Vladimir Putin confirmed plans to reestablish the Nord Stream gas pipeline flow after the current maintenance period. However, in the course of the last few months, data shows that Germany has reduced its reliance on Russian gas from 55% to 35% of its demand.

Bears placed their bets at $21,000 or lower

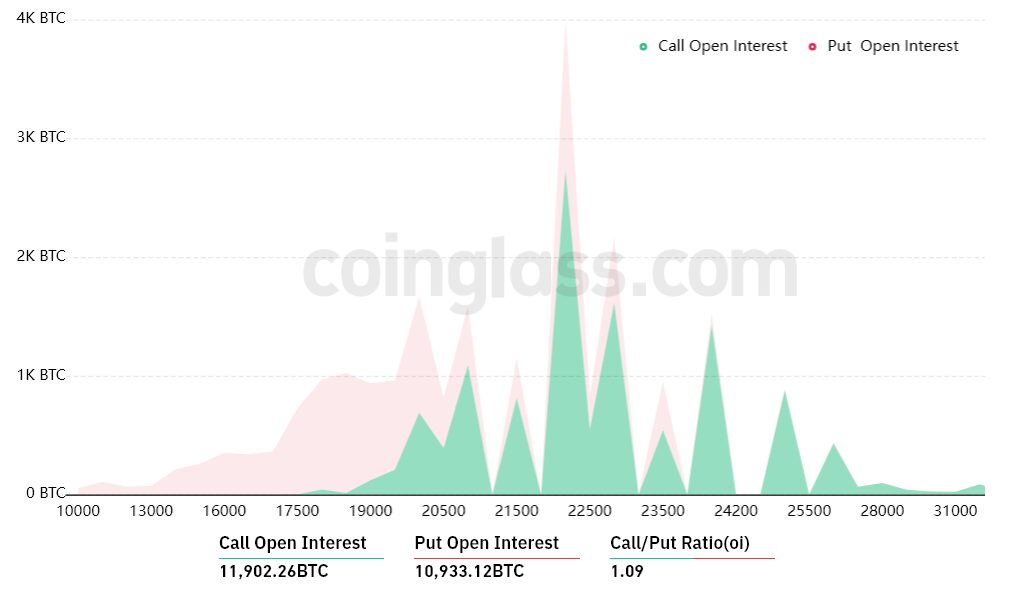

The open interest for the July 22 options expiry is $540 million, but the actual figure will be lower since bears have been caught by surprise. These traders did not expect a 23% rally from July 13 to July 20 because their bets targeted $22,000 and lower.

The 1.09 call-to-put ratio shows the balance between the $280 million call (buy) open interest and the $260 million put (sell) options. Currently, Bitcoin stands near $23,500, meaning most bearish bets will likely become worthless.

If Bitcoin’s price remains above $22,000 at 8:00 am UTC on July 22, only $30 million worth of these put (sell) options will be available. This difference happens because the right to sell Bitcoin at $22,000 is useless if BTC trades above that level on expiry.

Bears aim for $24,000 to secure a $235 million profit

Below are the four most likely scenarios based on the current price action. The number of options contracts available on July 22 for call (bull) and put (bear) instruments varies, depending on the expiry price. The imbalance favoring each side constitutes the theoretical profit:

- Between $20,000 and $21,000: 900 calls vs. 3,000 puts. The net result favors the put (bear) instruments by $60 million.

- Between $21,000 and $22,000: 2,400 calls vs. 3,000 puts. The net result is balanced between bulls and…

Click Here to Read the Full Original Article at Cointelegraph.com News…