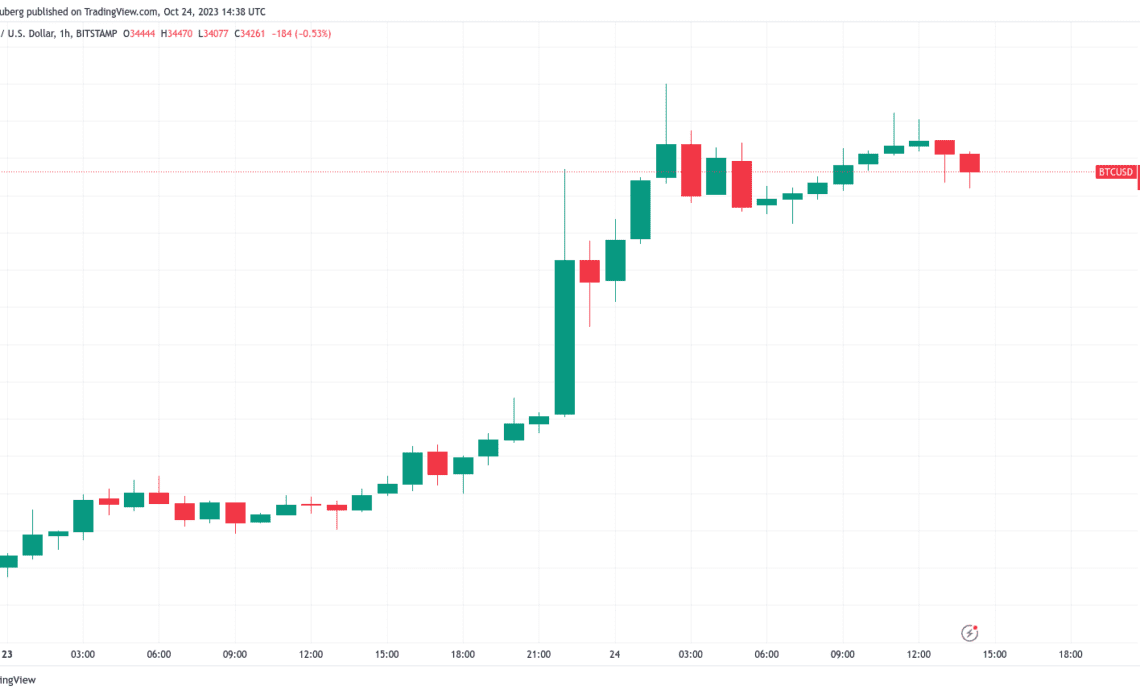

Bitcoin (BTC) consolidated near $34,000 after the Oct. 24 Wall Street open as the dust settled on 15% daily gains.

Opinions diverge on Bitcoin funding rates

Data from Cointelegraph Markets Pro and TradingView tracked BTC price volatility through the day, with $34,000 a focus at the time of writing.

The pair had previously hit 17-month highs near $35,200 on the back of fresh excitement over the potential approval of a Bitcoin spot price exchange-traded fund (ETF) in the United States.

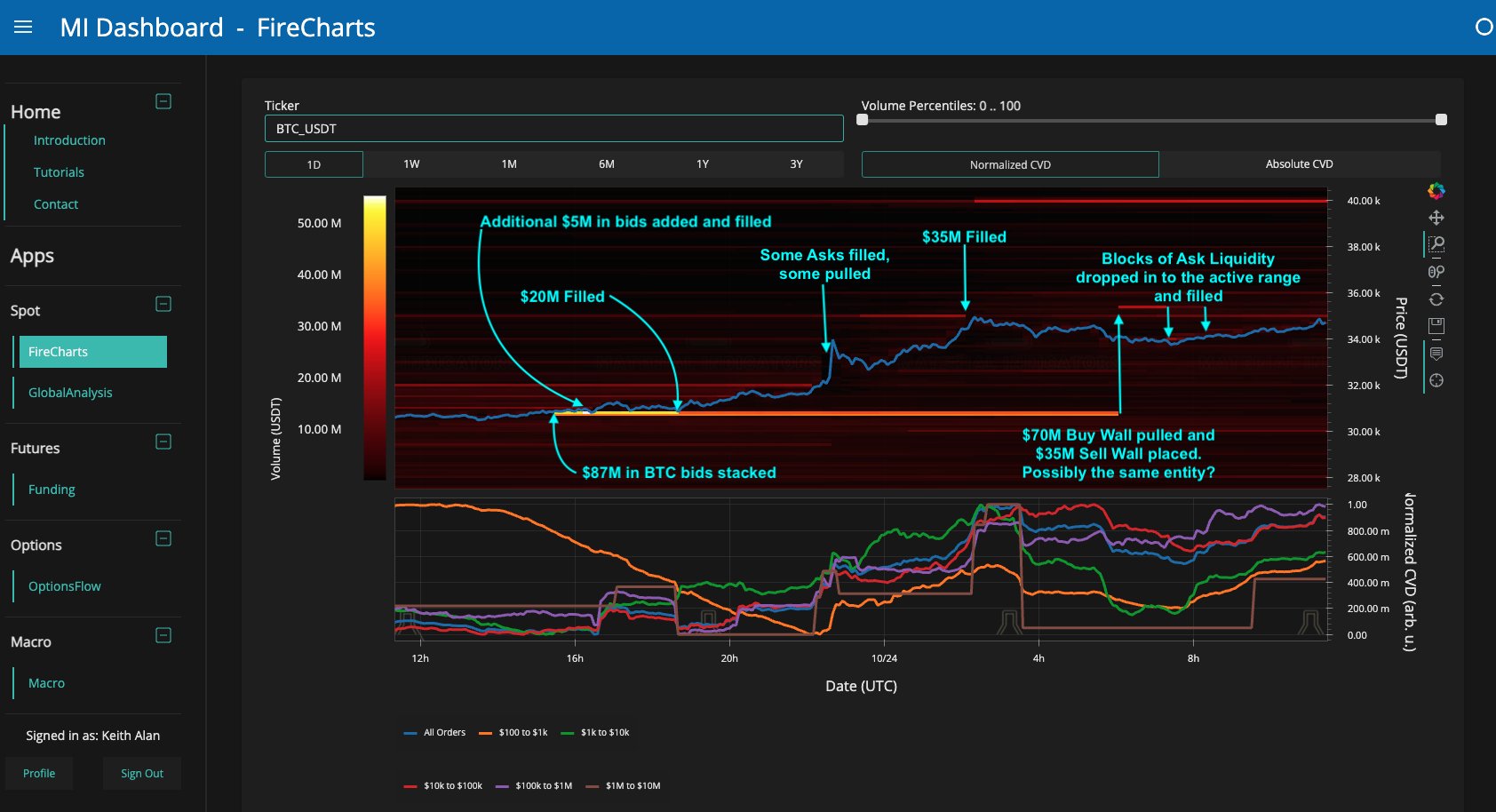

Analyzing the sequence of events which led to a $5,000 daily candle, monitoring resource Material Indicators revealed a support/resistance (R/S) flip at $30,600.

The speed at which the market broke through resistance in place throughout the past year-and-a-half was surprising, an X post read. Material Indicators “honestly expected to see more resistance at $30.5k, $31.5k and even $33k.”

“Those levels were obliterated and and when an $87M buy wall appeared at $30.6k that set the foundation for a R/S flip with no hesitation from the market,” it explained.

“Once $32k was taken out, some of the overhead liquidity was pulled and the thin liquidity made it easy for BTC to rip to $35k quickly.”

The post added that with some bid liquidity now pulled from below, there was a “opportunity for a potential retrace.”

One of two accompanying charts covered the past 24 hours on the Binance order book.

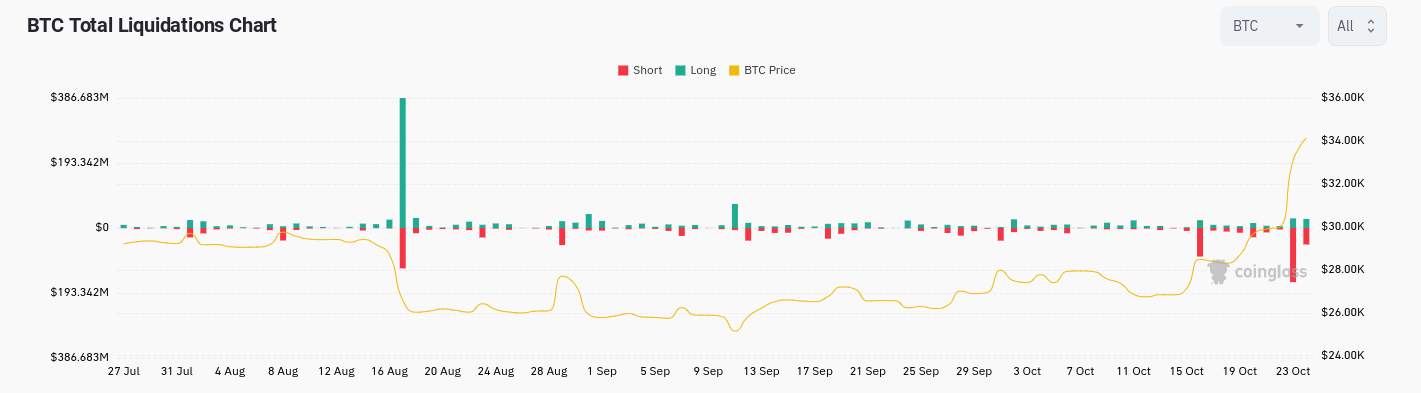

Other factors lining up to contribute to a deeper consolidation included funding rates across exchanges, which at the time of writing were deep inside positive territory.

Be cautious with new longs❗️ pic.twitter.com/jsuXPdIhRq

— CryptoBullet (@CryptoBullet1) October 24, 2023

“Funding is grossly positive,” popular trader CryptoBullet wrote during an X discussion.

“It means that the vast majority of traders are longing. The majority is never right. The market maker will have to wipe out those late longs.”

BTC short liquidations on the way up totalled $161 million and $48 million for Oct. 23 and 24, respectively, per data from monitoring resource CoinGlass.

Commenting on funding rates, fellow trader Daan Crypto Trades argued that the market might yet preserve its direction — part of familiar bull market behavior.

#Bitcoin Still a perpetual premium but it has come down a bit.

It’s good to note that during the bull…

Click Here to Read the Full Original Article at Cointelegraph.com News…